One of the major themes of this year's Federal Budget was the "Strengthening of the Middle Class." Along with tax rate cuts for the second lowest tax bracket and the creation of a new top tax bracket for the wealthiest Canadians, there have been significant changes to the various tax credits and allowances available to families. Gone or being phased out are:

Family tax cut. 2015 was the final year for which families could claim this tax credit, which allowed a higher-income spouse to notionally transfer up to $50,000 of taxable income to his/her spouse resulting in tax savings of up to $2,000.

Children's fitness and arts tax credits. 2016 is the last year for which these credits can be claimed. Furthermore, the maximum eligible amounts for these credits have been reduced to $500 for the fitness credit and $250 for the arts credit.

Universal Child Care Benefit ("UCCB") and the Canada Child Tax Benefit ("CCTB"). These are being replaced by the new Canada Child Benefit, which is discussed further below.

Child benefits will effectively be consolidated in the new Canada Child Benefit ("CCB").

What is the CCB?

The CCB is a non-taxable monthly benefit of up to $6,400 per year per child under the age of 6 and $5,400 per year per child aged 6 through 17.

How do I apply for the CCB?

To apply for the CCB, form RC66 Canada Child Benefits Application should be completed and sent to the Canada Revenue Agency (CRA). The form can be downloaded from the CRA's website. Alternatively, you can sign up for the benefit online through the "My Account" feature on its website.

Families that are currently receiving the UCCB or the CCTB do not need to apply for the new CCB. However, their 2015 tax returns should be filed so that the CRA can calculate the CCB payment. If you have not filed your 2015 tax return yet, please feel free to contact your Crowe MacKay tax advisor for assistance.

How much will I receive under the CCB?

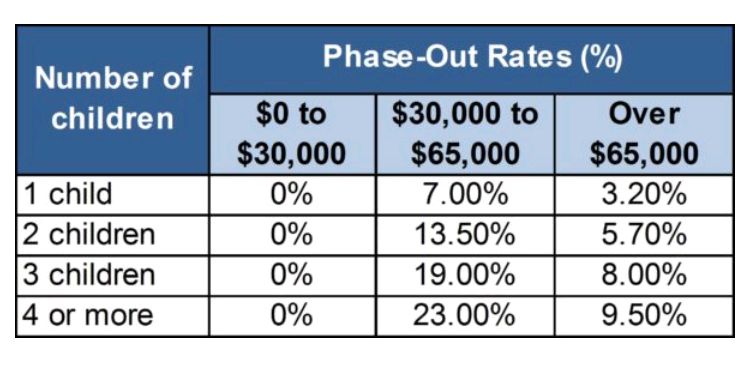

Benefits under the CCB will be determined based upon the number of children in a family and the adjusted family net income. Families with adjusted family net income of $30,000 or less will receive the maximum benefits under the CCB. As adjusted family net income exceeds $30,000, the CCB will be reduced using the rates summarized below:

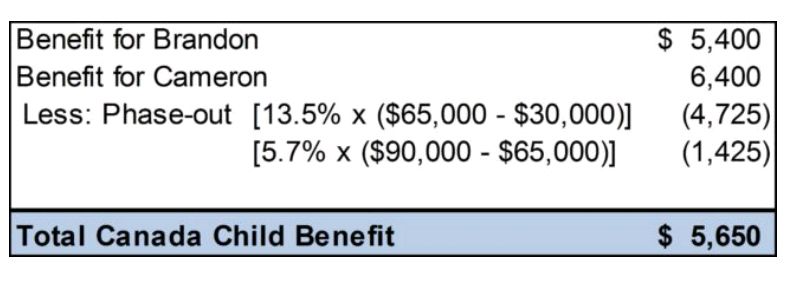

To illustrate how the CCB will be calculated, let us consider the Crowe family, which consists of father Russell, mother Sheryl, and sons Brandon (15 years old) and Cameron (5 years old). Their adjusted family net income is $90,000 and their CCB is calculated as follows:

Is the CCB better for me and my family?

Under the old UCCB and CCTB the Crowe family would expect to receive approximately $3,375 of benefits after tax (assuming a 15% tax rate is applicable to the UCCB), meaning additional benefits of $2,275 under the new CCB. It should be noted that because the UCCB is not phased out when family net income exceeds a certain level, there may be situations where families with high net family incomes are worse off under the new program. For example, a family's CCB may be phased out but they still would have been entitled to receive the UCCB under the old programs.

When will I receive my CCB?

The first payment under the CCB will be issued on July 20, 2016, replacing the current UCCB and CCTB. The last regular payments under these two old programs will be issued on June 20, 2016. It is expected that provincial benefits that are currently included with monthly CCTB payments will continue to be included with monthly CCB payments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.