2023 Financing Activity in Canada

As Canada's economy continued to face headwinds in 2023, the fundraising landscape for startups remained tight, with venture capitalists choosing a more selective investment approach that favoured existing portfolio companies.

1) Deal Activity

The overall number of deals in 2023 (127) was down approximately 13% from 2022 (146). This decline was felt more in the early and mid-stages (Series Seed, Series A and Series B), which saw deal numbers fall compared to last year, while later-stage financings (Series C and onwards) saw an uptick.

With a lower number of financings, and a significant number of later-stage down rounds in 2023, we saw companies facing the end of their runways being forced to embark on later-stage fundraising in a less than favorable environment for terms and valuations.

In 2022, we noted the rise in "sweeteners"—a trend that continued in 2023. Many investors opted to reserve their capital for insider rounds to shore-up and scale their existing portfolio investments. For new investments, venture capitalists continued to favour healthy valuations in Seed stage companies and sectors promising sustained growth, such as AI, cleantech and healthtech.

Despite lower financing activity in 2023, we are seeing a number of our clients raise funding at non-depressed valuations, showcasing the market's appetite for wellperforming businesses with clearly demonstrated growth strategies. Notably, 35% of financings were up rounds, which is positive considering that 51% of transactions were first-time priced round deals.

"In the long term, great companies will continue to

be financed and there will be growth and depth in the ecosystem.

However, the next 12-24 months will be challenging for founders as

closures, investor friendly terms and unfavourable macro-economic

conditions persist."

- Konata Lake, Partner, Head of Torys' Emerging Companies and

VC Group

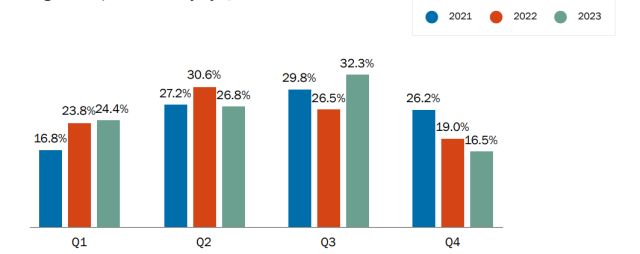

Figure 1.1) Deal Activity by Quarter1

Distribution of financings in 2023 followed the same pattern as in previous years, with the largest proportion of deals occurring in the second and third quarters.

Ontario and Québec continued to lead the way in the number of Canadian venture capital deals, with Ontario attracting over half (53.2%) of financings—mirroring the scale of the market. Québec maintained its position as the second strongest market in the face of significant regulatory changes. Updated privacy laws, launched in a bid to build consumer trust and limit the rising threat from bad actors, go well above the Canadian standard. While the new regime may offer the province's startups a springboard to gain a competitive advantage, startups will be forced to comply with this increased regulatory burden. Further, it remains to be seen if evolving developments in French language laws will influence the future of the province's ecosystem. Despite shifting regulatory landscapes, Québec-based investors and startups have been the beneficiary of significant government funding initiatives which may counterbalance some of the regulatory headwinds2.

Unsurprisingly, Alberta's venture capital financings remained in full swing, as the province entered its third year of growth. We attribute this in large part to the Alberta government's tech sector policies, and a community of industry leaders dedicated to supporting the next round of Alberta-based founders. With last year's number of financings in the province (17.5%) almost drawing level with Québec (19.0%), it has yet to be seen if Alberta can displace Québec as the second most active market on a deal count basis—particularly as venture capitalists continue to invest in cleantech projects which are an increasingly robust industry in Alberta. Unsurprisingly, transactions in the province skew to earlier stage given the recent growth of the Alberta market.

As 2024 progresses, Ontario and Québec will likely remain the frontrunners in the venture capital ecosystem, in part due to their mature ecosystems, deep capital pools and strong startup communities.

The number of early-stage financings (-16.8% YoY) and mid-stage financings (-20% YoY) were down on a year-over-year basis, while the number of later-stage financings trended higher (+29% YoY)3. Seed financings remained under pressure, while the proportion of mid-stage companies that completed series A and B preferred financings was lower in 2023. Series C financings and onward exceeded the number in 2022.

A three-year analysis provides a stark picture for the early-stage sector, with the number of early- and mid-stage financings in 2023 down approximately 37% since 2021. Later-stage financings had a softer decline, going down by 5% over the same period. This is due to an uptick in later-stage deals in 2023—a reflection of the high number of early-stage companies who, having received funding in the two years prior, were transitioning to later-stage and had reached the end of their runway and needed to raise again. This a testament to Canadian emerging companies' ability to navigate challenging economic headwinds and scale successfully in uncertain economic times.

To view the full article, click here.

Footnotes

1. This is our fourth annual Venture Financing Report. To showcase year-over-year trends, we have included comparisons to the data from our previous two studies throughout.

2. For example, the Impulsion PME program offered by Investissement Québec.

3. The proliferation of early-stage financings relying on simple agreements for future equity (or "SAFEs") may imply that the weakness in early-stage financings is overstated— i.e., some of the decline in transaction volume in that stage may be explained by parties choosing to rely on SAFEs rather than preferred share structures.