British Columbia has finalized details of its rule requiring companies to keep records of indirect or beneficial ownership. It amended its corporate legislation to this end in April of 2019, and has more recently filled in gaps with regulations and announced an in-force date of May 1, 2020. The substance of the regime, and some background, are described in this insight. We have included the applicable legislation and regulations at the end.

BC has also launched a public consultation on whether to implement a central registry of beneficial ownership for BC companies. This would involve including beneficial ownership information from a company's records in a government database. Whether and how much of that data should become public is canvassed in a consultation paper, which sets out a number of issues relating to corporate beneficial ownership disclosure. The consultation paper also seeks feedback on similar proposals in respect of trusts and partnerships. Consultation on these issues is open until March 13, 2020.

The federal government has also initiated consultation in respect of a central registry for federal corporations, with comments accepted until March 26, 2020.

The balance of this alert summarizes BC's legislative and regulatory changes that will become effective May 1, 2020.

Background

As a rule, all companies are required to keep a record of their shareholders. This is maintained in a register, i.e., a list, which has given rise to the term "registered" shareholders to describe the legal owners of shares. Because such a holder could be an organization or a nominee individual, even the board and management of a company may not know who ultimately owns or controls its shares. This anonymity can enable money laundering and tax evasion, among other things.

The federal corporations law was the first in Canada to mandate beneficial share ownership records.1 Changes to the Canada Business Corporations Act (CBCA) in 2019 require corporations governed by that law to keep a record of "individuals with significant control" (ISC), including 25 percent indirect or beneficial shareholders. We summarized that amendment in a previous insight. Shortly after the change took effect, the CBCA was further amended to allow law enforcement and the Canada Revenue Agency to access CBCA companies' ISC records in the context of an investigation.

These changes stem from an agreement among the provinces and the federal government in 2017, in which they undertook to mandate recording of indirect or beneficial 25 percent shareholders and to crack down on the use of bearer securities.2 That agreement, which focused on principles rather than specific amending language, reflects an international push for enhanced transparency of corporate ownership. It was also a response to critiques by the intergovernmental organization tasked with overseeing these matters.3

Overview of the changes

In light of the above, the 2019 amendments to British Columbia's Business Corporations Act (BCA) will require private companies and unlimited liability companies (ULC) governed by the BCA (each, a BC Company) to keep a record of their significant beneficial owners.4 In summary, this document, known as a Transparency Register, must record information about any individual (Significant Individual) who:

- Owns, directly or beneficially, or has indirect control of one

or more shares constituting:

- 25 percent or more of the issued shares (Significant Equity), or

- 25 percent or more of the rights to vote at general meetings (Significant Votes);

- Has the right to appoint or remove a majority of the directors, or has indirect control over such right (Board Rights); or

- Has the ability to exercise direct and significant influence over an individual with Board Rights (Influence).5

That is, an individual is a Significant Individual in respect of a BC Company if s/he satisfies any of four criteria: Significant Equity, Significant Votes, Board Rights or Influence.

As an anti-avoidance provision, if any such right is held jointly or subject to an agreement by two or more individuals – for example, if each of Anne and Bob owns 15 percent of a BC Company's voting shares, but have agreed to exercise their voting rights in concert – then all such individuals must be listed.

The new sections of the BCA that speak to Transparency Registers are set out in the Schedule A to this insight. The full amendment, including consequential amendments to other parts of the BCA, is available here.6

Indirect control

Of the four criteria in the definition of Significant Individual – being Significant Equity, Significant Votes Board Rights and Influence – the first three explicitly contemplate "indirect control". That is, an individual will be a Significant Individual in respect of a BC Company if s/he has indirect control of 25 percent or more of the shares or voting rights, or has indirect control of the right to appoint or remove a majority of the board.

The applicable regulations, which are set out in Schedule B to this insight, set out what constitutes indirect control over both shares and Board Rights. Such control can exist via one or more intermediaries, being a company, partnership, trustee, agent, or personal or other legal representative. The regulations also introduce the concept of a "chain of intermediaries", which is relevant to some types of indirect control. The definition of this term is complex, but in essence, it means having two or more intermediaries between the controlling individual and the applicable BC Company.

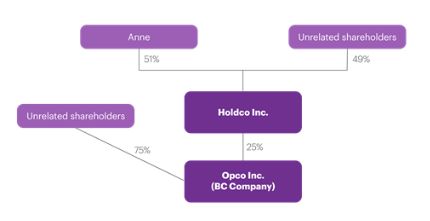

To illustrate, consider the following example:

Each of Holdco and Opco is a BC Company. Anne is the registered owner of 51 percent of the only class of issued shares of Holdco, which, in turn, owns 25 percent of the only class of issued shares of Opco.7 Anne is a Significant Individual in respect of Holdco (three times over), in that she has Significant Equity, Significant Votes and Board Control.

Anne is also a Significant Individual in respect of Opco, owing to her indirect control of Significant Equity in Opco. This stems from the definitions of "intermediary", "indirect control over shares" and "control", in section 46 and paragraphs 47(2)(a) and 50(1)(a) of the regulations, respectively. The key is that Anne controls Holdco, due to her right to elect a majority of its board, which is an intermediary and the registered owner of 25 percent of the issued shares of Opco.

Notably, the level of Anne's economic interest in the shares of Opco – being less than 13 percent – is not relevant in determining whether she is a Significant Individual.8

The BC government has also provided guidance setting out, among other things, example scenarios in respect of each criterion in the definition of Significant Individual.

Duty on registered shareholders

Because a company may not be able to identify its indirect shareholders, the BCA requires registered shareholders, on request from the BC Company, to take "reasonable steps" to determine who owns or controls shares registered in their name, and to "promptly" send that information to the BC Company. This is significant in that Canadian corporate statutes generally do not impose duties on shareholders.9

A BC Company is similarly required to take reasonable steps to confirm the information in its Transparency Register within prescribed periods.

Contents of Transparency Register

The Transparency Register must record the following for each Significant Individual, to the extent the BC Company is able to obtain this information:

- Their full name, date of birth and last known address;

- Whether s/he is a Canadian citizen or permanent resident;

- Every country or state of which s/he is a citizen, if not a Canadian citizen or permanent resident;

- Whether s/he is resident in Canada for income tax purposes;

- The date on which s/he became or ceased to be a Significant Individual in respect of the BC Company;

- A description of how s/he is a Significant Individual; and

- Information to be prescribed by regulation, if any.

If the BC Company is not able to obtain or confirm some or all of the above after making reasonable efforts, it must include in the Transparency Register a summary of the steps it took to obtain the missing information.

If the BC Company determines there are no Significant Individuals in respect of the BC Company, the Transparency Register must include a statement to that effect.

Access to Transparency Registers

Transparency Registers will be private corporate records, not accessible by the public, or (unlike ISC registers under the CBCA) other shareholders or the BC Company's creditors. This will address some of the privacy concerns raised in respect of the CBCA amendments.

Access by governmental and regulatory authorities will, however, be significantly broader than under the equivalent provisions of the CBCA.

Tax authorities will be able to inspect and take a copy of a Transparency Register in administering or enforcing tax laws, and provide information to certain foreign tax authorities. Law enforcement will also be entitled to access the Transparency Registers in conducting an investigation or assisting certain foreign investigative authorities, and for policing and criminal intelligence operations.

Moreover, certain regulatory authorities, including the BC Securities Commission, FINTRAC and the Law Society of BC, will be entitled to inspect and take copies of a Transparency Register in administering or enforcing laws for which they are responsible. They will also have access for assisting other Canadian regulators and certain foreign regulatory bodies.

The applicable CBCA rule allows less access by public authorities, in two broad respects. First, the CBCA does not enable access to ISC records by regulators, intelligence operations or assistance with foreign investigations. Second, access by law enforcement under the CBCA must be in the context of an investigation into certain listed offences (though that list is long), whereas the BCA Amendment mandates access to a Transparency Register for any investigation undertaken with a view to a law enforcement proceeding, or from which such a proceeding is likely to result.

Notification requirements

A BC Company must notify, in writing, any Significant Individual or any individual who has ceased to be a Significant Individual within 10 days of making the applicable notation in the Transparency Register.

Offences and sanctions

Offences under the BCA Amendment in respect of Transparency Registers are set out in a new section 427.1, which is in the Schedule A to this insight.

A BC Company commits an offence if its Transparency Register lists an individual in error, omits any Significant Individual or required information, or contains certain incorrect information. Any director or officer of a BC Company who permits or acquiesces in any such offence also commits an offence. A BC Company and its directors and officers will have a defence if they were unaware of the incorrect or omitted information and were duly diligent with respect to the preparation of the Transparency Register.

A registered shareholder who provides incorrect information in respect of a Transparency Register also commits an offence, subject to a similar defence if s/he was both unaware and duly diligent.

A breach of the duties associated with a Transparency Register by a BC Company, its directors or officers, or a registered shareholder, can result in a fine of up to $50,000 for an individual or $100,000 for a non-individual. These amounts are significantly larger than for breaches of other provisions of the BCA.

Unlike the CBCA, the BCA Amendment does not contemplate imprisonment for a breach of the new rules.

The context

The BCA Amendment, while significant, is hardly radical in light of related developments in BC and elsewhere. As noted above, Canada and BC have each begun consultation on creating a central registry. Québec has recently concluded a similar consultation.

Also relevant is British Columbia's Land Owner Transparency Act (LOTA). That legislation, when it comes into force (likely mid-2020), will create a publicly accessible registry of beneficial or indirect ownership of real property in British Columbia. We described this regime a recent insight.

The global leader in transparency legislation is the United Kingdom. The UK has had a publicly accessible registry of beneficial ownership of private companies for several years. Countries in the EU also have central and publicly accessible registries.10 Singapore and Hong Kong have similar legislation.11 The United States government has recently stated an intention to finalize a corporate transparency law in 2020.

Disclosure of beneficial ownership of non-corporate entities, such as trusts, is also on the horizon. The UK has a central but non-public register of trust interests, and starting in 2021, certain Canadian trusts will have to provide beneficial ownership information to the Canada Revenue Agency.12 Moreover, under LOTA, most trusts that own real estate in British Columbia will have to make a public filing as to their settlors, trustees and beneficiaries.

Possible additional guidance

The Province may provide additional guidance, including as to the application of the Transparency Register requirements to wholly-owned subsidiaries of public companies, prior to implementation of the new rules on May 1, 2020.

Daniel McElroy, Practice Support Lawyer in Dentons' Vancouver office, contributed to this note.

Schedule A – Legislation

Extract of Business Corporations Act Amendment, 2019

"5. The following Part is added [to the Business Corporations Act (British Columbia)]:

Part 4.1 – Transparency Register

Definitions

119.1 In this Part:

"inspecting official" means an individual who is authorized to conduct an inspection of the transparency register under section 119.7, 119.71 or 119.8;

"permanent resident" has the same meaning as in the Immigration and Refugee Protection Act (Canada);

"person who maintains the records office" in respect of a private company includes a private company that maintains its own records office;

"private company" means a company that is not

(a) a reporting issuer,

(b) a reporting issuer equivalent,

(c) listed on a designated stock exchange within the meaning of section 248 (1) of the Income Tax Act (Canada), or

(d) within a prescribed class of companies;

"regulator" means any of the following:

(a) the British Columbia Securities Commission continued under the Securities Act;

(b) the Financial Institutions Commission established under the Financial Institutions Act;

(c) the Financial Transactions and Reports Analysis Centre of Canada established under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada);

(d) the Law Society of British Columbia;

(e) a prescribed public officer, corporation, agency or other entity whose authority to regulate is based on a law of British Columbia or Canada;

"taxing authority" means the portion of the government of British Columbia or Canada responsible for administering or enforcing

(a) a law of British Columbia or Canada that provides for the imposition or collection of a tax, royalty or duty, or

(b) a prescribed law of British Columbia or Canada that is related to a law referred to in paragraph (a).

Significant individual

119.11 (1) In this section, "significant number of shares", in respect of a private company, means either of the following:

(a) 25% or more of the issued shares of the company;

(b) issued shares of the company that carry 25% or more of the rights to vote at general meetings.

(2) Subject to any prescribed class of exclusions, an individual is a significant individual in respect of a private company if any of the following apply:

(a) the individual has any of the following interests or rights, or any combination of them, in a significant number of shares of the private company:

(i) an interest as a registered owner of one or more of the company's shares;

(ii) an interest as a beneficial owner of one or more of the company's shares, other than an interest that is contingent on the death of another individual;

(iii) indirect control, within the meaning of the regulations, of one or more of the company's shares;

(b) the individual has any of the following rights or abilities, or any combination of them, that, if exercised, would result in the election, appointment or removal of the majority of the directors of the private company:

(i) the right to elect, appoint or remove one or more of the company's directors;

(ii) indirect control, within the meaning of the regulations, of the right to elect, appoint or remove one or more of the company's directors;

(iii) the ability to exercise direct and significant influence over an individual who has the right or indirect control described in subparagraph (i) or (ii);

(c) the individual has a prescribed interest, right or ability in relation to the private company, or a prescribed criterion or circumstance applies to the individual in relation to the private company.

(3) If an interest or right referred to in subsection (2) in respect of a private company is held jointly by 2 or more individuals, each individual is a significant individual in respect of the company.

(4) When 2 or more individuals have interests, rights or abilities that, when combined, meet a criterion described in subsection (2) (a), (b) or (c) in respect of a private company, each individual is a significant individual in respect of the company if

(a) the interests, rights or abilities are subject to an agreement or arrangement under which the interests, rights or abilities are to be exercised jointly or in concert by those individuals, or

(b) each individual is an associate, within the meaning of paragraph (c) or (d) of the definition of "associate" in section 192 (1), of the other individuals.

Transparency register

119.2 (1) A private company must take reasonable steps to maintain a transparency register that contains the information and material referred to in subsections (2) to (5).

(2) The transparency register must contain the following information for each significant individual in respect of the private company:

(a) the individual's full name, date of birth and last known address;

(b) whether or not the individual is a Canadian citizen or permanent resident of Canada;

(c) if the individual is not a Canadian citizen or permanent resident of Canada, every country or state of which the individual is a citizen;

(d) whether or not the individual is resident in Canada for the purposes of the Income Tax Act (Canada);

(e) the date on which the individual became or ceased to be a significant individual in respect of the company;

(f) a description of how the individual is a significant individual;

(g) prescribed information, if any.

(3) If a private company determines that there are no individuals who are significant individuals in respect of the company, the transparency register must contain a statement setting this out.

(4) If a private company is unable to obtain or confirm some or all of the information referred to in subsection (2) in respect of a significant individual, the transparency register must contain the following:

(a) the information referred to in subsection (2) that the company was able to obtain or confirm in respect of the individual;

(b) for information referred to in subsection (2) that the company was not able to obtain or confirm, a summary of the steps taken to obtain or confirm the information;

(c) prescribed information, if any.

(5) If, by operation of section 119.6, an order is made under section 45 (1) in respect of the private company's transparency register, the transparency register must contain a copy of the order.

Shareholder's duty to send information

119.21 (1) A private company may at any time send to a shareholder of the company a request to provide the company with information for the purposes of maintaining its transparency register.

(2) A shareholder, after receiving a request under subsection (1), must, after taking reasonable steps to compile the requested information, promptly send to the private company the information that the shareholder was able to compile.

Annual review to confirm information

119.3 A private company must annually, within the period starting on the anniversary of the date on which the company was recognized and ending 2 months after that date, take reasonable steps to confirm that the information required under section 119.2 to be contained in its transparency register is accurate, complete and up to date.

Duty to update information

119.31 (1) If a private company becomes aware of any new or different information referred to in section 119.2 (2) or (3) as a result of steps taken in accordance with section 119.3 or through any other means, the company must record that information in its transparency register within 30 days after becoming aware of the information.

(2) If a private company is unable to obtain or confirm some or all of the information referred to in section 119.2 (2) after taking steps in accordance with section 119.3 as part of the company's annual review, the company must record in the transparency register the information specified in section 119.2 (4) within the 2-month period referred to in section 119.3 in respect of that annual review.

Duties after individual ceases to be a significant individual

119.4 Within one year after the sixth anniversary of the date on which an entry is made in a private company's transparency register indicating that an individual has ceased to be a significant individual in respect of the company, the company must

(a) delete from its transparency register all information relating to the individual, and

(b) destroy any record that the company created or received in respect of the individual for the purposes of maintaining the transparency register.

Duty to notify individuals

119.41 A private company must, within 10 days after indicating in its transparency register that an individual is a significant individual in respect of the company or that an individual has ceased to be a significant individual in respect of the company, send a notice to the individual that sets out this fact and the prescribed information, if any.

Location of transparency register

119.5 (1) Subject to subsection (2), a private company must keep its transparency register at its records office.

(2) A private company may keep its transparency register at a location other than its records office so long as the register is available for inspection and copying, in accordance with sections 119.7 to 119.91, at its records office by means of a computer terminal or other electronic technology.

Requirements relating to transparency register

119.51 (1) A person who maintains the records office for a private company must take reasonable steps to

(a) keep the company's transparency register in a complete state,

(b) avoid loss, mutilation or destruction of the transparency register, except as required under section 119.4,

(c) avoid falsification of entries in the transparency register, and

(d) provide inspecting officials and the company's directors with simple, reliable and prompt access to the transparency register.

(2) A person who maintains the records office for a private company must ensure that the company's transparency register is maintained

(a) in an electronic form,

(b) on microfilm,

(c) in a bound or looseleaf form, or

(d) in another prescribed form.

Missing records

119.6 Section 45 (1) [missing records] applies in respect of a private company's transparency register.

Inspection of transparency register

119.61 (1) A person who maintains the records office for a private company must allow an inspecting official or a director of the company who complies with the requirements and restrictions under section 119.81 (1) or 119.9, as the case may be, to inspect the company's transparency register.

(2) A person who maintains the records office for a private company must not allow anyone to inspect the company's transparency register except

(a) an inspecting official, or

(b) a director of the company.

Inspection for tax purposes

119.7 An official or employee of a taxing authority may inspect a private company's transparency register for the following purposes:

(a) administering or enforcing

(i) a law of British Columbia or Canada that provides for the imposition or collection of a tax, royalty or duty, or

(ii) a prescribed law of British Columbia or Canada that is related to a law referred to in subparagraph (i);

(b) providing information contained in the transparency register to another jurisdiction in or outside Canada to assist the jurisdiction in the administration or enforcement of a law of that jurisdiction that provides for the imposition or collection of a tax, royalty or duty if this assistance is authorized under an arrangement, written agreement, treaty or law of British Columbia or Canada.

Inspection for law enforcement purposes

119.71 An officer within the meaning of the Police Act or a member of the Royal Canadian Mounted Police may inspect a private company's transparency register for the following purposes:

(a) conducting an investigation in Canada

(i) that is undertaken with a view to a law enforcement proceeding, or

(ii) from which a law enforcement proceeding is likely to result;

(b) policing and criminal intelligence operations in Canada;

(c) assisting another law enforcement agency in Canada for a purpose described in paragraph (a) or (b);

(d) providing information contained in the transparency register to a law enforcement agency in a jurisdiction outside Canada to assist the agency in a law enforcement proceeding if this assistance is authorized under an arrangement, written agreement, treaty or law of British Columbia or Canada.

Inspection for regulatory purposes

119.8 An official or employee of a regulator may inspect a private company's transparency register for the following purposes:

(a) administering or enforcing a law for which the regulator is responsible;

(b) assisting another agency in Canada in the administration or enforcement of a law that is similar to a law for which the regulator is responsible;

(c) providing information contained in the transparency register to an agency outside Canada to assist the agency in the administration or enforcement of a law that is similar to a law for which the regulator is responsible if this assistance is authorized under an arrangement, written agreement, treaty or law of British Columbia or Canada.

Inspecting official – requirements and restrictions

119.81 (1) An inspecting official who inspects a transparency register is subject to the following requirements and restrictions:

(a) subject to paragraph (b), the inspection must occur during statutory business hours;

(b) if a private company has passed an ordinary resolution in accordance with subsection (2) that reduces the hours during which the transparency register may be inspected, the inspection of the company's transparency register must occur during those hours;

(c) the inspecting official must present identification on the request of the person who provides access to the transparency register;

(d) prescribed requirements or restrictions, if any.

(2) A private company may, by an ordinary resolution, reduce the hours during which an inspecting official may inspect its transparency register, but the resolution must provide that the transparency register may be inspected for a period of at least 2 consecutive hours per day within statutory business hours.

Hours when director can inspect

119.9 A director of a private company is restricted to inspecting the company's transparency register during statutory business hours.

Copies of transparency register

119.91 (1) If an inspecting official or director requests a copy of a private company's transparency register and pays, to the person who maintains the records office for the company, the copying fee, if any, set by that person, the person must provide, in accordance with subsection (3), the copy to the inspecting official or director promptly after receipt of the payment.

(2) The copying fee referred to in subsection (1) must not exceed the prescribed maximum copying fee.

(3) A copy of the transparency register referred to in subsection (1) must be provided

(a) in a manner agreed on by the individual seeking to obtain the copy and the person who maintains the records office, or

(b) in the absence of agreement, in a prescribed manner or by registered mail as selected by the individual seeking to obtain the copy."

...

13 The following section is added:

"Transparency register – incorrect entries and false information

427.1(1) In this section:

"private company" has the same meaning as in section 119.1;

"significant individual" means a significant individual under section 119.11.

(2) Subject to subsection (4), a private company commits an offence if its transparency register

(a) identifies an individual as a significant individual who is not a significant individual in respect of the company,

(b) excludes an individual who is a significant individual in respect of the company,

(c) contains information about a significant individual that is false or misleading in respect of any material fact, or

(d) omits information about a significant individual, the omission of which makes the information false or misleading.

(3) If a private company commits an offence under subsection (2), any director or officer of the company who, subject to subsection (4), authorizes, permits or acquiesces in the commission of the offence also commits an offence, whether or not the company is prosecuted or convicted.

(4) No person is guilty of an offence under subsection (2) or (3) if the person

(a) did not know that the identification or exclusion of the individual was incorrect or that the information about a significant individual was false or misleading, and

(b) with the exercise of reasonable diligence, could not have known that the identification or exclusion of the individual was incorrect or that the information was false or misleading.

(5) Subject to subsection (6), a shareholder of a private company who sends information to the company for the purposes of the company's transparency register commits an offence if the information

(a) is false or misleading in respect of any material fact, or

(b) omits any material fact, the omission of which makes the information false or misleading.

(6) No person is guilty of an offence under subsection (5) if the person

(a) did not know that the information was false or misleading, and

(b) with the exercise of reasonable diligence, could not have known that the information was false or misleading."

14 Section 428 is amended by adding the following subsection:

"(2.1) A person who commits an offence under section 426 (4.1) or 427.1 (2), (3) or (5) is liable

(a) in the case of a person other than an individual, to a fine of not more than $100 000, and

(b) in the case of an individual, to a fine of not more than $50 000."

Schedule B – Regulations

Extract of Order in Council 533, October 24, 2019

"The Business Corporations Regulation, B.C. Reg. 65/2004, is amended by adding the following Part:

PART 18 - TRANSPARENCY REGISTER

Definitions

46 In this Part:

"chain of intermediaries", in relation to a private company, means a chain of intermediaries described in section 49;

"control" means control determined in accordance with the rules set out in section 50;

"intermediary" means a corporation, partnership, agent, trustee or personal or other legal representative;

"private company" has the same meaning as in section 119.1 of the Act.

Indirect control - shares

47 (1) This section sets out the meaning of indirect control of one or more of the shares of a private company for the purposes of section 119.11 (2) (a) (iii) of the Act.

(2) An individual has indirect control of one or more of the shares of a private company if the individual, who is not an intermediary,

(a) controls an intermediary that is the registered owner of the shares, or

(b) controls a chain of intermediaries, the last of which is the registered owner of the shares.

(3) In addition to any individual who has indirect control under subsection (2) (b), an individual has indirect control of one or more of the shares of a private company if the individual is a trustee or personal or other legal representative in a chain of intermediaries, the last of which is the registered owner of the shares.

Indirect control - rights relating to directors

48 (1) This section sets out the meaning of indirect control of the right to elect, appoint or remove one or more of the directors of a private company for the purposes of section 119.11 (2) (b) (ii) of the Act.

(2) An individual has indirect control of the right to elect, appoint or remove one or more of the directors of a private company if the individual, who is not an intermediary,

(a) controls an intermediary that has that right, or

(b) controls a chain of intermediaries, the last of which has that right.

(3) In addition to any individual who has indirect control under subsection (2) (b), an individual has indirect control of the right to elect, appoint or remove one or more of the directors of a private company if the individual is a trustee or personal or other legal representative in a chain of intermediaries, the last of which has that right.

Chain of intermediaries

49 For the purposes of this Part, a chain of intermediaries, in relation to a private company, is a group of 2 or more intermediaries having a hierarchal relationship to each other in which

(a) the last intermediary in the chain

(i) is the registered owner of one or more of the shares of the private company, or

(ii) has the right to elect, appoint or remove one or more of the directors of the private company,

(b) each intermediary in the chain controls the intermediary below it, and

(c) the first intermediary in the chain is

(i) controlled by an individual who is not an intermediary,

(ii) a trustee if the trustee is not controlled by a person, or

(iii) a personal or other legal representative if the representative is not controlled by a person.

Control

50 (1) For the purposes of this Part, control of an intermediary that is a corporation, partnership or agent, other than a corporation, partnership or agent that is a trustee or personal or other legal representative, is determined in accordance with the following rules:

(a) a person controls a corporation if the person has the right to elect or appoint a majority of the directors of the corporation;

(b) a person controls a partnership if the person is a partner in the partnership;

(c) a person controls an agent if the person is the principal of the agent.

(2) For the purposes of this Part, control of an intermediary that is a trustee is determined in accordance with the following rules:

(a) a person controls a trustee that is the registered owner of one or more of the shares of a private company if the person has, under the terms of the trust, the power to direct how the trustee is to exercise any of the rights that are attached to the shares;

(b) a person controls a trustee that has the right to elect, appoint or remove one or more of the directors of a private company if the person has, under the terms of the trust, the power to direct how the trustee is to exercise that right;

(c) a person controls a trustee that controls an intermediary if the person has, under the terms of the trust, the power to direct how the trustee is to exercise control over the intermediary;

(d) the rules in subsection (1) apply in determining who controls a corporation, partnership or agent that controls a trustee.

(3) For the purposes of this Part, control of an intermediary that is a personal or other legal representative is determined in accordance with the following rules:

(a) a person controls a representative that is the registered owner of one or more of the shares of a private company if the person has the legal authority to direct how the representative is to exercise any of the rights that are attached to the shares;

(b) a person controls a representative that has the right to elect, appoint or remove one or more of the directors of a private company if the person has the legal authority to direct how the representative is to exercise that right;

(c) a person controls a representative that controls an intermediary if the person has the legal authority to direct how the representative is to exercise control over the intermediary;

(d) the rules in subsection (1) apply in determining who controls a corporation, partnership or agent that controls a representative.

(4) For the purposes of this Part, an individual controls a chain of intermediaries if the individual controls the first intermediary in the chain.

Public Guardian and Trustee

51 Despite sections 47 and 48, if the Public Guardian and Trustee

(a) controls an intermediary that is the registered owner of one or more of the shares of a private company or controls a chain of intermediaries, the last of which is the registered owner of one or more of the shares of a private company, or

(b) controls an intermediary that has the right to elect, appoint or remove one or more of the directors of a private company or controls a chain of intermediaries, the last of which has the right to elect, appoint or remove one or more of the directors of a private company,

no individual has, for the purposes of section 119.11 (2) (a) (iii) or (b) (ii) of the Act, indirect control of those shares or that right.

Footnotes

1 Sections 21.1-21.4 of the CBCA. British Columbia is among the first provinces to amend its corporate statute to a similar end. Manitoba, which has made changes to its Corporations Act that are harmonized with the CBCA amendment, appears to be fastest out of the gate with an in-force date of no later than April 8, 2020.

2 Restrictions on bearer shares and warrants were included in the Business Corporations Amendment Act, 2019 (BCA Amendment), and came into force in May of 2019.

3 In a 2016 report of the Financial Action Task Force, Canada, the provinces and territories were graded "partially-compliant" in respect of corporate transparency, and "non-compliant" in respect of other legal arrangements, such as trusts (pp. 168, 170). The report also highlighted concerns in respect of misuse of lawyers' trust accounts, which have resulted in "enhanced client due diligence" changes to the rules of the provincial law societies. Those changes are being implemented in Alberta and British Columbia at first, with the balance of the provinces likely to follow in 2020.

4 BCA Amendment, Part 4.1 – Transparency Register, which adds Sections 119.1-119.91 to the BCA, the full text of which is included in the Schedule A to this insight.

5 BCA Amendment, section 119.11(1) and (2).

6 The link is to the Bill at First Reading. The final version is identical, but for the removal of the "explanatory notes".

7 As a rule of Canadian corporate law, if there is only one class of shares it must have voting rights, rights to dividends and rights following dissolution of the company.

8 Conversely, in a hypothetical scenario where an individual held all of the dividend rights but less than 25 percent of the issued shares and the voting rights, s/he would not be a Significant Individual. This is contrasted with the CBCA, where the definition of ISC includes a "value" criterion, i.e., if an individual owns 25 percent of a CBCA company's shares by value, s/he is an ISC.

9 There is a similar provision in the CBCA, enacted with the provisions noted above relating to ISCs.

10 Dentons maintains a comparative guide to legislation in respect of "EU Transparency Registers", available here

11 Singapore's legislation is described here and Hong Kong's here.

12 See the applicable CRA page.

About Dentons

Dentons is the world's first polycentric global law firm. A top 20 firm on the Acritas 2015 Global Elite Brand Index, the Firm is committed to challenging the status quo in delivering consistent and uncompromising quality and value in new and inventive ways. Driven to provide clients a competitive edge, and connected to the communities where its clients want to do business, Dentons knows that understanding local cultures is crucial to successfully completing a deal, resolving a dispute or solving a business challenge. Now the world's largest law firm, Dentons' global team builds agile, tailored solutions to meet the local, national and global needs of private and public clients of any size in more than 125 locations serving 50-plus countries. www.dentons.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances. Specific Questions relating to this article should be addressed directly to the author.