Introduction

Welcome to our 2019 tax planning issue, full of topics and opportunities that we believe you should consider as we reach the end of 2019 and look forward to 2020. This publication is not intended to be a summary of the technical provisions of the Income Tax Act, and before you undertake any tax planning strategy, it is important to review it thoroughly with your Crowe MacKay tax advisor.

Missed opportunities mean extra taxes

Thousands of Canadians pay more income tax than they should. By not taking full advantage of deductions, you may be one of those generous Canadians without even knowing it. Are you aware of all of the deductions that are available to you? Do you file your return on time? Do you pay tax instalments quarterly to avoid interest charges?

Here is a look at some of the important dates and some of the commonly missed opportunities that could be contributing to your larger than necessary tax bill.

Expenses you may be entitled to deduct

Employment expenses

Employees who are required to use their own automobiles for work (other than for travelling to and from their work place) without reimbursement from their employer can deduct the business portion of their automotive expenses. If you are reimbursed and the amount of the reimbursement is not "reasonable," you can still claim a deduction for the non-reimbursed portion. In order to claim employment expenses, your employer will have to provide you with a completed form T2200 Declaration of Conditions of Employment.

Carrying charges and deductible interest

Borrowed funds must generally be used for the purpose of earning income (e.g. investing) in order for the related interest to be deductible. Maintaining proper documentation of loans and interest payments will help support claims for interest deductions. Deductible carrying charges may include investment counsel fees, bank fees or similar charges.

Childcare expenses

Subject to certain limitations, childcare expenses may be deducted from income by the lower income spouse. These expenses include daycare, babysitting, boarding school and day camps. Note that you will have to provide the Social Insurance Number of any individual you paid for childcare and supporting documentation is frequently requested by Canada Revenue Agency (CRA).

Moving Expenses

If you moved during the year to be at least 40 kilometres closer to a new job, to run a business or to attend a post-secondary educational institute full-time, then you may be able to deduct certain moving expenses. The amount you can deduct is limited to the amount you earn at the new location in the year. Unused deductions can be carried forward and deducted against the related income in a subsequent year.

Some examples of allowable moving expenses are:

- Accommodation, meals and temporary living expenses near your new or old residence for up to a maximum of 15 days

- Cost of changing your address on legal Documents

- Cost of replacing your driver's license

- Cost of cancelling the lease for your old residence or expenses for selling your old residence, such as real estate commissions and advertising

- Cost to maintain your old residence when vacant (maximum of $5,000)

- Certain expenses related to purchasing your new residence

- Transportation and storage for household Effects

- Travelling from your old residence to your new residence

- Utility hook-ups and disconnections, etc. Proper documentation of your expenses, including receipts, is critical as the CRA generally requests support for moving expenses.

Charitable donations

Charitable donations made by you or your spouse during the year should normally be added together and claimed on the income tax return of one spouse. A higher credit is available when total donations exceed $200, so it makes more sense to combine the donations and claim them on one return. If your total donations are less than $200 there is no advantage to claiming them on one return. The key to supporting your claim is to keep the official tax receipts.

If you are donating certain publicly-listed securities, your donation credit is based on the fair market value of those securities. Furthermore, you will not pay tax on capital gains on the donated securities.

Donations can also be carried forward up to five years so if you find a donation receipt that was not previously claimed, bring it in to review with your Crowe MacKay tax advisor.

Medical expenses

You may claim a non refundable tax credit on medical expenses for yourself, your spouse and dependent children. While either spouse can make the claim, as with charitable donations, medical expenses should usually be added together and claimed on the income tax return of one spouse (usually the lower income spouse) in order to maximize tax savings. You are not restricted to claiming on a calendar year basis as you can claim medical expenses for any 12 month period that ends in the year, or for any 24 month period including the date of death in a final tax return.The most commonly missed expenses are dental bills, eye glasses, private medical insurance (including certain travel medical insurance premiums) and certain travel costs such as travel to regional or provincial centres for treatment.

You may also claim certain expenses in respect of an animal specifically trained to perform specific tasks to assist with posttraumatic stress disorder.

Medical cannabis can be claimed as a medical expense. However, you can only claim cannabis products as a medical expense if you are authorized to possess these substances for your own medical use under the Access to Cannabis for Medical Purpose Regulations (Regulations) or Section 56 of the Controlled Drugs and Substances Act (Act). Purchases must also be made in accordance with the aforementioned Regulations or Act from a specific registered seller in order to be eligible.

Attendant care and nursing home expenses

For persons who qualify for the disability amount, attendant care expenses may be claimed for:

- part-time or full-time attendant care in a self-contained domestic establishment (the person's home, for instance)

- full-time attendant care in a nursing home

- attendant care in retirement homes, homes for seniors, or other institutions

Attendant care expenses can be claimed as medical expenses to a maximum of $10,000 per year, or $20,000 in the year of death, if the disability tax credit is claimed. There is no maximum amount if the disability tax credit is not claimed.

When the expenses are for full-time care in a nursing home, there is no limit on the total attendant care expense that can be claimed as medical expenses. However, the disability tax credit cannot be claimed. Do get a detailed fee statement from long term care facilities to ensure appropriate expenses are claimed.

Disability tax credit

This credit is available to a person with a severe and prolonged impairment in physical or mental function, subject to certain criteria. To qualify, CRA must approve an application signed by your doctor or nurse practitioner. Areas that may apply include the following:

- Vision/blindness

- Life-sustaining therapy

- Impairment to physical functions such as walking, speech, hearing, feeding

- Impairment to performing the mental functions necessary for everyday life

The disability tax credit can be claimed retroactively for up to ten years. A T1 adjustment can be filed to claim the credit for any tax years that have lapsed since the time that impairment began, as certified by your doctor.

Once a person with a disability has applied for and is deemed eligible for the disability tax credit, he/she may also be eligible to participate in a Registered Disability Savings Plan, which will be discussed later in this newsletter.

Other credits may be available to those supporting certain family members who are dependent on them due to a physical or mental infirmity:

- Amount for infirm dependents age 18 or older

- Attendant care and nursing home expenses

- Canada Caregiver amount

Teacher and Early Childhood Educator School Supply tax credit

The Teacher and Early Childhood Educator School Supply tax credit is a refundable tax credit. This credit will allow an employee who is a teacher or early childhood educator to claim a 15% refundable tax credit on up to $1,000 of purchases of eligible teaching supplies during the year.

Student loan interest

Interest paid on student loans obtained under the Canada Student Loans Act, the Canada Student Financial Assistance Act, or similar provincial or territorial government legislation for post-secondary education can be claimed as a tax credit. If you do not use the credit for the year in which the interest is paid, the unused amount can be carried-forward for up to five years.

Home buyers' amount

Eligible taxpayers, including first-time home buyers and home buyers eligible for the disability tax credit, may be eligible to claim a 15% non-refundable tax credit on $5,000. Generally speaking, you may be considered a first-time home buyer if neither you nor your spouse or common-law partner owned and lived in another home anywhere in Canada in the calendar year of the purchase or in any of the four preceding calendar years.

Home Accessibility tax credit

The Home Accessibility tax credit is available for seniors (age 65 and older) and individuals who qualify for the disability tax credit. This credit allows these individuals to claim a 15% non-refundable tax credit on up to $10,000 of expenses incurred to perform a "qualifying renovation" on their home. Such a renovation must allow the individual to gain access to, or be mobile or function within the home, or reduce the risk of harm to the individual within or gaining access to the home. Such expenses may also be eligible for the medical expense tax credit, providing a double tax benefit from claiming these expenses.

What to do next?

Filing on time

The normal deadline for filing an income tax return for the previous year is April 30. This filing deadline is extended to June 15 if you or your spouse are self-employed. However, income taxes payable are still due on April 30. Similarly, the information return for "Specified Foreign Property" having an aggregate cost over $100,000 CAD at any time during the year (Form T1135) must be filed by the individual's filing deadline.

Taxpayers who do not file their income tax returns on time face significant late-filing penalties: 5% of the balance due plus 1% per month to a maximum of 12 months for the first offence, plus applicable interest on the penalty. The penalty can more than double where the taxpayer fails to file on time for a second time in three years and if a formal demand for filing has been issued by the Minister.

Interest and penalties are not tax deductible and add up quickly at the rates charged by CRA. Even if you cannot pay the amount of taxes due, ensure that you file on time.

Even if you do not have income to report, failing to file your return can put you at a financial disadvantage. Several benefits and social programs are issued to individuals based on the income (or lack there of) reported in their filed tax return. For instance, the Canada Child Benefit is a tax-free monthly payment from the government to assist eligible low income families with the costs of raising children. In order to be considered for the benefit, you and your spouse must file your return every year. Guaranteed Income Supplement (GIS), GST/HST credit, and the Canada Workers Benefit are other benefits that are assessed and paid based on personal income tax filings.

Penalties for failing to report income

If you have income from several sources, make sure that you do not miss reporting any of it. By failing to report income on your return in the current year and in any of the three preceding years, you could be subject to federal and provincial/territorial penalties based on a percentage of the unreported income in addition to paying the understated tax liability on the unreported income. Interest applies on the unpaid amounts. We recommend that you ensure that you have information on all of your income when having your return prepared.

Disclosing the sale of principal residence

Many Canadians are aware of the fact that they will likely not pay tax on the sale of their home as a result of the principal residence exemption. However, what some taxpayers are not aware of is that this does not relieve them of the requirement to disclose the sale to the CRA. If you sold your home during the year, you must disclose and report the sale in your personal tax return. Failure to do so will result in penalties.

Tax instalments

Failure to pay quarterly income tax instalments when required may result in interest charges. It is possible to make catch-up payments and reduce or offset the interest charges. Contact your Crowe MacKay tax advisor if you are unsure if you are required to make tax instalments.

How To Impact Your 2019 Tax Bill

Accounting fees and legal fees

Certain accounting or legal fees, such as the cost of representation on tax disputes, are deductible in the year paid. If you have these costs be sure to pay them before the end of the year.

Charitable or political donations

If you are planning to give money to a charity or political party, make sure the gift is made before December 31, 2019 to ensure you can claim the tax credit on your 2019 return.

Equipment purchases

If you have equipment you are planning to purchase for your business early next year, consider purchasing it before December 31, 2019 or before your corporate year end as applicable. The tax depreciation only starts when the equipment is available for use in your business. Similarly, if you are going to sell equipment, consider doing so early in 2020 rather than in 2019. Tax depreciation can only be deducted on equipment that is owned as at December 31, 2019.

Family trust

Ensure that any desired distributions to or from a family trust are made by December 31, 2019. If distributions are planned, ensure appropriate dividends are paid through the Trust by year end. Payments by cheques deposited and distributed before the end of the year are required, unless detailed steps are completed. The "tax on split income" rules introduced in 2018 remain in effect and may significantly impact certain tax benefits associated with using family trusts for income-splitting purposes. Please contact your Crowe MacKay tax advisor for more details on how these new rules may affect you and to mitigate the risk of having TOSI rules apply to the dividends paid to you and your family.

Home office

If you are an individual using a home office as your principal place of business (more than 50%), or exclusively for earning business income and on a regular and continuous basis for meeting clients or customers, then you may be able to deduct home expenses related to the office space. Such expenses include the business portion of rent, mortgage interest, property taxes, utilities, insurance, repairs, and telecommunications. The home office expenses you can deduct depend on whether you are an employee, a commissioned employee, self-employed, or a shareholder. Please consult with your Crowe MacKay tax advisor to determine the expenses you can deduct in your specific circumstances.

Investments

If you have realized capital gains in the current year, consider selling investments with unrealized capital losses before year end. This strategy could reduce your tax bill as capital losses can be offset against capital gains. The key is to trigger these losses in 2019 so the last settlement day for 2019 must be considered. Where a loss has been triggered, you or an affiliated party cannot acquire the same or an identical investment within 30 days before or after the sale or the loss will be disallowed. We recommend that you consult your Crowe MacKay tax advisor and your investment advisor prior to undertaking this strategy.

Transfer of dividend income from taxable Canadian corporations to a spouse

If you are entitled to a spousal tax credit for your spouse or common-law partner, you may be able elect to include all of your spouse's dividends from taxable Canadian corporations in your income if doing so will allow you to claim or increase the claim, for the spousal tax credit. The election should only be made if it results in lower overall taxes. It might not always be beneficial to transfer this between you and your spouse. Please contact your Crowe MacKay advisor to discuss this in further detail.

Old Age Security (OAS) claw back

If you are collecting OAS and your net income in 2019 is over $77,580, you are required to repay some or all of your OAS benefits. This "claw back" is the lesser of your OAS benefits received in the year and 15% of your net income that is over $77,580. The OAS claw back is calculated solely on your net income and is not affected by your spouse's income. Note that if your net income is $126,058 or greater in 2019 you will be required to repay all of your OAS benefits. If you are eligible to receive OAS but are subject to a full claw back, you may consider deferring receiving OAS until a year in which the claw back is reduced or eliminated. Deferring the receipt of OAS will increase your OAS entitlement when you begin to collect it and it will increase your maximum annual net income to receive OAS. Please contact your Crowe MacKay tax advisor if you have any questions about OAS.

Pension income-splitting

If you are earning eligible pension income you may be able to split up to 50% of this income with your spouse or common-law partner. Examples of ineligible pension income are Canada Pension Plan, Old Age Security and certain foreign pension income. This pension income-splitting may be done by filing a joint election with your income tax return and can result in significant tax savings if your spouse or common-law partner is in a lower tax bracket. Your spouse or common-law partner may also be able to claim the pension income amount tax credit on the income that he/she is deemed to have received (see below).

Pension sharing

If you are collecting Canada Pension Plan (CPP), you may be eligible to pension share this income with your spouse or commonlaw partner provided you live with them. If a taxpayer's spouse is in a lower marginal tax bracket, this may be an effective means of income splitting and reducing the couple's overall tax bill. Individuals must apply through Services Canada.

Pension tax credit

A $2,000 pension tax credit is available if you earn eligible pension income, which typically includes income from a registered pension plan, income from a registered retirement income fund (RRIF) and annuity payments from an RRSP. If you are eligible to receive pension income from one of these plans and are not currently doing so, you may consider starting to collect some of this pension income in order to claim the pension tax credit. One means of doing this would be converting a portion of your RRSP to a RRIF in order to receive eligible pension income on which the pension tax credit can be claimed. Please contact your Crowe MacKay advisor to discuss the opportunities and age restrictions that apply to your circumstances.

Registered Disability Savings Plan (RDSP)

The RDSP is a registered long-term savings plan specific to people with disabilities who are eligible for the disability tax credit. Contributions may be made by the beneficiary, a family member, or by any other authorized contributor. There is no annual limit on contributions; however, there is a lifetime contribution limit of $200,000.

Currently there are restrictions in place that limit an individual's use of an RDSP if their eligibility for the disability tax credit changes. The 2019 Federal Budget proposed to remove some of these restrictions for 2021 and subsequent years. The proposed changes include removing the limit on the period of time an RDSP can remain open for if the beneficiary is no longer eligible for the disability tax credit, and removing the requirement that the beneficiary receive certification that they are likely to become eligible for the disability tax credit again in the future should their eligibility change in a given year. We suggest you contact your Crowe MacKay tax advisor to determine how these proposed changes and transitional rules will impact you.

Although contributions to the plan are not tax-deductible, income earned inside the plan is not taxed until it is withdrawn by the beneficiary. Contributions can be made until the end of the year in which the beneficiary turns 59 and payments from the RDSP must begin by the end of the year in which the beneficiary turns 60.

There are currently two income-based programs in place to enhance the funds that are contributed to the RDSP. The Canada Disability Savings Grant Program, and the Canada Disability Savings Bond Program.

The rules related to RDSPs can be complex and we recommend you speak with your Crowe MacKay tax advisor if you believe this program may be right for you or a family member.

Registered Education Savings Plan (RESP)

Make contributions to an RESP before December 31 to qualify for any 2019 grants you may be eligible for. As in years past, beneficiaries under the age of 18 qualify for the Canada Education Savings Grant (CESG) which is equal to 20% of annual contributions made for a beneficiary, subject to a $500 annual cap and a $7,200 lifetime maximum. Additional grants are possible where there is unused grant room from a previous year and for families with lower net income.

Registered Retirement Savings Plan (RRSP)

Regular and spousal contributions for the 2019 taxation year may be made up to March 2, 2020. Similarly, if you must repay a portion of your Home Buyers' Plan or your Lifelong Learning Plan, payments must be made by that same date.

Overall tax savings are most significant for individuals who are currently in a high tax bracket but will be in a lower bracket when the RRSP money is withdrawn.

There may be an opportunity to income-split with your spouse if you contribute to a spousal RRSP, and he/she makes a withdrawal from that spousal RRSP in a subsequent year. Be careful of attribution rules that will apply if the funds are withdrawn within 3 years of your last contribution to a spousal RRSP. If you turn 71 and can no longer contribute to your own RRSP, you can still make contributions to a spousal RRSP until the end of the year in which your spouse turns 71.

The Home Buyers' Plan and Lifelong Learning Plan are also useful RRSP tools as they allow you to withdraw funds from your RRSP on a tax deferred basis to help fund a home purchase or full-time training or education. Please be aware if the required repayments under these plans are not made by the RRSP deadline, then the amounts will be included in your income for the 2019 tax year.

We suggest that you contact your Crowe MacKay tax advisor if you have any questions about RRSPs.

The RRSP contribution limit is $26,500 for 2019 and $27,230 for 2020.

Shareholder loans

If you have a shareholder loan from your company that has been outstanding since the December 31, 2018 year end, (i.e. it is at risk of showing up as a debit balance on two consecutive balance sheets), ensure it is repaid by December 31, 2019 or it may result in a deemed taxable benefit to the shareholder. Consult your Crowe MacKay tax advisor to determine if the amount must be repaid and to discuss repayment methods such as dividends or net wage compensation.

Family income splitting loans

If you have a spousal or family income splitting loan, ensure the interest is paid by January 30, 2020 by a "documented" method such as a deposited cheque. These loans with interest at the prescribed rate (currently 2%) are typically used for income-splitting where families have large investment pools (generally over $1M). Failure to pay the interest by January 30 can result in investment income earned on the loaned funds being taxed in the hands of the higher income lender.

Tax Free Saving Account (TFSA)

Canadian residents age 18 and over are eligible to open a TFSA. Income earned in a TFSA is not taxable as it is earned nor is it taxable when withdrawn from the account. Contributions to a TFSA are not tax deductible.

For 2019, the maximum contribution is $6,000 plus any outstanding contribution room carried forward. The cumulative contribution room granted to Canadians since the start of the TFSA program is $63,500 to December 31, 2019. Please contact your investment advisor for the maximum contribution you may make for 2019.

If you are considering a withdrawal in the foreseeable future, it is preferable to withdraw these funds in 2019 rather than early 2020. Withdrawals are added back to the taxpayer's contribution limit at the beginning of the calendar year after the withdrawal.

Taxable benefits

Auto benefit - If you drive an automobile that is owned or leased by your employer, you may be subject to a taxable benefit for your personal use of the automobile. You may reduce this taxable benefit by reimbursing your employer for the amount paid for your personal use of the automobile. The deadline for the reimbursement is February 14, 2020.

Interest benefit – if your employer provided you with an interest-free loan or a loan at an interest rate that is lower than CRA's prescribed rate (excluding a home relocation loan), you may be subject to a taxable benefit. You may reduce this taxable benefit by paying the interest to your employer at the prescribed interest rate (currently 2%). The deadline for this interest payment is January 30, 2020.

Tax on Split Income (TOSI)

The rules introduced by the Government in 2018 with respect to income splitting between family members remain in effect in 2019. In general terms, the TOSI rules will apply where an individual has received income from a private corporation that carries on a business in which a related individual is active, but has not worked or contributed much in the business. We suggest that you contact your Crowe MacKay tax advisor if you have any questions regarding the application of TOSI rules to your particular situation and to mitigate the risk of having TOSI rules apply to the dividends paid to you and your family.

Moving provinces

Generally speaking, Canadian individuals pay provincial taxes based on their province of residence as at December 31. If an individual is moving provinces towards the end of the year, it is worth trying to time the move before year-end if it is a move to a province with lower tax rates, and after year-end if it is a move to a province with higher tax rates.

US Citizens living in Canada

If you are a US Citizen living in Canada, you still have US tax filing obligations. If you are delinquent in your US filings, the IRS does have a streamlined process in place to allow you to get caught up without penalties. However, it is unclear how much longer the IRS will keep this process open, so if you have been holding off, now is the time to get caught up.

Being a US citizen can also present problems if you hold investments in Canada such as RESPs, RDSPs, TFSAs and mutual funds or if you are the shareholder of a Canadian corporation.

If you are or ever have been a US Citizen, we suggest you to contact your Crowe MacKay tax advisor to determine your filing requirements.

Snowbirds

If you own property in the United States, or are spending significant amounts of time down there, make sure you let your Crowe Mackay tax advisors know. You can run into tax issues on both sides of the border, so it is important to know and understand the rules and how they may affect you. Both Canada and the US can now track the number of days you are spending in each country, so being aware of your compliance requirements is more important than ever.

What's New For 2019

Capital gains exemption

For 2019, the capital gains exemption for qualified small business corporation shares has risen from $848,252 to $866,912. This exemption will be indexed for inflation in subsequent years. The capital gains exemption for qualified farm or fishing property remains at $1,000,000.

Home Buyers' Plan

Effective March 19, 2019, the RRSP withdrawal limit under the Home Buyers' Plan (HBP) has been increased from $25,000 to $35,000. This plan allows eligible taxpayers, including first-time home buyers and home buyers eligible for the disability tax credit, to withdraw funds from their RRSP to buy or build a qualifying home, without paying tax on the withdrawal, as long as the repayment conditions are met.

Passive investment income

Effective for taxation years beginning after 2018, a Canadian Controlled Private Corporation's (CCPC's) small business deduction limit will being phased out if the prior year's adjusted aggregate investment income of the CCPC and any associated corporation(s) is over $50,000. A corporate group's small business limit will be phased out at a rate of $5 per every $1 of adjusted aggregate investment income over $50,000. Therefore, a corporate group's small business limit will be completely phased out once its adjusted aggregate investment income reaches $150,000. Also under the new rules, a private company needs to pay a non-eligible dividend to obtain a dividend refund on certain taxes that previously could have been refunded when an eligible dividend was paid. These changes will have a significant impact on private corporations and their shareholders, and there may be tax planning opportunities for you to consider in order to minimize any adverse tax implications associated with them. Please contact your Crowe MacKay tax advisor for further details.

Canada Workers Benefit (CWB)

Effective in 2019, Canada Workers Benefit (CWB) is an enhanced, more accessible version of the former Working Income Tax Benefit. The CWB is a refundable tax credit that is intended to supplement the earnings of low income workers and improve incentives for low-income Canadians. The CWB is calculated as 26% of each dollar of earned income over $3,000, to a maximum credit of $1,355 for single individuals without children and $2,335 for families. The maximum credit is reduced by 12% of adjusted net income over $12,820 for single individuals without children and $17,025 for families. Individuals who are eligible for the Disability Tax Credit and the CWB may be eligible to receive an additional CWB disability supplement in a maximum amount of $700 and it will be reduced by 12% (6% if both spouses or common-law partners in a family are eligible for the supplement) of adjusted net income over $24,111 for single individuals without children and $36,483 for families.

Accelerated Investment Incentive

2019 was the first full tax year in which Canadians had access to the Accelerated Investment Incentive (AII). An enhanced depreciation can be claimed on equipment purchased after November 21, 2018 and available to be used before 2028. The AII allows a deduction at one and a half times the prescribed Capital Cost Allowance (CCA) rate in the year of purchase on eligible property while suspending the CCA halfyear rule, immediate write-off of machinery and equipment used for manufacturing or processing goods, and immediate write-off of specified clean energy equipment.

Small business tax rate and tax on dividends

For Canadian Controlled Private Corporations (CCPCs) claiming the small business deduction, the federal tax rate is 9% effective January 1, 2019, down from 10%. There has been a corresponding increase in the combined federal and provincial/territorial personal tax rates on non-eligible dividends, on average by one percent. As a result, you will pay more tax on non-eligible dividends.

Major Changes Coming in 2020

Employee Stock Options

Effective January 1, 2020, each arm's length employee of an employer will have an annual $200,000 limit on the value of stock options that can vest and be eligible for the employee stock option deduction. This restriction will apply to stock options in non-CCPCs and mutual fund trusts. Options in CCPCs or a qualifying highly innovative, fast-growing company will still enjoy the current employee stock option tax treatment without limitation. The new tax treatment has been introduced to limit the extent to which mature, established companies can make use of stock options as a form of tax effective compensation, while maintaining the benefit for smaller, growing companies of doing so. Employee stock options remain an important form of compensation for smaller companies, especially during the growth phase of their life cycle when cash flows may be limited.

Individuals employed in non-CCPCs should keep in mind the limited tax benefit of stock options over the $200,000 annual limit when negotiating their compensation packages.

Canada Training Credit

This is a refundable tax credit that aims to help workers between the ages of 25 and 64 and encourages them to pursue professional development. Eligible individuals can accumulate $250 of credit room per year, up to a lifetime maximum of $5,000. Eligible individuals must have at least $10,000 of qualifying income (income from employment, self-employment, and certain other amounts) and not more than approximately $150,000 in total net income. The amount that an individual can claim as a credit in a particular tax year is equal to the lesser of 50% of eligible tuition and fees paid in a year and the accumulated room at the beginning of the year. Therefore, since room begins accumulating in 2019, 2020 will be the first year in which a credit can be claimed.

Digital news subscription tax credit

For tax years after 2019 and before 2025, individuals can claim a 15% tax credit on amounts up to $500 spent on a digital news subscription with a qualified Canadian journalism organisation.

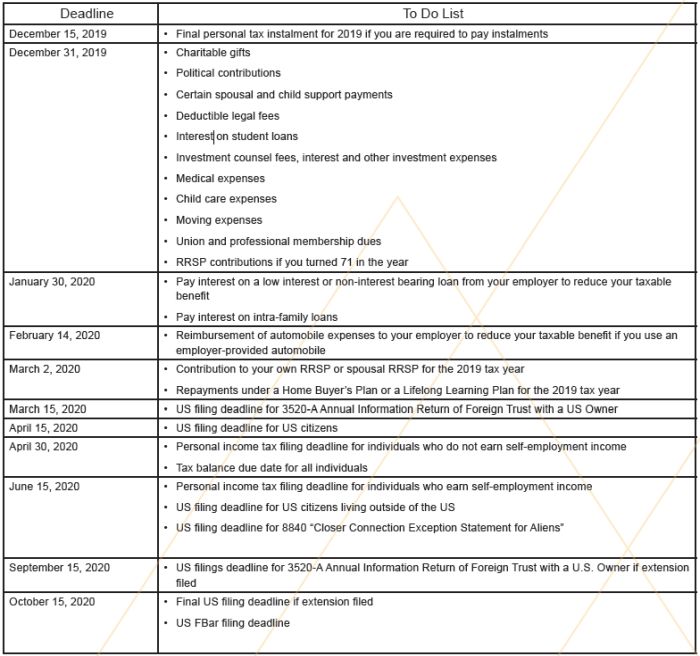

Important 2019 Tax Year Dates

Too many deadlines? No problem, we put together a list of key dates to help you navigate the 2019 tax year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.