Introduction

After years of moving at a glacial pace, the global energy transition has now kicked into high gear.

In a series of climate change conferences following the landmark Paris Agreement made in December 2015, countries have gradually escalated their efforts to meet the commitments set out in the accord, whose 200 signatories promised to keep global warming below 2 degrees Celsius this century, and ideally below 1.5 degrees, to avoid the worst effects of climate change. Russia's invasion of Ukraine in 2022 caught Europe and the world unprepared leaving many western nations with a large hole in their energy supplies. This shock created an immediate and desperate need to lessen our dependency on fossil fuels.

Now, rather than searching for replacement sources of fossil fuels to replace Russian imports, European countries are accelerating their adoption of greener fuels and transforming international energy markets, according to the International Energy Agency (IEA), which forecasts global clean energy investment will exceed $2 trillion per year by 2030 as a result.1

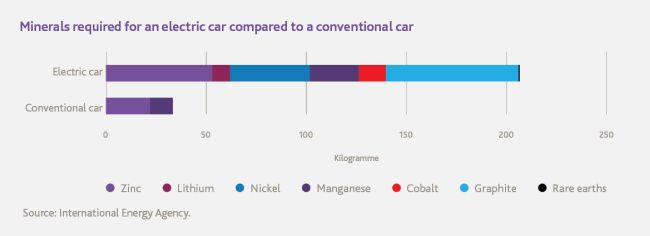

Even before Russia's invasion, commitments to achieve a goal of net-zero emissions were being made by an ever increasing number of governments and major corporations. In contrast, the stream of critical mineral projects coming online, which are key to enabling the energy transition, is (and has been) nowhere near sufficient to meet the demand generated by these commitments. Minerals like lithium, nickel, cobalt, graphite and copper – key to battery technology powering electric vehicles, wind turbines, solar panels and more – emerge from the ground in a few select regions of the world and take significant time to explore for, develop and extract.

In fact, according to the IEA, meeting the resulting carbon-neutrality targets by 2050 will require six times more mineral inputs for clean energy technologies than we require today.

For western nations, the energy crisis that followed the onset of war in Ukraine shone a spotlight on the weaknesses in their energy strategies and related supply chains, and now nations like Canada have an opportunity to become leaders in securing a reliable supply of not only traditional energy sources, but also of the critical minerals that form the building blocks of a clean energy future.

With potentially significant deposits of many of these minerals, Canada is in a prime position to fuel the worldwide demand for critical minerals but this will require hard work and commitment thanks, in part, to the head-start China has given itself in the sector as a long-term investor in international exploration and domestic projects.

The critical mineral advantage

Raising capital is always a challenge for mining companies: the fluctuating returns and long-term outlooks associated with the industry can make it a tough sell for investors in a market too often focused on last- and next-quarter results. Meanwhile, recent economic uncertainty has done little to improve the background conditions for investment.

However, there are positive signs in the critical minerals sector, thanks to the anticipated surge in demand over the coming years as countries around the world begin to implement their energy transition plans in more meaningful and material ways.

Last year, PWC reported that the market capitalizations for miners of critical minerals outperformed the index of the world's top 40 miners by between 49 and 147 per cent, driven primarily by growth among producers of lithium, graphite and rare earths.2

Lithium: white gold

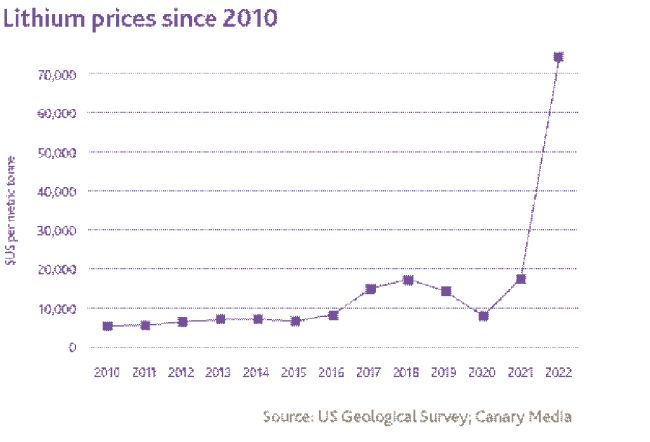

Lithium has taken centre stage among critical minerals because of its use in lithium-ion battery technology, being the current technology of choice for electric vehicle batteries. Lithium-ion battery technology is also being explored (along with vanadium and other minerals) as a source of grid-scale energy storage, helping to drive a doubling in global demand for the metal since 2017, alongside a massive spike in its price per tonne that has earned lithium its "white gold" nickname.

But that's nothing compared with future projections: according to the IEA, if we are to remain on target to hit the goals set at Paris, demand for lithium will multiply 40-fold by 2040, the fastest projected growth among critical minerals. Graphite, cobalt and nickel follow at a rate of 20 to 25 times their current demand.

Walking the talk on ESG

The pivotal role of critical minerals, and lithium in particular, in the worldwide shift to net zero has given a major boost to the image of the mining industry as a potential partner to meet net- zero emission targets.

But global decarbonization plans remain a double-edged sword for companies in a traditionally greenhouse-gas-intensive sector. Mining materials in a sustainable fashion is essential for those who want to maintain their social licence to operate while enhancing their attractiveness to investors.

However, many in the industry are already deploying cutting edge technology and innovative extraction techniques to get these clean energy building blocks into the hands of manufacturers in an environmentally responsible way.

Greening white gold

For example, strides have been taken to reduce the environmental impact of lithium mining, where the large volume of water required for the brine-extraction process favoured by many producers has raised concerns about local supply and potential contamination.

Lithium is a big focus for companies such as B.C.-based Saltworks Technologies Inc., whose advanced desalination techniques help producers improve yields and purity. The firm also works with miners of various minerals to provide cost-effective wastewater treatment solutions at extraction sites.

Meanwhile, U.K. miner Cornish Lithium Plc. is among those experimenting with nascent "direct lithium extraction" processes, which preserve the vast majority of the water supply used during extraction. For Cornish Lithium, the target is lithium contained within local geothermal waters and that has been leeched from granite rock, and the company is hoping to reduce its carbon footprint all the way to zero by relying on geothermal energy to decarbonized local businesses. The company is also looking to extract lithium at its hard rock project, utilizing Lepidico's low-carbon footprint processing technology.

Mining innovation

Miners are also doing their bit for the decarbonization effort, using alternative fuels, automating processes and relying on digital technology and artificial intelligence where possible. For instance, Glencore's new Onaping deep nickel mine in Ontario, Canada has been hailed for its innovative ventilation technology, energy-efficient cooling systems and remote operating centre, which will rely on advanced sensors to allow for real-time management, monitoring and control from the surface. By the time the mine comes online in 2025, its entire fleet of equipment is also expected to run on electricity.

Looking to the future, many in the mining industry are also pinning their hopes on small modular reactors to improve both energy efficiency and project feasibility in remote areas of countries without the networked electricity and transportation infrastructure normally needed to support significant industrial activity.

Off-grid mines are generally supported by diesel generators, but a recent study by Ontario Power Generation suggested that a subcategory of very small modular reactors – those that produce less than 10MW of energy and are potentially as small as a shipping container or train car – used in conjunction with diesel power could replace as much as 90 per cent of the baseload power required for mining operations, drastically reducing the greenhouse-gas output associated with an isolated mining site.

Deal-making innovation

Innovative thinking in the critical mineral sector is not confined to extractive and operational technology. Recently, the combination of surging demand for critical minerals and the urgent need for project funding has resulted in some unconventional partnerships, which may portend a paradigm shift for the entire industry, as miners and technology companies each extend their reach into previously unfamiliar parts of the clean energy value chain.

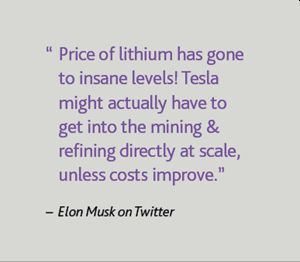

For example, U.S. electric vehicle giant Tesla has dipped its toe into the mining industry as part of its bid to secure a reliable supply of the critical minerals it needs to power its cars, sealing major agreements with the owners of nickel mines in both the U.S. and New Caledonia in the South Pacific.

Before inking his deal to buy Twitter, Tesla CEO Elon Musk took to the social media platform to suggest that the automaker may also have to get into lithium mining and processing as a result of the metal's skyrocketing price levels.

General Motors appears to have been thinking along the same lines. The car manufacturer recently became Lithium America's largest shareholder following the closing of a USD$650 million investment. According to Lithium America, proceeds from the investment will be directed toward the development of the company's Thacker Pass project in Nevada, the largest known lithium resource in the U.S. that is fully permitted to begin construction.

Other notable deals include a contract between the Chilean government and Chinese electric-vehicle manufacturer BYD for the extraction of 80,000 tonnes of lithium over the next two decades, as well as a joint partnership between Giga Metals and Mitsubishi Corporation for the development of nickel and cobalt operations in Canada.

Moving in the other direction along the value chain, miners who are able to incorporate early refinement processes into their operations – producing minerals in their more valuable forms such as lithium hydroxide, nickel sulphide or cobalt sulphate – will also boost their investment prospects.

Canada's supply-demand opportunity

With potentially significant deposits of many of the raw materials needed to fuel the global energy transition, there is no doubt that Canada is in a prime position to benefit from the worldwide clamour for critical minerals.

The case for more investment in Canada got a further boost with the recent passage of the U.S. Inflation Reduction Act, which includes a provision for a USD$7,500 tax credit for new electric vehicle purchases. In order to qualify for the credit in 2023, 40 per cent of the critical mineral content in the vehicle's battery must have been extracted or processed in the U.S., countries with which the U.S. has a free trade agreement, or have been recycled in North America.

Canada is already in select company among U.S. trade partners with the processing capacity and potential critical mineral deposits to match its mining know-how, and its attractiveness will only increase over time as the legislated threshold for qualification escalates annually by 10 percentage points, topping out at 80 per cent of battery materials in 2027 and beyond.

Few critical minerals highlight Canada's production opportunity better than lithium. After limited production between 2014 and 2019, the country has not produced any more – in part due to the sharp decline in global lithium prices in 2019 and 2020. With prices surging again, however, Canada is strongly positioned to capitalize on growing global demand. The country has proven reserves of 530,000 tonnes – enough to place it sixth in the global rankings and accounting for 2.5 per cent of world's known reserves of the metal in 2020. Natural Resources Canada estimates that the country's actual lithium resources could be as high as 2.9 million tonnes in total but there remains much work to be done to prove this up.

Canada stakes its critical minerals claim

In the last year, the Canadian federal government launched its Canadian Critical Minerals Strategy, staking a claim for the country to become a global supplier of choice.

The strategy, released in December 2022 and backed by almost $4 billion in financial commitments to be doled out over the next eight years, identifies 31 minerals that the federal government considers critical because of their strategic value, limited reserves and increasing concentration in terms of both extraction and processing.

However, six minerals are highlighted above the others because of their key role in priority supply chains: lithium, nickel, graphite, cobalt, copper and rare earth elements.

Among the key planks of the federal strategy are a $1.5-billion Strategic Innovation Fund devoted to advanced projects and various commitments aimed at speeding up the approval and construction of new mines. For example, $40 million is allocated to support permitting in Canada's North, plus another $21.5 million to support the Critical Minerals Centre of Excellence with its new mandate assisting project developers in navigating regulatory processes and federal support measures.

The Trudeau administration also reaffirmed its commitment to a new 30 per cent critical minerals exploration tax credit, boosting Canada's position as one of the mining world's lowest effective tax rate jurisdictions.

The tax credit, previously announced in Canada's 2022 federal budget, will be made available to investors under certain flow-through share agreements, doubling the existing 15 per cent exploration tax credit available for such investors, as long as their projects relate to certain qualifying critical minerals, including copper, nickel, lithium, cobalt, graphite, rare earth elements, vanadium and uranium, among others.

Looking forward, in its Canadian Critical Minerals Strategy and earlier 2022 budget, the federal government recognized the need for even better and more innovative technology to meet the coming worldwide spike in demand for clean energy materials. Allocations of funding for research and development are aimed at every stage of critical mineral exploration and processing, including $79 million for public geoscience to improve identification and assessment of deposits.

All of this is in addition to existing initiatives, such as the Sudbury, Ont.-headquartered Mining Innovation Commercialization Accelerator – a provincially and federally supported network designed to connect startups and technologists in various industries whose products are ripe for integration in the mining field.

Domestic and international cooperation

Delivering shorter and smoother approvals for mine development may be more challenging in practice than it appears in writing, considering the realities of environmental review and Indigenous consultation processes, but the federal government has provided a strong framework for the exploration and development of the country's critical mineral resources.

Encouragingly, the critical mineral issue appears to be one of the few topics on which Canada's various levels of government can agree. A number of provincial and territorial governments, including Ontario, Alberta and Quebec, cast aside traditional rivalries to issue their own critical mineral strategies, each complementary to the federal plan.

Outside Canada, the federal government has joined forces with allies to challenge China's current dominance in both the refinement and processing of critical minerals, launching a joint action plan with the U.S. to secure supply chains for clean technology, aerospace and defence. At the recent COP15 in Montreal, Canada also signed on to the Sustainable Critical Minerals Alliance with nations including the U.K., the U.S., France, Germany, Australia and Japan.

For all the overlapping commitments, policies and strategies, the unifying message is that Canada intends to establish itself as a responsible and reliable source for critical minerals.

Chinese funding drying up?

One side-effect of Canada's global push for critical-mineral independence is its concomitant crackdown on foreign state owned or influenced enterprise (SOE) control of critical mineral projects.

In recent months, the federal government implemented a new policy under the Investment Canada Act (ICA) specifically targeting critical mineral investments by foreign state-owned or influenced entities, emphasizing applications for acquisitions of control of Canadian companies by such institutions will only receive net-benefit approval on an "exceptional basis."

Under the ICA, all acquisitions of control of an existing Canadian business by a foreign investor are subject to either notification or net-benefit review (i.e., an assessment of whether the proposed investment is likely to be of net benefit to Canada), depending on whether or not the investment exceeds the applicable financial threshold for a net-benefit review. The net-benefit review threshold for 2023 for most direct investments by SOEs is $512 million based on the book value of the target's assets. Where net benefit approval is required it must be obtained pre-closing.

In addition, investments by foreign state owned or influenced enterprises relating to critical mineral projects will generally support a finding that the investment could be injurious to Canada's national security – regardless of the size of the investment – under the tighter updated rules. This could result in the possible use of the government's discretionary power to block, condition or even undo closed deals, regardless of whether net benefit approval is required.

Within days of the October 2022 policy announcement, Innovation, Science and Industry Minister Francois-Philippe Champagne, under the new powers, ordering the divestiture of investments by three Chinese companies in Canadian junior miners:

- Sinomine (Hong Kong) Rare Metals Resources Co., Limited's investment in Power Metals Corp.

- Chengze Lithium International Limited's investment in Lithium Chile Inc.

- Zangge Mining Investment (Chengdu) Co., Ltd.'s investment in Ultra Lithium Inc.

These developments may not necessarily spell the end of state investment in Canadian critical mineral companies, since investments by SOEs from "like-minded" governments may find it easier to clear the national security review hurdle.

Notably, the government's national security review powers apply not only to the establishment of a new Canadian business or the acquisition of control of an existing Canadian business, but also minority investments and the establishment of any entity "carrying on . . . any part of its operations in Canada." As such, the national security review powers can apply to investments in businesses with only tenuous links to Canada.

It is also important to note that, in December 2022, the government introduced significant proposed amendments to the ICA. If passed in their current form, the proposed amendments would, among other things, require pre-closing notification in certain circumstances, including for non-control level investments, depending on whether they relate to prescribed business sectors. While the prescribed business sectors have yet to be specified, critical minerals will likely be one such area.

Door opens for global players

Worldwide competition for critical minerals suggests the impact on valuations could be marginal, with other global players lining up to fill the vacuum left by Chinese investors and capitalize on Canadian mining experience. For instance, Korean lithium-ion battery producer LG Energy Solution has signed partnerships with a number of North American critical mineral suppliers, including Canadian trio Snow Lake Resources, Electra Battery Materials and Avalon Advanced Materials.

In the meantime, established companies seeking to diversify their interests from more traditional mining outputs, such as coal and iron ore, will be looking closely at junior miners with critical mineral assets as potential M&A targets.

Production-linked lending such as royalty and streaming financing is still a popular choice for miners seeking an alternative to traditional equity and debt finance to fund the development of assets, and rising demand for base and battery metals means they are likely to remain attractive prospects to the increasing number of public and private providers in the market.

Latin America's "critical" role in the global energy transition

Whatever level of success results from the Canadian government's efforts to jumpstart exploration and production of critical minerals, domestic developments are only one target for Canada's mining companies.

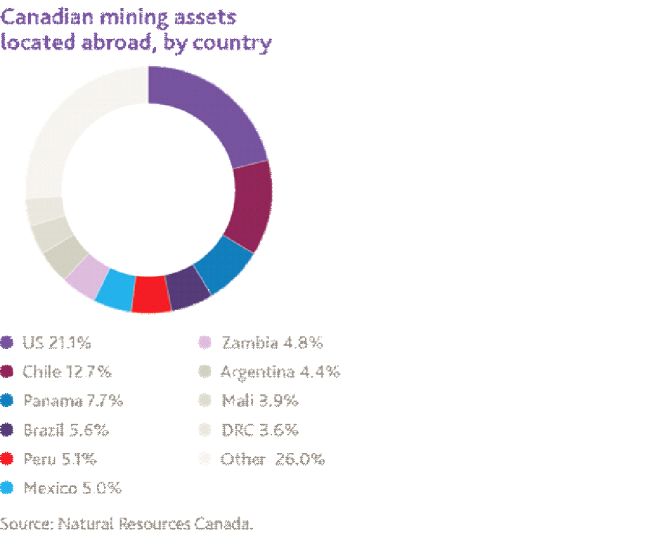

TSX and TSX-V listed mining companies have never limited themselves to their own shores – and when looking for critical minerals, they have found a home in Latin America.

Discover our Latin America country desk

This vast region – stretching from the tip of Argentina, just a few hundred miles from Antarctica, all the way to the southern U.S. border – is already home to close to one third of all mining assets held by companies listed on Canadian stock exchanges, valued at a total of $85.4 billion in 2020, up three per cent from the previous year.3

And the trend is likely to continue as the global focus on critical minerals intensifies, in a sector where many Latin American countries are already making names for themselves.

Lithium hotspot

Well over 50 per cent of the world's estimated lithium resources can be found in the salt flats of Bolivia, Chile and Argentina, earning the area its "Lithium Triangle" nickname, although the three countries have enjoyed wildly varying fortunes when it comes to getting the metal out of the ground.4

Despite having the trio's smallest estimated share of reserves – 9.8 million tonnes, according to the U.S. Geological Survey – Chilean mines produced 18,000 tonnes of lithium in 2020, close to a quarter of the global total. With twice as many identified resources as Chile, Argentina managed to produce around 6,000 tonnes, while Bolivia – home to the world's largest deposits – is yet to get its lithium operations off the ground after several abortive efforts at development with German and Chinese partners.5

Latin American countries also contain around half of the global reserves of copper – another of those on the priority list of Canada's critical minerals strategy – based largely in Chile and Peru, as well as in Mexico.6

Brazil, a powerhouse in the production of the more traditional mining output iron ore, has not been as prominent in the critical minerals sphere, but does register significant reserves of nickel, niobium and vanadium, which is touted as a potential alternative to lithium for certain rechargeable battery technologies and grid-scale energy storage.

Apart from its use in aerospace and nuclear reactor components, the metal is also the key ingredient in vanadium redox flow batteries (VRFBs), a generally cheaper and longer lasting utility-scale solution for the storage of intermittent renewable energy that its supporters claim has a lower carbon footprint compared with lithium ion batteries over their full life cycles.

Largo Inc., a Canadian miner with major vanadium operations in Brazil, is another critical mineral company to have taken a step upstream in recent years, with the launch of Largo Clean Energy – a vertically integrated VRFB business built on the acquisition of battery technology to complement its existing source of vanadium via the company's Maracas Menchen mine in the Brazilian state of Bahia.

Resource nationalism resurgent

On the flip side of the coin, Latin American projects are not without risk, making competent local and international expertise integral to a venture's success.

In recent years, political developments have spurred fears of a resurgence of resource nationalism, and in late 2021, consulting firm Verisk Maplecroft highlighted Latin American nations as the biggest movers on its risk index thanks to the increased threat of asset seizures and tax hikes.7

In 2022, their forecast proved prescient as Mexican President Andres Manuel Lopez Obrador nationalized the country's burgeoning lithium industry, creating a new state-owned company to handle commercial production, while inviting foreign and private investors to take a minority stake in its operations.

More recently, Canadian miner First Quantum Materials Ltd. got its own taste of political trouble when the Panamanian government announced plans to suspend operations at its copper mine following a dispute over a contract with the government revolving around tax and royalty payments.

Continent swings left

After a period when more conservative administrations dominated the region, the pendulum has recently swung back in the other direction. Left-leaning presidents have taken power in Bolivia, Colombia and Chile, where the new government delivered mixed messages on its openness to mining.

For example, in the year since Chilean President Gabriel Boric's March 2022 inauguration, members of his government have already rejected permits on environmental grounds for major copper projects owned by domestic miner Andres Iron and global giant Anglo American.

The Boric administration has given more positive indications over the development of lithium reserves in the country, but has also proposed royalty and tax reforms that would impose a fixed sales royalty of one per cent on large-scale operators, over the objections of the mining industry.

The intricacies of left-right dynamics and their impact on project approvals are not the be-all and end-all for junior miners, who tend to be working on much longer time horizons than any single presidential or congressional cycle. However, concerns over political stability run much deeper in some nations than others: recent events in Brazil – where supporters of defeated populist President Jair Bolsonaro attacked the presidential palace in protest at the alleged illegitimacy of his electoral defeat to his rival, current President Lula Da Silva – raised questions of a much more existential nature, as did the chaos that ensued in Peru when President Pedro Castillo attempted to dissolve Congress before the legislature ultimately voted to impeach him.

Key takeaways

As the global energy transition picks up speed, there has never been a more exciting time to be involved in the critical mineral sector.

As demand spikes for the raw materials powering clean energy technology such as battery storage, electric vehicles and solar panels, the Canadian Critical Minerals Strategy has put some substance behind the country's claim to be considered the world's friendly source.

Meanwhile, Latin America will play an increasingly important role in satisfying the global demand for critical minerals, but mining companies operating in the region must take care negotiating the domestic and international geopolitics at play, in order to take full advantage of its abundant deposits.

Wherever in the world their operations are located, miners with critical mineral assets are protected from some of the capital-raising challenges faced by the broader mining sector, even as the Canadian government cracks down on Chinese sources of funding – thanks in part to the environmental credibility that comes with its central role in the energy transition.

In order to maintain the advantage conferred by their green credentials, critical mineral miners will need to continue their innovative use of pioneering mining technology as they help satisfy global demand.

Footnotes

1. "World Energy Outlook 2022." International Energy Agency. October 2022

2. "Mine 2022: A critical transition." PwC. June 2022

3. "Canadian Mining Assets." Natural Resources Canada. January 2022

5. "Top six countries with the largest lithium reserves in the world." NS Energy. Nov. 19, 2022

7. "Resource nationalism sweeps Latin America's top mining countries." Mining.com. August 19, 2021

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.