McCarthy Tétrault's Competition/Antitrust & Foreign Investment Group has recently released its Competition/Antitrust & Foreign Investment Outlook 2024, which highlighted proposed amendments to the Investment Canada Act's national security regime. Below is a summary of proposed amendments to the Investment Canada Act. The full guide can be downloaded at Trends to Watch: 2024 Competition/Antitrust & Foreign Investment Outlook.

CHANGE REMAINS ON THE HORIZON

Set in motion at the end of 2022, the move toward a more robust national security enforcement regime has been on hold through much of 2023.

The move toward a more robust national security enforcement regime has been onhold through much of 2023.

In November, 2022, following three high profile divestiture orders involving Chinese investors in the lithium mining sector, the government tabled Bill C-34: An Act to amend the Investment Canada Act ("Bill C-34"), which – once enacted – will mark the first significant legislative changes to the Investment Canada Act since the introduction of the national security regime in 2009. The pending changes are largely designed to render the national security review process more effective in detecting national security risks and more efficient in enforcing against them. Notably, the amendments will expand the categories of investments subject to pre-implementation notification to include any investment in an entity carrying on a "prescribed business activity", a concept still undefined but expected to align with the enumerated national security factors in the Investment Review Directorate's (IRD) national security guidelines, where the investor would acquire certain decision-making powers and receive sensitive, non-public information or access to "material assets" as a result of the investment. The hope is that pre-implementation notification in these instances will allow the government to more effectively screen potentially injurious acquisitions prior to closing, the harms of which could be realizable immediately upon implementation. By contrast, most national security enforcement action under the present regime operates on a post-closing, non-suspensory basis, arguably frustrating some remedial outcomes.

Pre-implementation notification in these instances will allow the government to more effectively screen potentially injurious acquisitions. The move toward a more robust national security enforcement regime has been on hold through much of 2023.

Other pending amendments include simplifying the process for the government to claim national security privilege during judicial review cases, empowering the Minister to impose interim measures where an investment has been completed and the government initiates the national security review process, and codifying Ministerial jurisdiction to approve investments with mitigation, without referring the decision to Cabinet (as the Investment Canada Act currently stipulates).

In addition, on September 28, 2023, the House of Commons Standing Committee on Industry and Technology proposed additional Investment Canada Act amendments that have since been incorporated into Bill C-34. These amendments include:

- enabling the Federal Cabinet to order a net benefit review of a notifiable investment where the investor is a state-owned or influenced enterprise from a country without a trade agreement with Canada;

- requiring the Minister to consider an investment's impact on intellectual property developed or funded by the Canadian government and Canadians' personal data during the net benefit review process;

- requiring (not merely allowing) the Minister to impose interim measures during the national security review process where such measures are necessary to prevent injury to national security and would not themselves introduce new risks of harm;

- codifying that the national security regime applies to the acquisition of assets of an entity carrying on all or part of its operations in Canada; and

- making prior corruption convictions a basis for the Minister to conclude that reasonable grounds exist to believe that an investment by a non-Canadian could be injurious to national security, though the Minister still retains the discretion whether to initiate the national security review process.

As of writing, the amendments remain under review before Senate committee and, after which, must be sent to the Senate for approval before the bill can receive royal assent. It is therefore possible, though not certain, that at least some of the amendments will come into force early in the New Year. Others – like the introduction of mandatory preclosing notifications for prescribed business activities – will not come into effect until parallel changes are made to the Investment Canada Regulations, drafts of which have not been released. Once enacted, however, both the filing requirements and voluntary strategies associated with national security review in Canada will change significantly.

ENFORCEMENT RAMPS UP

Despite the slow progression of legislative amendments, IRD has continued to strengthen its national security enforcement posture in 2023, reflecting recent policy announcements that focus on certain categories of investors (state owned enterprises, SOEs) and target industries (critical minerals and infrastructure).

The overall number of applications and notifications received from investors was down to 1,010 in the government's fiscal year ended March 31, 2023, following an all-time high of 1,255 applications and notifications in fiscal year 2021-2022. Instead, the number of filings received in 2022-2023 was consistent with the most recent five year average. Investors from the United States, the United Kingdom and the European Union accounted for the significant majority (approximately 80%), with the United States alone accounting for approximately 55% of notified investments. The next largest investors were China (43 investments), India (29 investments), Australia (15 investments) and Japan (15 investments).

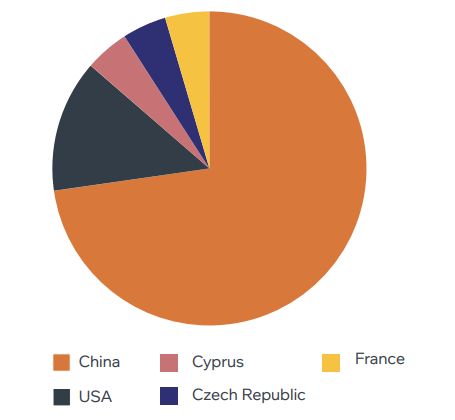

Extended National Security Reviews by Investor Origin

This chart compares the number of extended national security reviews by investor country of origin.

Despite the decline in the total number of notified investments, IRD's national security enforcement activity increased significantly. A record 32 investments were subject to extended reviews under Part IV.1 in 2022- 2023, compared to 24 and 23 in 2021-2022 and 2020- 2021, respectively. Of those 32 extended reviews, 22 received an order for full review pursuant to section 25.3, which was 10 more than the year prior. Of those 22 full reviews, eight investors withdrew their application and terminated their investments, three were ordered to divest their investments and 10 reviews were discontinued by the government. However, it is likely that some – if not most – discontinuances were conditional upon negotiated undertakings between the Minister and the investor (a process not currently prescribed by the Investment Canada Act but to be codified via Bill C-34).

Detailed information about the reviewed investments and the concerns they raise is unknown. Despite the government's promise to enhance transparency where full reviews are ordered, no public statements have been made regarding specific reviews since November 2022. However, certain trends and assumptions can be gleaned from IRD's Annual Report. In particular, consistent with IRD's national security guidelines, full reviews appeared to be reserved for investments in industries raising one or more of the guidelines' enumerated national security factors. For example:

- Investments involving sensitive and critical technology and know-how were closely scrutinized, with the Minister reviewing seven investments in computer systems design businesses, two investments in scientific research and development businesses and one investment in a communications equipment manufacturing business.

- Critical mineral supply remained front of mind, with six reviews launched for investments in mining (though the minerals were unspecified, one review involved metal ore mining and five involved non-metallic mineral mining and quarrying).

- One review was ordered for an investment in an investigation and security services business, which may have raised several national security factors, including the potential for foreign surveillance and espionage, the potential impact on Canada's intelligence or law enforcement and/or the investor's potential collection and use of sensitive personal data through the investment.

The origin of the investor continues to be a key national security consideration. As in recent years, investments by Chinese investors made up a disproportionate number of investigations. Of the 22 full reviews ordered, 16 related to Chinese investments. However, it is critical to note that despite Chinese investors accounting for the majority of reviewed investments, 27 Chinese investments were allowed to proceed without review and five of those reviewed on an extended basis were allowed to proceed. Accordingly, while Chinese investors are likely to attract increased scrutiny, Canada is not closed to all investment from China.

INVESTMENT CANADA ACT: A DEAL FACTOR

Our annual review of the 30 largest deals involving Canadian publicly-listed entities between January and December 1, 2023 indicates that the Investment Canada Act is increasingly considered when negotiating the acquisition of a Canadian business. Of the 22 deals involving a foreign-controlled buyer, 68% included a representation regarding the buyer's status as either a World Trade Organization or trade agreement investor (designations which dictate the applicable Investment Canada Act review threshold).

This is a 28% increase over the top 30 deals of 2022. In addition, 27% included a representation that the investor is not a state-owned enterprise, compared to 23% and 13% in 2022 and 2021, respectively.

However, the Investment Canada Act is not only impacting representations and warranties in transaction agreements – it is increasingly pertinent to deal timing.

Of the 22 deals with a foreign-controlled buyer, 27% included national security clearance under Part IV.1 of the Investment Canada Act as a closing condition, compared to 5% and 17% in the previous two years, respectively.

More prescriptive conditions regarding filing timelines, cooperation covenants and remedies and break fees with respect to national security remain unusual but are likely to become more commonplace as the national security landscape continues to shift.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.