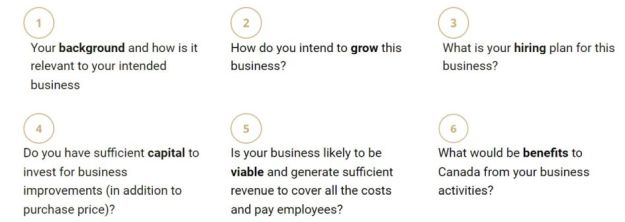

In this article, we discuss 3 strategies that will help you find, negotiate, and buy a business in Canada for the price that fits your budget. If you are unsure what strategy suits you best or you have other questions about business immigration, you can always schedule a 1-hour strategy meeting with our lawyers. When buying a business in Canada for profit and immigration, be ready to explain to immigration officers the following:

Use one of the 3 strategies below to buy the right business in Canada for your personal, financial and immigration goals.

Strategy 1: Buy a Profitable Business

Buying a profitable business in your desired industry should be your first priority when looking for a business to buy in Canada. Usually, profitable businesses are the ones that have been in operations for more than 5 years, have loyal customers, run by systems, enjoy highest employee engagement and retention and systematically generate solid net profits for their owners.

Challenge:

It is usually hard to find highly profitable businesses that are for sale in Canada since not many business owners are willing to sell their revenue generating businesses. In addition, such businesses are usually expensive. The price for a business is normally determined by the following formula: Price=5 x EBITA (earnings before interest, tax and amortization). Thus, a business generating a net revenue of $100,000 per year, would cost around $500,000 (5 x $100,000) to acquire.

If you have a budget to buy a highly profitable business, then focus all your efforts on finding a good business that meets your criteria.

Solution:

If you do not have sufficient budget to buy a highly profitable business in Canada or moderately profitable business that meets your revenue expectations, then you should focus on finding a low-priced businesses that you understand and are excited about.

Follow the tips in Strategy 2 below to find the right business that fits your budget and can support your financial and immigration goals.

Strategy 2: Buy a Destitute Business

If you do not have sufficient budget to buy a profitable business in Canada or you do not wish to invest large amounts of capital upfront, then you can buy a struggling business and commit to its improvement. Do not buy a struggling business that generates less than $30,000 in profits for the owner! There are many struggling businesses that are for sale in Canada and the key here is to ensure that you are not taking too much liability by buying a destitute business.

Challenge:

Struggling businesses almost always require further capital investments and operational improvements from its new owners. When buying a destitute business you must have a solid business plan that focuses on improvement and additional capital to fund your improvement. You must also convenience immigration officers that you have solid growth strategy and will be able to execute it. If you have necessary skills, additional capital and clear vision on how to scale your newly acquired business, then perfect, you can buy a destitute business for your immigration and personal goals. If not, see solutions below.

Solution:

Turning around a destitute business can be a challenging undertaking, especially if you lack industry knowledge and entrepreneurship experience. You can overcome this by working with professionals who can help you to improve the performance of your business or use the Strategy 3 below to buy a franchise in Canada.

Strategy 3: Buy a Franchise

If you lack necessary skills and background to buy a struggling business then consider buying a franchise so you can benefit from the experience and support of the franchisor. Many well-established franchises might require $500,000 + of upfront investment, but there are plenty of smaller franchises that can be acquired for $80,000 – $250,000 and generate at least $50,000 (per year) in revenue for the owner. When buying a franchise, you can choose an established location or opt for a new one depending on your budget and amount of liability you want to take.

Challenge:

Keep in mind that franchisors usually charge royalty fees ranging from 5% to 20% of gross revenue depending on level of support they provide and this may affect your profitability. In addition, franchisors will limit your entrepreneurial freedom and there will be little opportunities for you to improve operations of the business or generate additional streams of revenue without the franchisor's prior consent.

Solution:

Franchises are not for everyone. If you are a sophisticated entrepreneur who understands how to build, grow and scale businesses, then opting for a non-franchised business may be a better option for you. If you want turn-key solutions and do not mind limiting your entrepreneurial freedom, then look for established and thriving franchises that offer flexibility, marketing support and have great brand loyalty. We suggest using a franchise broker to identify the right option for you.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.