Canada's Evolving Electricity Grids: Recent Developments in Distributed Energy Resources

THE EXPANDING SCOPE AND CHALLENGES ARISING FROM DERS

Distributed Energy Resources ( DERs) are increasingly offering the opportunity to create a more efficient and sustainable electricity grid by incorporating smaller, decentralized resources that are dynamic and responsive to changing energy needs.

These resources (which encompass distributed energy storage) are leading to increasing expectations for Canada's electricity grids, and the regulatory regimes that govern them, to be receptive and adaptable. DERs, and storage in particular, are hailed for the myriad of benefits they already offer (or could in theory offer) to energy stakeholders, from grid balancing, to peak shaving, to reducing the need for expensive infrastructure, to overall reliability — the list goes on.

Not only are the potential benefits substantial in their own right, but virtually every electricity stakeholder — including generators, transmitters, industrial loads, and ratepayers — stand to benefit from the deployment of DERs in one way or another.

While DERs representing a significant amount of capacity are already online (including, for example, in Ontario), there is a long way to go before the traditional centralized grids that continue to dominate Canadian electricity grids can claim to be fully leveraging DER potential, from both a regulatory and market perspective.

Whether Canadian regulators and system operators will go to the hassle of maximizing DER integration is an open question. Notwithstanding this continuing uncertainty, the following is an overview of some recent developments in the space, particularly as they relate to the increasing deployment of energy storage across Canadian provinces and the regulatory conditions that are enabling or impeding development.

OVERVIEW OF DEVELOPMENTS IN CANADA

Québec

Hydro-Québec continuing to make moves in DER development

EVLO Energy Storage Inc. (EVLO), Hydro-Québec's subsidiary launched in 2020, designs, sells and operates sustainable energy storage systems, and has developed lithium iron phosphate batteries used in energy storage systems. In 2021, EVLO announced its most advanced storage system to date: a 1-MWh battery storage designed for large-scale projects mainly aimed at power producers, transmission providers and distributors. During the same period, EVLO entered into a reseller agreement with Nuvation Energy, a provider of battery management systems and energy storage engineering services to battery manufacturers and power producers. Such agreement will allow Nuvation to resell the energy storage system developed by EVLO, which would then be built using Nuvation's battery management systems.

The technology developed by EVLO has been implemented in some of Hydro-Québec's projects and has seen its range of applications grow, including:

- Deployment of a 20-MWh battery energy storage system during work being carried out on a transmission line in the municipality of Parent, Québec, a remote community which is supplied by a single transmission line. The storage system, which will be recharged overnight, will supply the residential and commercial customers of Hydro-Québec with electricity during the day while the line is de-energized for work to be performed on the transmission line. The system will remain in place once the work is completed to act as an auxiliary source of energy in the event of a power outage. It is a solution to replace generators running on fossil fuels that would have otherwise been used during the transmission line work.

- The energy microgrid project located in Lac-Mégantic's new downtown area was inaugurated in 2021 and is an example of the implementation of DERs. The microgrid is equipped with solar panels and energy storage units, and can operate independently from Hydro-Québec's main grid. Energy surpluses generated by the microgrid can be fed back to the main grid. Hydro-Québec hopes to use the technology and expertise developed as part of the Lac-Mégantic project to decarbonize its off-grid systems, which are located in remote areas that mostly remain fossil-fuel dependent.

- A behind-the-meter application of EVLO's technology in an office building in Blainville, Québec, to help manage peak energy consumption.

Furthermore, in its recent requests for proposals launched in December 2021 in respect of a 480 MW block of renewable energy and a 300 MW block of wind power, with expectations that energy delivery would begin no later than November 30, 2026 (as further described in our Quebec Regional Overview), Hydro- Québec has specified that the proposed projects can be combined with energy storage projects.

It is noteworthy that the energy storage component of a proposal will be considered by Hydro-Québec on a number of levels. The following project details must be included in a proposal: (i) the daily profile of the power available through the energy storage system for the winter period, with certain minimum requirements to be met in respect of guaranteed and fixed power availability (a minimum of 100 hours for the winter period and a minimum of three hours per day during peak winter periods), (ii) the installed capacity of the energy storage component, and (iii) such component's contribution in the determination of the cost of electricity for the project.

Ontario

The OEB and DERs – background

In 2017, the Ontario Energy Board (OEB) issued its Strategic Blueprint: Keeping Pace with an Evolving Energy Sector (Strategic Blueprint) which set out its commitment to modernize its approach to regulation in order to keep pace with an evolving energy sector. The Strategic Blueprint reflects the OEB's recognition of significant changes underway and sets out four strategic goals:

- Utilities are delivering value to consumers in a changing environment;

- Utilities and other market participants are embracing innovation in their operations and the products they offer consumers;

- Consumers have confidence in the oversight of the sector and in their ability to make choices about products and services; and

- The OEB has the resources and processes appropriate for the changing environment.

In 2018, the OEB established an Advisory Committee on Innovation to help determine whether and how to adapt its regulatory framework to meet the above listed goals. In January 2019, the OEB held a public Stakeholder Forum to receive feedback on how it should proceed with initiatives to support the evolution of the sector. In response to the feedback received, the OEB initiated two integrated consultation processes: Utility Remuneration (EB-2018-0287) and Responding to Distributed Energy Resources (DERs) (EB-2018-0288). The OEB then held two further stakeholder meetings in September 2019 and February 2020, the latter at which the OEB facilitated the presentation of expert studies it commissioned to assist in confirming the scope and next steps for the Utility Remuneration and Responding to DERs initiatives.

Following further stakeholder feedback on these expert studies, the OEB announced in March 2021 that it would be effectively amalgamating the two initiatives into a single consultation entitled Framework for Energy Innovation: Distributed Resources and Utility Incentives (EB-2021-0118).

During this 2017-2021 period of lengthy public consultation conducted by the OEB, the Independent Electricity System Operator (IESO) has been steadfastly developing a framework for DERs integration at the wholesale level. The IESO's work began with a series of white papers including conceptual models for DER participation (released October 2019), non-wire alternatives using energy and capacity markets (released June 2020), and exploring expanded DER participation in the IESO-administered markets (draft released in November 2020). In addition, the IESO commissioned its own report from third party consultant ICF on the development of possible transmission-distribution frameworks that facilitate DER market participation at both the wholesale or distribution levels and/or a hybrid participation model.

Current status

The recommendations and conclusions from these papers and report ultimately formed the framework for the IESO's DER Roadmap launched in June 2021, establishing objectives, initiatives and timing for DER integration. The final version of the DER Roadmap objectives and proposed timelines was presented at an IESO stakeholder engagement webinar on October 20, 2021.

The DER Roadmap is in turn being used to inform the IESO's contemporaneous Enabling Resources Program (ERP) engagement, which will purportedly produce a five to ten year plan to enable, among other resource types, distributed resources to provide services that they currently are not. Most recently the IESO announced its draft ERP work plan which will ultimately inform and be incorporated as part of the IESO's broader DER Market Vision and Design Project for the integration of competitive DER market participation.

The DER Market Vision Project phase will explore new, "foundational" participation models for DER integration into wholesale markets and will identify the criteria for more sophisticated models that will form the basis of future DER integration efforts. The second Market Design Project phase will design and implement the foundational participation models from the first phase.

Passing the DER buck?

Notably, the first phase of the project includes a recently-issued joint IESO/OEB call for DER innovation pilot projects or research to be funded through the merged OEB Innovation Sandbox and IESO Grid Innovation Fund (~C$9.5 million annual budget). It seems, then, that the OEB has effectively jumped on the IESO bandwagon rather than continuing to independently pursue its own policy mandate for DER integration even though DERs are primarily connected at the distribution level and not the wholesale level.

After all, DER integration falls outside the legislative mandate of the IESO, and should arguably instead continue to remain within the scope of policy development and regulatory oversight of the OEB. Indeed, the closest IESO legislative object found under the Electricity Act, 1998 is subsection 6(1)(n) which provides that the IESO is required "to engage in activities in support of system-wide goals for the amount of electricity to be produced from different energy sources" (italics added). This language suggests that, at best, the IESO is only mandated to provide a supporting or facilitating role with respect to DER integration and not to usurp the lead role in "[facilitating] innovation in the electricity sector" which properly belongs to the OEB under subsection 1(1)4 of the Ontario Energy Board Act, 1998.

Furthermore, and despite the IESO continuing to (at least co-) lead the charge on DERs, new demand response DERs are being effectively left behind in terms of participation in near-term contract procurement opportunities. Most recently, the IESO confirmed at its December 16, 2021 stakeholder engagement sessions that its ERP work plan — and therefore ultimately the DER Market Vision and Design Project — will be more immediately geared toward the integration of storage and proposed hybrid generation-energy storage models (namely, (i) Interim Storage Model + Generator Resource (ISM+G), and (ii) the Integrated Hybrid Model) over the integration of other new potential load side or demand response DER participation models.

This information has been met with frustration by the demand response community — aggregators and otherwise — as it effectively means that new DER participation models will be unable to compete for IESO contract procurement opportunities before the 2026- 2029 time frame. DER developers and aggregators claim there to be ~5,000 MWs of potential capacity currently available to be deployed at the wholesale level in Ontario but for regulatory lag; the IESO estimates this amount to only be ~200 MWs. Irrespective, time will tell if the IESO will evolve its ERP work plan to allow for new demand side participation models to compete alongside existing DER models in the current medium-term RFP and anticipated long-term RFQ and RFP to be released in 2022/2023.

Alberta

Energy storage projects in Alberta have been accelerating throughout 2021. Following completion of Alberta's first transmission connected energy storage project in September 2020, three more energy storage projects have been completed and are participating in Alberta's electricity market. As of the date of publication, there are over 17 energy storage projects listed within the AESO's connection queue.

On November 4, 2021, the Government of Alberta announced C$25 million in financial support for solar-plus-storage and pumped hydro energy storage as part of a C$176 million package that will also give funding to the oil and gas industry.

In continuing to implement the Energy Storage Roadmap, the Alberta Electric System Operator (AESO) and the Government of Alberta implemented the following key developments for the integration of energy storage:

- AESO's Long-term Energy Storage Market

Participation Draft Recommendation Paper: In

February 2021, the AESO released this

paper examining four identified areas requiring

clarification, consideration or amended or new ISO rules to

integrate energy storage into Alberta electricity market. As

discussed in detail within the report, the AESO made the following

recommendations in the four areas identified:

- ISO rules to allow for hybrid asset configurations; however, include the variable energy resource block mechanism to determine the allowable dispatch variance for those assets.

- Optional full-range participation of energy storage using the linked-assets submission mechanism for those participants that choose to submit the full operational range of the resource; and a must-communicate charging levels requirement for participants that choose not to participate with their full-range.

- "State of charge" to be defined in the ISO Rules as an aggregate measurement from the site as a percent charge ranging from zero to one hundred percent that will be provided to the AESO and updated in real-time via supervisory control and data acquisition (SCADA) systems; however, this information would not be reported publicly.

- Sites with controllable inflows or outflows to be required to submit two offer blocks during commissioning and that those offer blocks include an offer with a price of zero dollars and an offer at the price cap.

- Bill 86: On November 17, 2021, as part

of Alberta's

Recovery Plan, Alberta

introduced Bill 86: the Electricity

Statutes Amendment Act, 2021 (Bill 86). If passed, this Act

will amend the laws and regulations regarding energy storage,

electricity sale and transmission in Alberta, including

the Alberta Utilities Commission Act (

AUCA), the Electric Utilities

Act (

EUA) and the Hydro and Electric

Energy Act (

HEAA). If passed, the amendments are expected

to be finalized in 2022. Highlights of the

proposed amendments include:

- The integration of energy storage into Alberta's interconnected electricity system (grid) in both the competitive electricity market and the transmission and distribution system.

- A statutory definition for energy storage. The definition proposed is any "facility that uses any technology or process that is capable of using electric energy as an input, storing the energy for a period of time and then discharging electric energy as an output."

- Amendments to the AUCA create a separate category for energy storage facilities, for which approval by the Alberta Utilities Commission (AUC) is required.

- Allowing distribution and transmission companies to use energy storage facilities to provide utility service under certain circumstances.

- Allowing unlimited self-supply with export to the grid (i.e. on site generation with ability to sell excess power to the market).

- Building on the AUC Distribution System Inquiry by (i) requiring distribution transmission owners (DFOs) to prepare electric distribution system plans; and (ii) allowing competitive forces to develop distributed energy resources.

- Distribution owners will be required to prepare electric distribution system plans in accordance with future regulations.

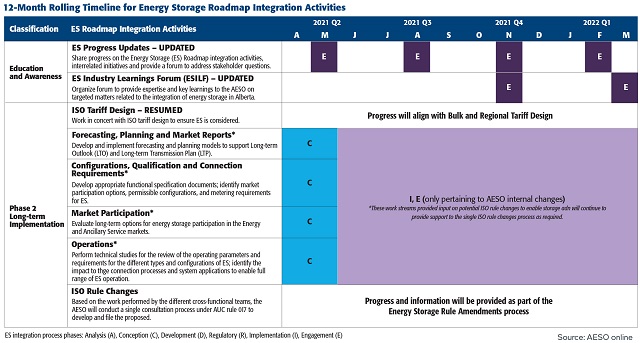

- Amendments to the ISO Rules: As part of Phase 2 of the AESO's Energy Storage Roadmap Integration Activities (set out in the AESO's Energy Storage Roadmap), the AESO is expected to commence the Energy Storage Rule Amendment process in 2022. The AESO intends to develop draft proposed amendments to the ISO Rules. These amendments are anticipated to impact more than 30 ISO rules, including those addressing: market participation, fast frequency response, technical, qualification and connection requirements, technology agnostic application of requirements, adjustment to load on the margin and opportunities to reduce red tape. Draft ISO Rule amendments are anticipated to be ready for stakeholder feedback in Q1 2022.

- Bulk and Regional Tariff Design: In October 2021, the AESO completed 19 months of engagement for the Bulk and Regional Tariff Design, intending to redesign the ISO tariff to ensure rates appropriately recover sunk costs of the current transmission system and send efficient price signals to guide investment and consumption decisions. The AESO submitted its Bulk and Regional Rate Design and Modernized DOS Rate Design Application (Application) to the AUC on October 15, 2021.

In response to an increased number of System Access Service Requests submitted by energy storage resources, the AESO examined the appropriate treatment of energy storage resources under the ISO tariff. The AESO did not propose a separate rate for energy storage resources or other special relief for energy storage resources under the ISO tariff. In the Application, the AESO maintained that energy storage resources should continue to pay for the costs of the transmission system based on the flows of electricity and the associated benefits by charging the owner of an energy storage resource Rate STS when electricity is injected onto the transmission system and Rate DTS when electricity is withdrawn from the transmission system.

Given the flexible nature of energy storage resources when withdrawing electricity from the transmission system, the AESO's Application recognizes that energy storage resources may qualify for the same opportunity services under the ISO tariff as other Rate DTS market participants, specifically, Rate DOS. Rate DOS is an existing non-firm rate that allows additional use of available transmission capacity that would not otherwise be used. The AESO is seeking to modernize Rate DOS (Modernized DOS) by removing barriers to entry to Rate DOS to enable owners of energy storage resources to utilize spare transmission system capacity not otherwise used. If approved, this would be a partial shift from the AESO's view in its 2018 general tariff application.

Source: AESO online.

British Columbia

Further to its Clean Power 2040 consultations which were completed in 2021, BC Hydro has made available to the public its 2021 Integrated Resource Plan which articulates BC Hydro's strategy to meet the electricity needs of the province on a 20-year horizon.

The plan is now under review by the BC Utilities Commission. BC Hydro anticipates that following the implementation of certain demand-side measures, including energy efficiency programs, voluntary time-varying rates and implementation of smart-charging technology for electric vehicles, no new energy needs will be expected to occur before 2030 and no new capacity needs will be expected to occur before 2037.

In light of such findings, the plan does not put forward a short or medium-term strategy to provide additional capacity through energy storage technologies such as utility-scale batteries and pumped hydro storage. For now, the potential and characteristics of such new sources of electricity are monitored by BC Hydro.

It is noted that BC Hydro expects cost declines in respect of utility-scale batteries over the next 10 years, which would make this technology more attractive at such time.

CONCLUSION

Notwithstanding persistent barriers stemming from the legacy of centralized grids, DERs continue to make inroads in a number of Canadian jurisdictions. Especially when it comes to storage, there is wide acknowledgement that scaling up distributed resources is a key aspect of decarbonization and achieving net zero emissions. All stakeholders, particularly regulators, system operators, and project proponents, will need to step up their collaborative efforts in order to realize DER potential in the coming years.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.