For Canada to meet its recently announced "Net Zero by 2050" climate commitment, reducing the carbon intensity of natural gas production, distribution and consumption is a priority - all the more so given Canada's bold ambition to reduce greenhouse gas (GHG) emissions by 40 to 45 per cent below 2005 levels by 2030 (announced on April 22, 2021, at the Leaders Summit on Climate).

Renewable Natural Gas (RNG), also known as biomethane, is often seen as the key to decarbonizing the natural gas system. And for good reason: RNG is a drop-in replacement for conventional natural gas, but with much lower GHG emissions. Some RNG projects can do even more, delivering RNG through existing infrastructure that is not just incrementally better for the climate than conventional natural gas when it is burned but is actually "carbon negative" when measured on a lifecycle basis.

However, similar to other emerging energy-related technologies that are in the early stages of adoption, the cost to produce RNG is significantly higher than for conventional natural gas. This poses special challenges for regulated utilities in Canada's natural gas sector that may wish to introduce RNG into their supply mix. But incentives and regulatory action, as well as innovative programs introduced by utilities themselves, can help to reduce the price gap between RNG and conventional natural gas, meet the demand for RNG, and secure RNG's role in Canada's energy transition.

What is RNG and How is it Produced?

RNG is a non-fossil fuel form of natural gas (methane) produced from a variety of different sources. Regardless of its source, RNG is chemically indistinguishable from conventional natural gas, so it can easily be introduced into the conventional natural gas transmission and distribution systems.

The vast majority of RNG available today is refined from biogas generated when agricultural waste (such as livestock manure), wastewater sludge and food waste decompose (this process is called biomethanization). RNG is produced by purifying and concentrating the biogas that results when these waste products are passed through an anaerobic digester. The RNG that is produced is almost pure methane, which can then be injected into local natural gas systems, once it has been refined in order to comply with applicable quality standards.

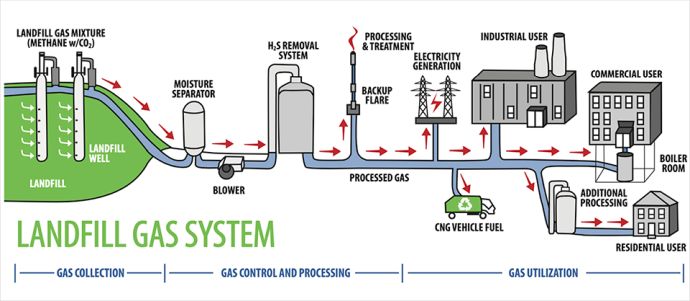

Image available online at: Northwest Gas Association

Landfill decomposition also releases large quantities of gas, which is typically much closer to pure methane than raw biogas. As such, RNG produced from landfills is more concentrated and requires less processing than raw biogas. Additionally, municipal landfills are a much larger source of biogas than individual agricultural operations, which makes the production of RNG at scale from landfills more efficient.

The industry also continues to expand the sources of RNG production. For example, technologies have matured relatively recently that can produce RNG from woody biomass, such as sawdust, wood chips and shavings, through a high temperature thermochemical process called gasification. New sources such as these can greatly increase the potential supply of RNG.

What are the Benefits and Costs of RNG?

The main benefit of RNG is that it is interchangeable with conventional natural gas, so utilities can inject it into their networks with no modifications to infrastructure, other than interconnection facilities. Similarly, RNG can be used for any application where conventional natural gas is being used, from cooking and home heating, to powering major industrial processes and fueling vehicles.

Increasing the amount of RNG used in Canada's natural gas system reduces GHG emissions in several ways, including by making use of methane that would otherwise be released into the atmosphere, and by replacing conventional natural gas. Reducing the demand for conventional natural gas has a double benefit because it both keeps carbon locked underground that otherwise would be released into the atmosphere as carbon dioxide when the gas is burned, and also avoids the fugitive methane emissions associated with extracting and processing conventional natural gas.

Cyrs, T., J. Feldmann, and R. Gasper. 2020. "Renewable Natural Gas as a Climate Strategy: Guidance for State Policymakers." Working Paper. Washington, DC: World Resources Institute. Available online at http://www.wri.org/publication/renewable-natural-gas-guidance.

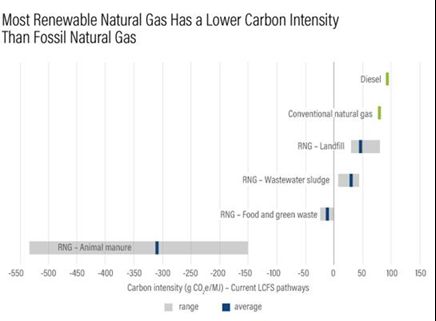

With respect to climate change, the advantages of using RNG can vary, depending on how it is produced. This is because different production methods use varying amounts of energy in the production and refining processes, and also capture and use different amounts of methane that would otherwise be released into the atmosphere. On a lifecycle basis, RNG produced from dairy farm wastes and large municipal landfills can be particularly beneficial from a climate perspective, whereas the carbon benefits of generating RNG from woody biomass vary depending on the efficiency of the process and the nature of the biomass feed used.

RNG is currently many times the cost of conventional natural gas, and this price gap is one of the primary barriers to widespread RNG adoption. The cost differential between RNG and conventional natural gas has been exacerbated in recent years due to the increase in conventional natural gas supplies created by new technologies such as hydraulic fracturing. This has driven the cost of conventional natural gas to historic lows, creating a challenge for natural gas distributors and other would-be adopters of RNG.

To overcome these barriers, government incentives and regulations are critical. While there may be niche markets willing to absorb the higher cost of RNG to reduce GHG emissions, in competitive markets, government support is needed to pave the way for an increased role for RNG in Canada's energy transition.

Promoting RNG doption in Canada

As public utilities have brought forward proposals for RNG programs, utility regulators have been forced to weigh the benefits of RNG's lower GHG emissions against the higher cost of RNG for ratepayers. In Canada, three current provincial models highlight different approaches that can be taken to the trade-offs presented by RNG and illustrate the importance of government involvement to enable utilities to meet the increasing demand for RNG.

Ontario

The most recent and limited of the three Canadian models is in Ontario. The Ontario Energy Board (OEB) approved Enbridge Gas Inc.'s voluntary RNG program on a pilot basis in September 2020.1 Enbridge began marketing its RNG "OptUp" program in early April 2021, and anticipates that up to 28,000 customers will participate during the first five years of the program.

This approval represents a change for the OEB, which had denied Enbridge's two previous attempts at launching an RNG program. Ongoing Ontario government policy support for RNG may have contributed to the OEB's decision to finally approve the latest iteration of Enbridge's proposed program, albeit on a pilot basis. As the OEB concluded:

"RNG is a renewable energy source that reduces GHG emissions and should be explored as a means of diversifying the gas supply portfolio."

While Enbridge's program was not mandated by legislation, it was supported by provincial policy. On November 29, 2018, the Ontario government introduced its Made-in-Ontario Environment Plan (MOEP). One of the actions identified in the MOEP is "encouraging uptake of renewable natural gas and the use of lower carbon fuels." The MOEP also identified the government's intent to "Require natural gas utilities to implement a voluntary renewable natural gas option for customers."

Enbridge's program is voluntary. Participating customers pay a fixed charge of $2 per month, which Enbridge uses to cover the incremental cost of RNG (relative to conventional natural gas). The direct costs of the program are borne only by participating customers.

Because the Enbridge program is voluntary and does not provide long-term security for cost recovery, Enbridge limits its RNG supply to short-term contracts. Moreover, at $2 per month from 28,000 customers, the purchase of only a limited amount of RNG will be funded. As a result, Enbridge anticipates that the program will reduce CO2 emissions by 8,000 tonnes, at most.

British Columbia

The first public utility RNG program in Canada was in British Columbia, with FortisBC Energy Inc. (FortisBC) receiving approval from its regulator - the British Columbia Utilities Commission (BCUC) - to commence its program on a pilot basis in 2010 and continue it as a permanent program in 2013.

While later bolstered by government legislation, the start of FortisBC's program is significant in that it was not mandated by legislation. Rather, it was driven by the general demand for reducing GHG emissions and the public utility's interest in responding to that demand by greening the content of its system.

Like Enbridge's program, FortisBC's program is voluntary. Rather than paying a fixed fee per month, however, participating customers choose the percentage of their natural gas consumption (between 5% and 100%) that FortisBC will source from RNG. Larger, institutional customers may also choose to commit to long-term, high-volume RNG purchases. RNG customers pay a premium for the RNG, and any costs not recovered from voluntary customers are tracked and recovered through FortisBC's distribution rates.

A key development in the RNG program occurred in March 2017, when the provincial government introduced amendments to a regulation that empowered FortisBC to acquire more RNG. Under the regulation, FortisBC can acquire RNG subject to a price cap of $30 per GJ and a supply cap of 5% of FortisBC's load in 2015. At $30 per GJ, RNG is competitive with the cost of clean electricity in British Columbia.

With the regulation in place, FortisBC was able to acquire significantly more RNG. FortisBC has acquired RNG from inside and outside of BC and is nearing the 5% supply cap in the regulation. The fact that the province intervened with legislation to bolster the program may indicate that there are limits on how much public utilities and their regulators can achieve without specific regulation. Notably, the BC government has indicated a goal for 15% of gas consumption to come from renewable gas, which may signal further legislative action to come.

Québec

When it adopted the 2030 Energy Policy (Politique énergétique 2030) in 2016, the Quebec government clearly stated its intention to diversify energy sources to drive the shift toward a low-carbon economy. To achieve that goal, the government implemented specific actions concerning RNG, since this source of energy could potentially amount to 144.3 million GJs by 2030, which represented approximately 66% of the volume of conventional natural gas distributed in Quebec in 2018 by the main natural gas distributor (Énergir).

On March 20, 2019, the Quebec government, rather than opting to facilitate the implementation of voluntary programs by the province's natural gas distributors, enacted the Regulation respecting the quantity of renewable natural gas to be delivered by a distributor (the Quebec Regulation). Under the Quebec Regulation, the minimum quantity of RNG to be delivered annually by a natural gas distributor was set at 1% of the total volume of conventional natural gas distributed for 2020-2021. This will gradually increase to 5% by 2025-2026. For Énergir, this represents a minimum amount of 60.359 million cubic metres of RNG to be injected in its distribution network for 2020-2021.

Recently, Énergir announced that in its efforts towards decarbonization, it intends to go beyond the current obligations under the Quebec Regulation and increase the proportion of RNG injected in its distribution network to 10% by 2030.2This announcement echoed the 2030 Green Economy Policy (Plan pour une économie verte 2030) published by the Quebec government in November 2020. This is a good demonstration of the momentum resulting from a government imposed RNG distribution requirement and is a promising step toward a more diverse source of carbon neutral power supply and greater investments in the Quebec RNG sector.

As the three provincial models show, increased government support of RNG can drive demand. However, it is not just the provinces who can impact the transition to RNG. Federally, Canada's proposed Clean Fuel Standard (CFS) can also play an important role in promoting RNG, if the CFS is adopted. Indeed, the CFS may even be necessary to motivate some jurisdictions to implement RNG programs.

Canada's Proposed CFS Program

Canada's federally proposed climate plan sets a net-zero emissions goal by 2050, to be achieved through policies, funding programs, and regulations working together to encourage the transition to renewable energy. As part of those measures to achieve Canada's ambitious goal, the federal government has proposed the CFS to complement the Greenhouse Gas Pollution Pricing Act (commonly referred to as the carbon tax). While carbon pricing creates a broad incentive across the whole economy to use less energy and improve efficiency, the CFS targets change in how renewable fuels are produced and used in Canada.

The draft Clean Fuel Regulations (CFR) propose a credit market for participants where each credit represents a lifecycle emission reduction of one ton of CO2 equivalent. The mechanism is quite complex; however, the basic idea is that as a result, Canada would see a decrease of about 13% below 2016 levels in the carbon intensity of liquid fuels used in Canada by 2030.

Originally, the CFR was intended to apply to solid, liquid and gaseous fuels. However, in December 2020, the federal government announced that the CFR would only apply to liquid fossil fuels, including gasoline, diesel and oil, which are mainly used in the transportation sector. In its current shape and form, the draft CFR would still provide an opportunity to create credits for supplying RNG for natural gas vehicles as well as for non-transportation purposes. Those credits can then be used by primary suppliers of fuels for compliance purposes.

California and British Columbia have already adopted clean fuel regulations that apply to transportation fuels. While the impact of the British Columbia regime has been limited, California's Low Carbon Fuel Standard (LCFS) offers a good demonstration of how such a program can positively impact the RNG sector.

The LCFS was implemented to decrease California's carbon intensity and increase the range of renewable alternatives to traditional fuels. Under the program, companies providing transportation fuels are required to show that their mix of fuels meets specific benchmarks for carbon intensity. Companies can do this either by changing their own fuel mix or by acquiring credits from other companies. With the lowest carbon intensity rating of all fuels in the LCFS program, RNG made up almost 90% of all natural gas vehicle fuel in the program in the first half of 2020.

Canada's CFS is still in its early stages and differs from the California LCFS in that it applies to any type of liquid fuels, not just transportation fuels.

We expect that the federal government will continue to develop some credit creation opportunities for low carbon gaseous fuels like RNG in a subsequent phase of the CFR, which will likely have a bigger impact than the current version.

Conclusion

RNG is an important part of the overall transition of Canada's energy sources. There is demand for RNG, but the cost is a significant issue impeding adoption. Incentives are needed to create enough momentum in supply and demand in order for the sector to develop to a point where it is self-sustaining.

Operational RNG programs in Canada show that RNG energy transition is feasible, but that furthering this shift will likely depend on specific legislative requirements - either through mandatory programs and targets or creating carbon credit systems - being adopted to facilitate an effective transition in different jurisdictions. The examples of British Columbia and Quebec, in particular, show how government involvement can positively impact the development of the RNG sector. Further expansion of the role of RNG in other jurisdictions across Canada's energy system will be challenging without at least some level of government involvement.

Footnotes

1

Ontario Energy Board, Decision and Order

EB-2020-0066, September 24, 2020

2 Énergir's Climate Resiliency Report,

February 2021.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.