Unlocking the Potential of Hydrogen: Canadian Developments in the Drive to Net Zero

GROWING AMBITIONS — GLOBALLY AND DOMESTICALLY

The potential for hydrogen to play an essential role in transitioning to a net zero economy continues to generate enthusiasm amongst key stakeholders, including governments, investors, and project proponents. 2021 saw steadily increasing investment commitments aimed at realizing that potential.

The International Energy Agency (IEA) reports that, globally, countries that have adopted hydrogen strategies have committed at least USD$37 billion, while the private sector has announced an additional investment of USD$300 billion. Such commitments are driven not only by the policy imperative embodied in such multilateral summits as COP 26 in Glasgow, but also by the scale of the economic opportunity. Indeed, the IEA has identified hydrogen as being amongst the "biggest innovation opportunities" in the push toward net zero.

This figure reflects an anticipated dramatic increase in demand beyond the existing market (consisting of refining and industrial feedstock). Such demand is expected to come from numerous additional sectors including transport, heating, and difficult-to-decarbonize industrial applications like steel production.

From an industrial policy perspective, there are now 17 governments worldwide (Canada included) that have established hydrogen strategies, compared with only three in 2019. There are now also numerous subnational strategies, including those of Alberta and British Columbia. While the pace of change will need to accelerate if the hydrogen sector's ambitions are to be realized, the incremental developments we discuss below are nevertheless steps in the right direction.

NEW DEVELOPMENTS

Following the late 2020 release of the Federal Hydrogen Strategy (Federal Strategy), there has been momentum growing across Canada whereby provinces have begun setting the course for the future of the hydrogen economy in their own backyards. Since the release of the Federal Strategy in 2020, two of the provinces that are expected to become major players in the national hydrogen economy — from production to export and everything in between — have released their own plans. British Columbia released its B.C. Hydrogen Strategy (BC Strategy) on July 6, 2021 and Alberta released its Alberta Hydrogen Roadmap (Roadmap) on November 5, 2021.

Federal

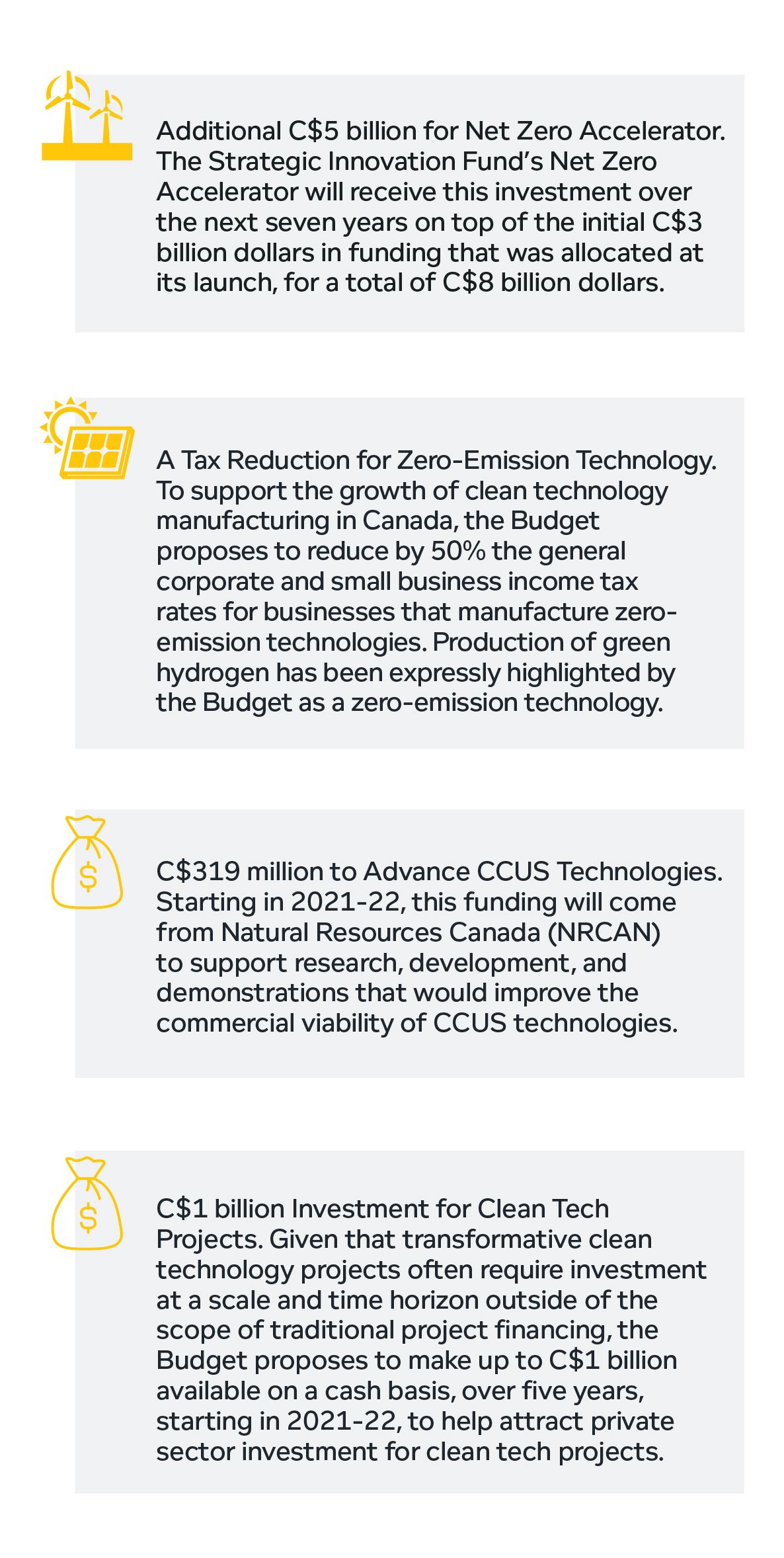

When it was released, the Federal Strategy was notably lacking in new investment measures. As a result, industry stakeholders looked to the 2021 federal budget (Budget) with great anticipation. While there were a number of hydrogen-specific aspects of the Budget, the greatest support for the sector will come from measures earmarked for the net zero transition generally, including the Net Zero Accelerator, and an expansion of tax incentives targeted at clean technologies. Some of the these direct spending and incentives that will impact the hydrogen industry include:

British Columbia

With more than half of the country's active companies in the hydrogen industry located in British Columbia, the province is expected to play a major role in the future of the Canadian hydrogen industry.

The BC Strategy is anchored against the province's CleanBC strategy which sets out the province's commitments to achieving net-zero emissions by 2050. Although the BC Strategy does not single out specific initiatives related to hydrogen, it does set out 63 policy actions to be undertaken over the short (2020-2025), medium (2025-2030), and long term (2030-beyond). The immediate priorities are a focus on scaling up green hydrogen production in the province and establishing a regulatory framework for carbon capture, utilization and storage (CCUS) to enable low or zero emission blue hydrogen production.

Clean BC also creates numerous market supply options for hydrogen in BC. For example, hydrogen should be able to play a role in compliance, and potentially credits under the soon to be revamped BC Low Carbon Fuel Standard. Clean BC also supports hydrogen in the ZEV transportation space and hydrogen will also likely play a role in helping BC utilities to meet Clean BC requirements to decarbonize the natural gas grid.

In addition to the BC Strategy, the province's 2021 budget contains measures to support hydrogen development and, in particular, to address the significant barrier created by high electricity costs with respect to large scale hydrogen production. BC announced a C$10 million investment over three years to develop a policy on reducing the carbon intensity of fuel and advancing the hydrogen economy. The province also launched the "Clean Industry and Innovation Rate" in January 2021 to help support innovative industries by lowering the cost for such industries to connect to BC Hydro's grid. The initiative provides a 20% discount from BC Hydro's standard industrial rate for the first five years, 13% for year six and 7% for year seven. The initiative is available to plants that produce low-carbon fuel or use a process to remove greenhouse gases from the atmosphere.

Alberta

Alberta boasts industrial infrastructure and geological advantages that stand to give the province an important edge, particularly when it comes to blue hydrogen. The Alberta Roadmap was developed with this in mind. Based on advice and input from municipalities, industry, academia, indigenous organizations, and non-governmental organizations, the Roadmap outlines seven key policy pillars to achieve its plans:

(i) Build new market demand;

(ii) Enable Carbon Capture, Utilization and Storage;

(iii) De-risk investment and improve access to capital;

(iv) Activate technology and innovation;

(v) Ensure regulatory efficiency, codes, and standards to drive safety;

(vi) Lead the way and build alliances; and

(vii) Pursue hydrogen exports.

The first phase of implementing the Roadmap focuses on establishing policy, investing in technology to reduce the carbon intensity of hydrogen production and accelerating commercialization across the supply chain. The second phase will focus on growth and achieving scale through improved technologies and commercialization.

The Roadmap outlines several short and long term actions in furtherance of each of the seven key policy pillars. These include:

- Supporting hydrogen blending in the utility market by amending the Gas Utilities Act and Gas Distribution Act;

- Advancing CCUS hubs and improving the economics of CCUS;

- Supporting clean hydrogen production through the Alberta Petrochemicals Incentive Program;

- Support hydrogen technology and innovation throughout the value chain by establishing a Clean Hydrogen Centre of Excellence and hydrogen feasibility studies;

- Support the development of national and provincial codes and standards;

- Coordinate the development of hydrogen hubs and partnerships across the province; and

- Pursue international market access by establishing a clean energy corridor with connections through British Columbia and other jurisdictions.

The release of the Roadmap makes it quite clear that Alberta is committed to moving forward — sooner rather than later — in order to capture its share of the hydrogen economy in Canada.

Target Markets

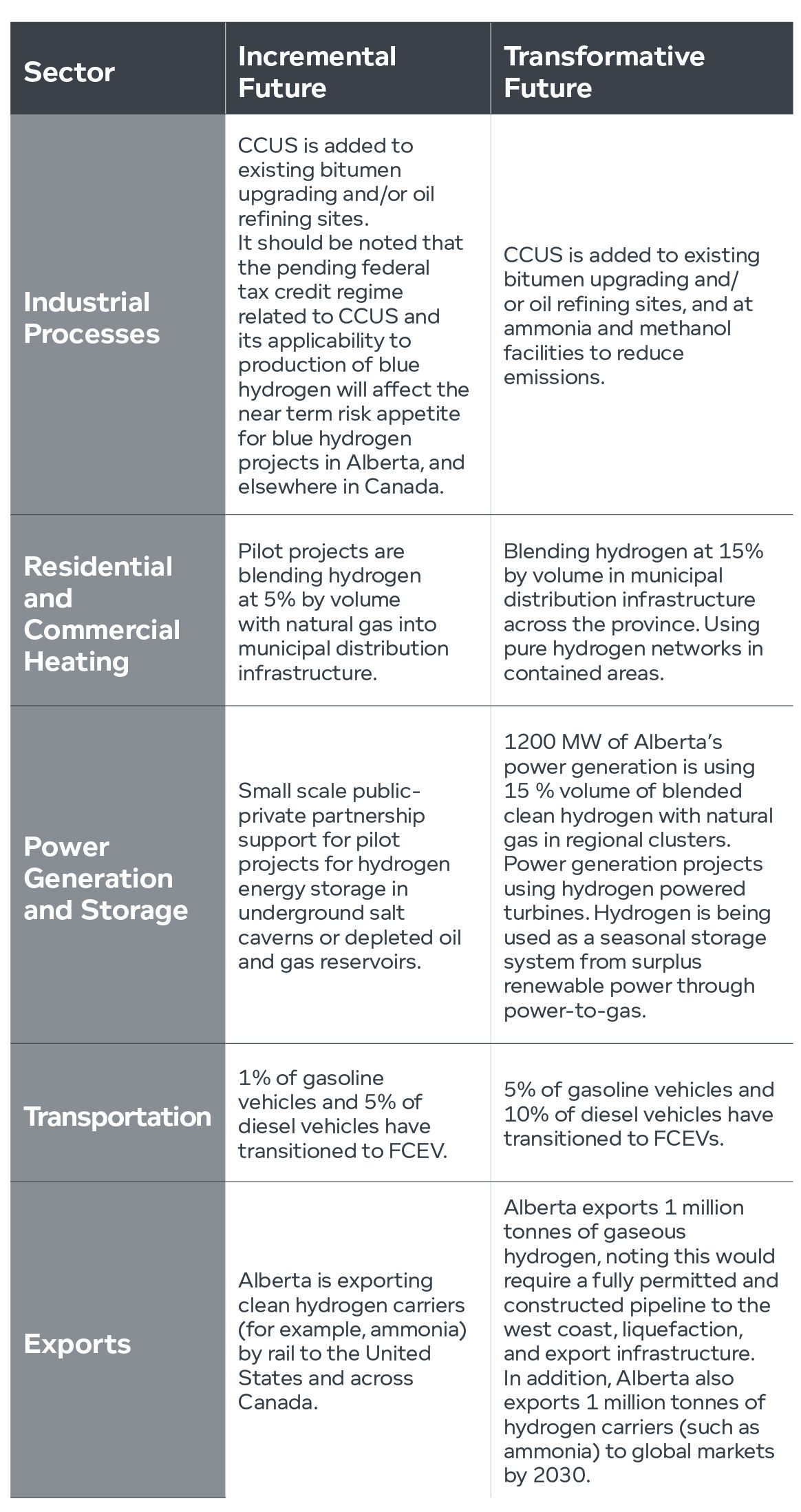

In addition to the Roadmap's key policy pillars, it also identifies five major markets for hydrogen which represent opportunities for Alberta:

Each of these markets represent significant opportunity, and several of them have already begun transitioning to zero-carbon fuel.

Why Alberta has a Competitive Advantage

Alberta holds significant competitive advantages that will help support the growth of Canada's hydrogen economy and thereby support the global transition to clean energy. Alberta currently produces the most hydrogen of any province in Canada, approximately 2.4 million tonnes per year — primarily used in industrial applications. This experience will help enable Alberta to scale hydrogen production quickly and efficiently.

Currently, hydrogen is predominantly produced from fossil fuels such as natural gas, which is in abundant supply. With more than 60% of Canada's natural gas production and well-established extractive capabilities, Alberta has the potential to be one of the world's lowest cost producers of blue hydrogen. This is assuming CCUS is an integral piece of the development of clean hydrogen. Due to its geology and focus on emissions reduction in the oil and gas industry, Alberta also has a robust and established regulatory and risk management framework in place for large-scale CCUS which has already supported the development of two world-scale commercial CCUS projects for large industrial emitters in the Province.

As the focal point of Canada's energy industry, Alberta has the opportunity to leverage existing infrastructure, natural gas reserves, and expertise to play a leading role as Canada enters the global hydrogen economy. In an effort to attract investment to Alberta, the government has implemented the following measures:

- Job Creation Tax Cut — reduction of the general corporate income tax rate on July 1, 2020;

- Alberta Petrochemicals Incentive Program — financial incentives for investment in hydrogen facilities using CCUS;

- Alberta Indigenous Opportunities Corporation — provides indigenous communities with access to up to C$1 billion in financial support and loan guarantees for participation in equity ownership of natural resource projects;

- Creation of Invest Alberta; and

- Technology Innovation and Emissions Reduction (TIER) Fund - a commitment of up to C$750 million over three years for innovative projects that reduce emissions.

The Alberta Hydrogen Roadmap models two potential scenarios which are helpful to understand what the hydrogen economy could look like in Alberta by 2030 and what it takes to ensure that the hydrogen economy is successful. The two models are:

- An Incremental Future where clean hydrogen has a slow uptake into the provincial economy. This scenario assumes industry continues on with business as usual with incremental demand for hydrogen under the existing policies and regulations.

- A Transformative Future where clean hydrogen is integrated into provincial energy systems on a large scale. This scenario assumes favorable policies that create demand growth and technological development. This would lead to large-scale domestic hydrogen deployment and exports by 2030.

MAKING MOVES: CANADIAN HYDROGEN DEALS AND PROJECTS IN 2021

Although the drive to harness low and zero emissions hydrogen remains nascent in Canada, 2021 nevertheless saw a noteworthy range of hydrogen-related transactions and announcements involving Canadian entities and their assets. Publicly announced deals spanned a number of energy-related sectors and applications, including clean tech, transportation, blue hydrogen production & export, and industrial/heating. Canadian entities active in the hydrogen space are frequently transacting internationally as purchasers, targeting acquisitions, or forming project development partnerships.

Clean Tech

- On June 25, 2021, BioHEP Technologies Ltd. (Vancouver) and Next Hydrogen (Toronto) completed an amalgamation. The resulting issuer, Next Hydrogen Solutions Inc., is engaged in development of water electrolysis technology and providing green hydrogen solutions.

- On September 8, 2021, HTEC Hydrogen Technology & Energy Corporation (Vancouver), a designer, builder and operator of hydrogen fuel supply solutions, announced the completion of a C$217 million investment by Chart Industries, Inc. (USA) and I Squared Capital (ISQ) (USA). Chart is a manufacturer of liquefaction and cryogenic equipment serving multiple applications in the energy and industrial gas end markets, including hydrogen.

- On September 20, 2021, Xebec Adsorption Inc. (Montreal) announced the execution of its first steel metal treatment contract to supply two Hy.GEN® 150 units to a Turkey-based flat steel manufacturer. The two units will have a capacity of approximately 600 kg of hydrogen per day (220 tons per year).

Fuel Cells & Transportation

- On May 11, 2021, Matthews International Corporation (USA) announced the acquisition of the assets of Terrella Energy Systems, Ltd. (Vancouver), a supplier of technology solutions to the global hydrogen fuel cell industry.

- On August 18, 2021, Tidewater Renewables Ltd. announced the completion of its initial public offering (IPO) and announced a positive final investment decision (FID) on a Renewable Diesel and Renewable Hydrogen Complex.

- On October 7, 2021, Nikola Corporation and TC Energy Corporation announced their agreement to collaborate on co-developing, constructing, operating and owning large-scale hydrogen production facilities (hubs) in the United States and Canada. Nikola and TC Energy desire to accelerate the adoption of heavy-duty zero-emission fuel cell electric vehicles (FCEVs) and hydrogen across industrial sectors.

- On November 10, 2021, Hyzon Motors Inc. (USA), a supplier of hydrogen-powered fuel cell electric vehicles, and TC Energy Corporation (Canada) announced an agreement to collaborate on development, construction, operation, and ownership of hydrogen production facilities (hubs) across North America. The facilities will be used to meet FCEV demand.

- On November 11, 2021, Ballard Power Systems (British Columbia), a designer and manufacturer of PEM fuel cell engines for medium- and heavy-duty vehicles, announced the acquisition of Arcola Energy (UK), a systems engineering company specializing in hydrogen fuel cell powertrain and vehicle systems integration.

Blue Hydrogen Production & Export

- On August 3, 2021, Itochu (Japan) announced a partnership with Petronas (Malaysia) to explore and plan for a natural gas-based ammonia facility with CCUS in Alberta, to export ammonia as a hydrogen carrier to Asian markets.

- On September 8, 2021, Mitsubishi Corporation (Japan) and Shell Canada announced a MOU regarding the production of low-carbon blue hydrogen to support Japan's push for clean energy. Mitsubishi plans to build and start up the low-carbon hydrogen facility near Shell's Scotford facility in Alberta. The companies aim to produce about 165,000 tons per annum of hydrogen in the first phase of the project, which would be converted to low-carbon ammonia for export to Asian markets.

Industrial & Natural Gas Blending

- On May 11, 2021, ATCO Ltd. (Alberta) and Suncor Energy Inc. (Alberta) announced a collaboration on early stage design and engineering for a potential clean hydrogen project near Fort Saskatchewan, attempting to blend hydrogen into a subsection of its natural gas distribution system with a concentration of 5% by volume.

- On June 3, 2021, Ontario Power Generation subsidiary Artura Power and Hatch Ltd. (Toronto) announced a partnership exploring the feasibility of the creation of regional hubs in Ontario with potential end-uses in natural gas blending, industrial applications (e.g. steel production), and fuel cells.

WHAT'S NEXT?

As demonstrated by the 2021 Federal Budget, the development of both federal and provincial strategies, as well as an increasingly active transactional landscape, there is little doubt that Canada intends to compete in the developing global hydrogen economy — yet certain obstacles persist.

Remaining Challenges

Despite Canada's natural resource and infrastructure advantages, several challenges still need to be tackled in order to achieve the long-term success of a hydrogen market in Canada.

- Supporting Policy and Regulations: In addition to the adoption of hydrogen strategies at both the provincial and federal levels, long-term policies are required to provide for a regulatory framework that includes hydrogen. Given the large upfront capital costs associated with developing these new technologies, without clear policies that recognize hydrogen's essential role in Canada's net zero greenhouse gas future, uncertainty remains for investors. Some good examples are the pending federal tax credits for CCUS, the pending federal regulations for the Canadian Clean Fuel Standard, and the revisions underway to the British Columbia Low Carbon Fuel Standard.

- Codes and Standards: Gaps in existing codes and standards (e.g. hydrogen blending limits in natural gas pipelines) need to be addressed to enable greater adoption of hydrogen and hydrogen technologies.

- Availability of Low-Carbon Intensity Hydrogen: Access to domestic low-carbon intensity hydrogen in many parts of Canada is preventing both pilot and commercial development. In provinces with low-cost natural gas and the geology suitable for permanently sequestering the byproduct CO2, blue hydrogen can be produced at a price of $1.50 to $2.0/kg H2 ($10 to $14/GJhhv H2). The cost of producing green hydrogen remains significantly higher, however, some anticipate that by 2030, green hydrogen will be cost-competitive as a result of the declining cost of renewables and the scaling up of electrolyzer technology (although such estimates are based on assumptions which are arguably speculative at best).

- Investment: A lack of sustained investment in innovation is impeding the advancement in technology that is needed to support the production and use of hydrogen. Without stable support, costs will not decrease, performance will not improve and Canada will not be able to maintain a leadership role at the cutting edge of clean technology.

- Exports: In order for Canada to become a large exporter of hydrogen, there needs to be a fully permitted and constructed pipeline to the west coast, as well as liquefaction and export infrastructure. Support from Canada, British Columbia, and Indigenous and local communities will be critical to establish hydrogen export supply chains.

A Promising — But Uncertain — Outlook for Canada

It is an open question as to whether Canada will rise to meet these challenges and fulfill its potential as a global hydrogen leader in the drive to net zero. As discussed above, recent movements in the sector are encouraging, but are arguably insufficient to accelerate the industry in the context of an increasingly active global market. As Canada seeks to secure its future in a rapidly transforming energy system, it will remain essential for government and industry leaders to keep pace with international competitors in the hydrogen industry.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.