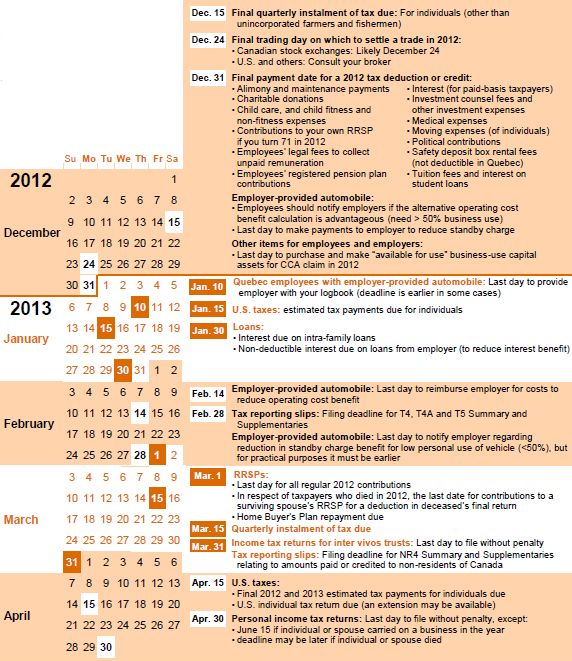

LOOMING TAX DEADLINES – DECEMBER 2012 TO APRIL 2013

This calendar includes many key tax deadlines during the next few months. Among the deadlines not included are those for provincial payroll taxes, payroll withholdings, provincial health insurance premiums, workers' compensation, federal and provincial corporate income and capital tax payments, Goods and Services Tax/Harmonized Sales Tax and provincial sales taxes.

Deadlines falling on holidays or Sundays may be extended to the next business day.

WHO SHOULD USE THIS PLANNER?

The Year-end tax planner is designed primarily for individuals who have accumulated some wealth or who own their own businesses (large or small). Your PricewaterhouseCoopers LLP (PwC) adviser or any of the individuals listed on page 25 can help you use it.

In addition to tax, your financial plan should reflect investment philosophies, sound business practices and motivational considerations. Owner-managers should ensure that sufficient funds are retained to meet business objectives; given the uncertainty in the economic environment, cash flow management is especially important.

WHAT'S NEW?

Federal

- Corporate rates – general and M&P dropped from 16.5% to 15% in 2012 (small business remains 11% in 2012 and subsequently).

- Eligible dividends –

- personal taxes increased in 2012.

- designation rules loosened for payments after March 28, 2012.

- personal taxes increased in 2012.

- Pooled registered pension plans – new voluntary savings plan introduced.

- Personal services business – tax rate increased for taxation years starting after October 31, 2011.

- Employee profit sharing plans (EPSPs) – new tax for certain EPSP contributions generally made after March 28, 2012.

- Retirement compensation arrangements – anti-avoidance rules expanded, generally for transactions occurring and investments acquired after March 28, 2012.

- Group sickness or accident insurance plans – employer contributions generally made after March 28, 2012, relating to coverage after 2012, will be included in an employee's income.

- Partnership information returns – information requirements expanded (transitional relief is available for 2011 and 2012 fiscal periods).

- Joint ventures – separate fiscal period eliminated for taxation years ending after March 22, 2011.

- Scientific research and experimental development

(SR&ED)

- 20% investment tax credit (ITC) decreasing to 15% for taxation years ending after 2013.

- capital expenditures no longer eligible for SR&ED deduction or ITCs after 2013.

- overhead proxy rate reduced in stages from 65% to 55% after 2012.

- SR&ED contract payments eligible for ITCs reduced in some cases after 2012.

- program to be reviewed.

International

- Shareholder loans – Canadian corporations controlled by non-residents can elect to make certain loans to foreign parent companies or related non-resident companies without incurring the deemed dividend withholding tax, generally for loans received or indebtedness incurred after March 28, 2012. Also applies to loans made by, or to, certain partnerships.

- Thin capitalization rules

- 2-to-1 debt-to-equity ratio decreasing to 1.5-to-1 for taxation years beginning after 2012.

- scope of rules broadened.

Provincial/territorial

- General and M&P corporate rate

- in British Columbia, may increase to 11% (April 1, 2014).

- in Ontario, non-M&P rate remains 11.5% for 2012 and until Ontario's budget is balanced (scheduled for 2017-2018); rate reductions rescinded.

- Small business rate and threshold

- British Columbia rate remains 2.5%; reduction rescinded.

- New Brunswick rate may drop (2013 to 2015).

- Nova Scotia rate declining (2012 to 2013).

- $500,000 threshold applies in all jurisdictions except Manitoba

and Nova Scotia, which have a $400,000 threshold.

- General capital tax – no longer exists (applied only in Nova Scotia, where it was eliminated on July 1, 2012).

- Ontario personal income tax – tax on incomes over $500,000 increasing from 11.16% to 12.16% in 2012 and to 13.16% after 2012 (surtaxes apply); rate increases to be rescinded when Ontario's budget is balanced (scheduled for 2017-2018).

- Quebec personal income tax – tax on incomes over $100,000 possibly increasing from 24% to 25.75% after 2012.

- Quebec Sales Tax (QST)

- rate increased from 8.5% to 9.5% on January 1, 2012.

- to be further harmonized with the GST on January 1, 2013, when

the rate will increase from 9.5% to 9.975% and QST will be

calculated exclusive of GST (effective harmonized rate of

14.975%).

- Harmonized Sales Tax (HST)

- British Columbia – 12% HST to be replaced by 7% provincial sales tax (PST) and 5% federal Goods and Services Tax (GST) on April 1, 2013.

- Nova Scotia – rate decreasing from 15% to 14% by July 1, 2014, and to 13% by July 1, 2015.

- Prince Edward Island – combined 15.5% PST/federal GST to be replaced by a 14% HST on April 1, 2013.

YEAR-END TAX PLANNING CHECKLISTS

Working with your PwC adviser is essential when considering the following year-end tax planning tactics.

Owner-managed businesses

- Salary/dividend mix – Determine the

optimal mix of salary and dividends for you and other family

members for 2012.

- Consider all relevant factors, including the owner/manager's marginal tax rate, the corporation's tax rate, provincial health and/or payroll taxes, RRSP contribution room ($132,333 of earned income in 2012 is required to maximize RRSP contribution in 2013), CPP contributions and other deductions and credits (e.g., for child care expenses and donations).

- Be aware that if you earn dividends (especially eligible dividends) your alternative minimum tax (AMT) exposure can increase.

- If the individual does not need cash, consider retaining income

in the corporation.

- Tax is deferred if the corporation retains income when its tax rate is less than the individual owner-manager's rate. See Table 1 on page 20.

- In times of economic uncertainty, retaining income in the corporation will help the corporation's cash flow and will allow the corporation to have income and pay corporate tax that may be recovered by possible future business losses.

- Consider the effect of retaining income in the corporation on

corporate share value for estate and shareholder agreement

purposes.

- Ontario – If you are resident in Ontario, ensure that

your remuneration strategy accounts for Ontario's new personal

income tax rate on incomes over $500,000 — 12.16% plus

Ontario surtax in 2012, increasing to 13.16% plus Ontario surtax

after 2012, until Ontario's budget is balanced (scheduled for

2017-2018).

- To avoid the new Ontario high-earner tax, keep taxable income at $500,000 or less, by deferring the receipt of taxable bonuses or discretionary dividends until the high income tax is eliminated.

- If your Ontario taxable income is expected to exceed $500,000 in 2013, consider accelerating taxable bonuses and discretionary dividends to 2012 to avoid the higher tax rate after 2012. Be aware that this strategy may increase your AMT exposure and will hasten the payment of tax.

- If your Ontario taxable income will exceed $500,000 in 2012 and later years, consider moving to a lower-tax jurisdiction before the end of 2012 (if this timing is not feasible, before the end of 2013).

- If you are subject to the new Ontario high-earner tax, be aware

that distributing non-eligible dividends (starting 2012) and

eligible dividends (starting 2013) to trigger a refund of

refundable tax on hand is no longer a cash-positive transaction,

because the dividend refund rate (i.e., 33 1/3%) is less than the

top personal tax rate on these dividends (i.e., non-eligible,

34.52% for 2012 and 36.47% after 2012; eligible, 33.85% after

2012).

- Nova Scotia – If Nova Scotia tables a budget surplus in its 2013-2014 fiscal year, for 2013 the top $150,000 personal tax bracket and 21% rate will be eliminated, but the 10% personal income tax surtax on provincial income tax exceeding $10,000 will be reinstated. In that case, owner-managers should take into account that personal tax rates may change in 2013 and adjust strategy on the payment of salary and/or dividends accordingly.

- Quebec – If you are resident in Quebec, be aware that

Quebec's minority government is proposing, starting 2013, to

increase:

- the personal income tax rate from 24% to 25.75% on incomes over $100,000; and

- the health contribution from $200 to a maximum of $1,000 if

your net income exceeds $130,000, up to $150,000 (the health

contribution will decrease for net incomes below $42,000).

- Ensure that your remuneration strategy accounts for these proposed changes.

-

- Consider accelerating taxable bonuses and discretionary dividends to 2012 to avoid the possibility of a higher tax rate on incomes over $100,000 after 2012. Note that this strategy may increase your AMT exposure and will hasten the payment of tax.

- If the proposed changes are enacted and you will be subject to the top combined federal/Quebec marginal income tax rate in 2013, be aware that distributing eligible dividends to trigger a refund of refundable tax on hand will no longer be a cash-positive transaction, because the dividend refund rate (i.e., 33 1/3%) is less than the top personal tax rate on eligible dividends (i.e., 35.22%, starting 2013).

- Qualifying small business corporation share status – Recognize that forgoing bonus and/or dividend payments and stockpiling passive investments could cast doubt on whether substantially all of the assets of a Canadian-controlled private corporation (CCPC) are used in an active business, in turn jeopardizing the ability to claim the $750,000 lifetime capital gains exemption, among other things.

- Scientific research and experimental development (SR&ED) – Consider not forgoing bonus payments if it causes a CCPC's SR&ED investment tax credits (ITCs) to be non-refundable and subject to the lower ITC rate. (But retaining some income will allow the company to use the non-refundable ITCs.)

- Salaries to family members – Pay a reasonable salary to a spouse or child who is in a lower tax bracket and provides services to your business. This also allows family members to have earned income for CPP, RRSP and child care expense purposes.

- Dividends to family members – Consider paying dividends

to adult family members who are shareholders in your company and in

a lower tax bracket. Individuals with no other income can receive

up to about $50,000 in dividends, without triggering any tax,

depending on their province or territory of residence and the

availability of the general rate income pool (GRIP).

- Dividend tax regime – Be aware of how

the dividend tax rules affect dividend distributions.

- Designate dividends that can qualify as eligible dividends. (Designation procedures differ for public and non-public companies, but both require designation at the same time as, or before, payment of the eligible dividend.)

- Consider electing to treat all or part of any excess eligible dividend designation as a separate non-eligible dividend.

- Be aware that for dividends paid after March 28, 2012:

- a corporation can designate, at the time it pays a taxable dividend, any portion of the dividend to be an eligible dividend; and

- the Minister of National Revenue can accept late eligible

dividend designations that are made within three years after the

day the designation was first required to be made.

- CCPCs

- Determine the CCPC's ability to pay eligible dividends by estimating its general rate income pool (GRIP) as at its 2012 year end.

- Consider distributing dividends in the following order:1

-

- Eligible dividends that trigger a refundable dividend tax on hand (RDTOH) refund.

- Non-eligible dividends that trigger a RDTOH refund.

- Eligible dividends that do not trigger a RDTOH refund.

- Non-eligible dividends that do not trigger a RDTOH refund.

- Consider making the election that permits a CCPC to be treated as a non-CCPC for purposes of the dividend tax regime. For a newly incorporated CCPC that is expected to earn only active business income and will not benefit from the small business deduction, this would eliminate the need to calculate and monitor GRIP before paying eligible dividends.

- A CCPC that will become a non-CCPC (i.e., planning to go public

or become controlled by non-residents) should consider the effect

of the federal dividend tax rules, as well as the deemed year-end

rules.

- Non-CCPCs

- Determine whether the non-CCPC must pay non-eligible dividends before it can pay eligible dividends, by computing its low-rate income pool (LRIP).

- A non-CCPC that will become a CCPC should consider the effect

of the federal dividend tax rules.

- Cash flow management – Recognize that managing your business cash flow is critical, especially in times of economic uncertainty. To reduce working capital outflows, reduce or defer tax instalments (if lower taxable income is expected), maximize federal and provincial refundable and non-refundable tax credits (e.g., SR&ED ITCs and film, media and digital incentives), trigger capital losses to recover capital gains tax paid in previous years, and recover any income, sales or customs tax overpayments from previous years.

- Remuneration accruals – Accrue reasonable salary and bonuses before your business year end. Ensure accrued amounts are paid within 179 days after the business' year end and appropriate source deductions and payroll taxes are remitted on time.

- Pooled registered pension plan (PRPP) – Consider joining a PRPP, a voluntary savings plan that is similar to a defined contribution RPP (or a group RRSP plan). See our Tax memos:

-

- "Pooled Registered Pension Plans: A new retirement savings vehicle"; and

- "Pooled Registered Pension Plans (PRPPs)–Tax rules introduced."

- Legislation to implement federal PRPPs has been enacted. The provinces and territories must introduce their own enabling legislation to implement provincial and territorial PRPPs. Quebec intends to introduce a similar voluntary retirement savings plan.

- Retirement compensation arrangements (RCAs)

– Consider setting up an RCA as an alternative to paying a

bonus. However, be aware that:

- anti-avoidance rules for RCAs engaged in non-arm's length

transactions will parallel the "prohibited investment"

and "advantage" rules applicable to tax-free savings

accounts, RRSPs and RRIFs. They will apply to:

- investments acquired after March 28, 2012, or that become prohibited after March 29, 2012; and

- advantages extended, received or receivable after March 28,

2012.

- for RCA contributions made after March 28, 2012, RCA tax

refunds are restricted in certain cases when the RCA property,

reasonably attributable to a prohibited investment or advantage,

has declined in value.

- anti-avoidance rules for RCAs engaged in non-arm's length

transactions will parallel the "prohibited investment"

and "advantage" rules applicable to tax-free savings

accounts, RRSPs and RRIFs. They will apply to:

- See our Tax memo "Employee benefits and executive compensation: Draft legislative proposals released."

- Employee profit sharing plans (EPSPs) – Consider setting up an EPSP as an alternative to paying a bonus. However, be aware that for EPSP contributions generally made after March 28, 2012, a new tax will be imposed on the portion of an employer's EPSP contribution, allocated by the trustee to a "specified employee," that exceeds 20% of the employee's salary received in the year from the employer. A specified employee generally includes an employee who has a significant equity interest in, or does not deal at arm's length with, the employer. See our Tax memo "Employee benefits and executive compensation: Draft legislative proposals released."

- Employee stock options – Be aware that only the employer or employee (not both) can claim a tax deduction for cashed-out stock options. File an election if the company chooses to forgo the tax deduction.

- Donations – Make charitable donations and provincial political contributions (subject to certain limits) before year end. Be aware that Canadian donors will be able to make tax-receiptable gifts after 2012 to foreign charitable organizations that have been granted designated status for 24 months by the Minister of National Revenue.

- Final corporate tax balances – Pay final corporate income tax and (in Nova Scotia, capital tax) balances and all other corporate taxes imposed under the Income Tax Act within two months after year end (three months for certain CCPCs).

- Corporate withdrawals – Make tax-effective withdrawals of cash from your corporation (e.g., by paying tax-effective dividends or non-taxable capital dividends, returning capital or repaying shareholder loans).

- Corporate income

-

- Small business rate – Small businesses in Nova Scotia and New Brunswick should consider deferring income to 2013 and later years by maximizing discretionary deductions (e.g., CCA) in 2012 to benefit from future small business rate decreases. Nova Scotia's rate decreases to 3.5% on January 1, 2013, and New Brunswick plans to decrease the rate in stages to 2.5% over the next three years, but no details have been announced.

- General rate – If your company is subject to British Columbia's general tax rate, consider accelerating income to 2012 and 2013 by minimizing 2012 and 2013 discretionary deductions; the general rate may increase from 10% to 11% on April 1, 2014, if the province's fiscal situation worsens.

- Mandatory e-filing of corporate income tax and information returns – To avoid penalties, e-file:

-

- corporate income tax returns if annual gross revenues exceed $1 million (similar penalties apply in Quebec); and

- information returns if more than 50 information returns are submitted annually.

- Partnership information returns – Be aware that information requirements for partnership information returns have been expanded for fiscal periods ending after 2010 (transitional relief is available for 2011 and 2012 fiscal periods). Partners must start gathering information to determine the adjusted cost base of each partner's interest in the partnership and each partner's at-risk amount for the partnership. See our Tax memo "Changes to partnership returns: What they mean for you."

- Partnership deferral – If you have a

corporate partner in a partnership, be aware that the deferral of

partnership income is curtailed for certain corporate partners with

taxation years ending after March 22, 2011, in respect of

partnerships with misaligned year ends. As a result:

- the corporate partner must accrue a notional income amount from the partnership for the portion of the partnership's incomplete fiscal period that falls within the corporation's taxation year;

- the corporate partner should consider requesting permission to

change either:

- the fiscal year end of the partnership to coincide with that of the corporate partner; or

- its taxation year end; and

- the corporate partner should determine whether a reserve

continues to be available in respect of additional income reported

on the transition to the new rules.

- Joint venture deferral – If you have a

corporate participant in a joint venture arrangement, be aware that

the CRA's administrative policy no longer allows joint venture

arrangements to report income using a separate fiscal period. As a

result:

- the corporate participant must report its actual share of joint venture income or loss up to the end of its own yearend for tax years ending after March 22, 2011, and in certain cases can claim a transitional reserve for the additional income included in that year; and

- the corporate participant should consider:

- making the accounting period used for the joint venture align more closely with the year ends of the corporate participants;

- requesting permission to change its taxation year end to align with the joint venture's reporting period; or

- converting the joint venture arrangement into a

partnership.

- See our Tax memo "Joint

Ventures—CRA ends policy allowing separate fiscal periods:

How will this affect your company? (Updated March 23,

2012)."

- Hiring credit for small business – Claim this credit of up to $1,000 in 2012 if your business's 2011 employment insurance (EI) premiums were $10,000 or less and increased in 2012.

- Avoidance transactions – Be aware that:

-

- draft legislation makes an "avoidance transaction" meeting certain conditions a "reportable transaction" that must be reported to the CRA, generally for transactions entered into after 2010 and those that are part of a series of transactions completed after 2010. The draft legislation was re-released on October 24, 2012. Contact your PwC adviser to discuss changes to these rules.

- Quebec requires disclosure of certain aggressive tax planning transactions. See our Tax memo "Quebec's Regime for Aggressive Tax Planning: Prescribed Form Released."

- Depreciable assets

-

- Accelerate purchases of depreciable assets. Ensure assets are available for use at year end.

- Purchase eligible M&P machinery and equipment. The CCA deduction is enhanced from 30% declining balance to 50% straight-line, for purchases made before 2014.

- Consider making a special election to treat leased fixed assets as purchased under a financing arrangement.

- Reserves – Identify and claim reserves for doubtful accounts receivable or inventory obsolescence.

- Business income reserve – If you sold goods or real property inventory in 2012 and proceeds are receivable after the end of the year, you may be able to defer tax on related profits by claiming a reserve over a maximum of three years.

- Dispositions – Defer, until after year end, planned dispositions that will result in income.

- Accounting method – Consider changing the corporation's method of accounting in respect of the timing of income inclusions. This may require the Minister's approval. Alternatively, consider using a different method for tax than for accounting purposes, if permitted for tax purposes. For example, for construction projects, if the percentage of completion method is used for accounting purposes, use the completed contract method for tax purposes to provide a tax deferral.

- Costs of doing business – Compare costs of doing business in different jurisdictions.

- Intercompany charges

-

- Ensure charges are reasonable given changes in the economy.

- Consider adjustments to intercompany charges to reduce overall taxes paid by the related group. For example, charge reasonable mark-ups for services provided by related corporations.

- Capital gains reserve – If you sold or will sell capital property in 2012 in exchange for debt, you may be able to defer tax on part of the capital gain by claiming a capital gains reserve over a maximum of four years.

- Foreign exchange – Consider triggering a foreign exchange loss that is on account of capital before year end to offset capital gains in the current year or previous three.

- Individual pension plans (IPPs) – If you have (or will) set up an IPP, be aware that certain advantages have been eliminated (e.g., minimum withdrawal requirements will apply to IPP members over 71, starting 2012, and new rules apply for funding past service contributions after March 22, 2011).

- Shareholder loans to your corporation – Determine whether your corporation would benefit from deductible interest on shareholder loans made to the corporation, to reduce active business income to the $500,000 threshold ($400,000 in Manitoba and Nova Scotia).

- Shareholder loans from your corporation – Repay shareholder loans from your corporation no later than one tax year after the amount is borrowed (exceptions apply).

- Taxable capital – If your company's taxable capital for federal tax purposes exceeds certain limits, on an associated group basis, your company will start losing access to the small business deduction and the enhanced 35% SR&ED ITC rate. Monitor your taxable capital and discuss with your PwC adviser ways to reduce taxable capital before your company's year end.

- Protect your investment in your business assets – Consider:

-

- transferring assets (e.g., real estate and intellectual property) from an operating company to a separate company on a tax-deferred basis; and

- arranging to secure a loan from a shareholder.

- Capital gains rollover – If you sold or will sell eligible small business corporation shares in 2012, invest the proceeds in other eligible small business corporation shares by April 30, 2013, to be eligible to defer all or part of the capital gain. (Applies to individuals only.)

- Exemption for qualified small business corporation shares

-

- Structure the business so that corporate shares become or remain eligible for the $750,000 capital gains exemption.

- Consider crystallizing the capital gains exemption and/or restructuring to multiply access to the $750,000 capital gains exemption with other family members.

- A cumulative net investment loss (CNIL) may reduce your ability to use your remaining capital gains exemption. To reduce or eliminate any CNIL, consider receiving dividends and interest income, instead of salary, from your company.

- SR&ED – Ensure claims in respect of SR&ED expenditures or ITCs are filed by the deadline, which is 18 months after the corporation's year end. Make SR&ED expenditures before significant changes to the federal ITC program become effective. Changes:

-

- reduce the 20% SR&ED ITC rate to 15% for taxation years ending after 2013 (pro-rated for taxation years straddling January 1, 2014);

- provide that capital property acquired, generally after 2013, is neither deductible as an SR&ED expenditure nor eligible for ITCs;

- reduce the overhead proxy rate from 65% to 60% for 2013 and to 55% after 2013; and

- allow only 80% of SR&ED contract payments (net of SR&ED capital expenditures) to an arm's length contractor, incurred after 2012, to be eligible for ITCs.

- See our Developments "Legislative proposals confirm SR&ED changes."

-

- If you are a partnership that includes a corporation, be aware that your deadline for filing an SR&ED claim for work done in that partnership may, in certain situations, have been reduced by up to 13 months. Ensure that you file your SR&ED claim on time.

- GST/HST

- Ensure that GST/HST has been correctly collected and remitted on taxable supplies and that input tax credits have been claimed on eligible expenses throughout the year.

- GST/HST electronic filing requirement – To avoid penalties, file your company's GST/HST returns electronically if certain criteria are met (e.g., annual taxable supplies on an associated basis exceed $1.5 million).

- Recaptured input tax credits – Determine if your business is required to report recaptured input tax credits; this generally applies to large businesses, including financial institutions.

- British Columbia – Be aware that on April 1, 2013, the

province's HST will be replaced with a sales tax regime similar

to the one that applied before July 1, 2010 (i.e., 7% provincial

sales tax (PST) and 5% federal GST). Businesses subject to British

Columbia's HST may have to:

- review all systems (accounting, point of sale, etc.);

- consider if the return to the PST will affect consumer purchasing decisions before the reinstatement date;

- consider the effect of the PST on capital expenditures and purchasing; and

- review significant contracts to ensure contract clauses will

address the cost and/or reimbursement of PST on significant

projects.

- See our Tax memos:

- "B.C. votes to extinguish HST";

- "Eliminating the HST in British Columbia: Canada's Department of Finance proposes transitional rules";

- "Re-implementation of British Columbia Provincial Sales Tax: Transitional rules"; and

- "Returning to B.C.'s Provincial Sales Tax: Transitional rules for new housing."

- Nova Scotia – Be aware that Nova Scotia will reduce its HST rate from 15% to 14% by July 1, 2014, and to 13% by July 1, 2015 (i.e., the provincial portion of the HST will decrease from 10% to 9% and to 8%, respectively.) Consider deferring large purchases for which input tax credits might not be recoverable to after July 1, 2015.

- Prince Edward Island – Set up a transition team, if necessary, to prepare for the 14% HST (i.e., 9% provincial component plus the 5% federal GST) that will replace the combined PST/GST rate of 15.5% (i.e., 10% PST, which applies on the 5% GST) on April 1, 2013. In addition:

-

- evaluate the impact of the HST on costing and pricing;

- assess the tax effect related to inter-provincial sales, central purchasing and importing goods;

- review all contracts and agreements that straddle April 1, 2013, and all contracts with one- to two-year terms that will be entered into or renewed, to consider the effect of harmonization on these contracts; and

- review the timing of planned expenditures and capital acquisitions, and plan appropriate strategies to either accelerate or defer large purchases.

- QST

-

- Be aware that the QST will be further harmonized with the GST

on January 1, 2013, with an effective harmonized rate of 14.975%.

(The QST rate will increase to 9.975% and will be calculated

exclusive of the 5% GST). Businesses should:

- review all systems (accounting, point of sale, etc.) to determine if they can account for the three decimal points; and

- be aware that financial services will be QST exempt instead of

zero-rated. Because financial institutions will be affected

significantly, they must address the various changes that will

apply.

- See our Tax memo "QST to be harmonized with GST by 2013."

- Restricted input tax refund – Determine if your business

is required to restrict input tax refunds; this generally applies

to large businesses, including financial institutions.

- Be aware that the QST will be further harmonized with the GST

on January 1, 2013, with an effective harmonized rate of 14.975%.

(The QST rate will increase to 9.975% and will be calculated

exclusive of the 5% GST). Businesses should:

- GST/HST and QST – Determine if the following common GST/HST and QST traps apply to your business:

-

- Management/intercompany fees – Ensure that GST/HST and/or QST is charged on management and inter-company fees within your corporate group. Determine if it is possible to make a special election to avoid having to charge GST/HST and/or QST.

- Place of supply rules – If your company sells to different Canadian jurisdictions, understand the provincial place of supply rules to ensure that your company is collecting the correct rate of tax.

- Input tax credit documentation – Ensure that your company has obtained the required written documentation to support input tax credit claims. You can check the CRA (or Revenue Quebec) website to verify the GST/HST (or QST) registration number of the supplier from which you made the purchase.

- Taxable benefits – Determine if your company is required

to remit GST/HST and/or QST on amounts reported as taxable benefits

for employees.

Also, see our article "GST/Harmonized Sales Tax (HST) trips and traps for privately owned businesses" in Wealth and tax matters (2012 – Issue 2).

- Property tax

-

- To challenge the company's property tax bill, appeal the property value assessment, which generally is mailed early in the year. Filing deadlines vary by province or territory, are compulsory and usually fall before the property tax bill is mailed.

- Ontario

- Be aware that all property owners will receive a property assessment notice in 2012 based on the property's value as of January 1, 2012. This notice is used to calculate property taxes for the 2013 to 2016 tax years. A company can appeal its 2012 property assessment (used for the 2013 tax bill) by March 31, 2013. On appeal, the onus is on the assessment agency to prove that the assessed value is correct.

- A company that has a vacancy in a commercial or industrial facility in 2012 may be able to claim a tax refund by filing a request to the municipality by February 28, 2013. Filing for this rebate is the owner's responsibility.

- Verify your company's property tax rate classification

(i.e., industrial, commercial). Using the correct tax rate may

reduce property taxes.

- Discuss with your PwC adviser ways to reduce municipal property

tax.

- Environmental incentives – Be aware of

federal and provincial environmental incentives that can help your

company go green and save money. See our Going Green Tables

(2011). Recent enhancements that apply to assets acquired

generally after March 28, 2012:

- expand the types of waste-fuelled thermal energy equipment that qualify for the 50% declining CCA rate; and

- allow equipment using eligible waste fuels to qualify for the

30% or 50% declining CCA rate only if the applicable environmental

laws and regulations were complied with when the equipment first

became available for use.

- Provincial or territorial tax incentives

– Benefit from provincial or territorial tax incentives and

enhancements to these incentives. For example, determine whether

your company qualifies for:

- Manufacturing and processing (M&P) investment tax credits – available in Manitoba, Nova Scotia, Prince Edward Island, Quebec (includes a proposed refundable credit for certification expenses to commercialize products outside Quebec) and Saskatchewan.

- SR&ED tax credits – available in all provinces (except Prince Edward Island) and the Yukon. Enhanced in Alberta for taxation years ending after March 31, 2012, and revised in Saskatchewan for R&D expenditures incurred after March 31, 2012.

- Media tax incentives – modified in British Columbia (film and digital media) and Quebec (multimedia titles), enhanced in Manitoba (film), new programs in New Brunswick (multimedia initiative effectively replaces the film tax credit, and digital media development program introduced), but Saskatchewan's refundable film tax credit ends and may be replaced by a non-refundable film tax credit.

- British Columbia training tax credits – extended three years to December 31, 2014, and now available for employers with apprentices in the shipbuilding and ship repair industry.

- British Columbia book publishing tax credits – extended five years to March 31, 2017.

- Manitoba data processing investment tax credit – new refundable tax credit (equal to 4% of buildings and 7% for machinery and equipment) for corporations that purchase or lease new qualified property for use in a data processing centre in Manitoba after April 17, 2012, and before 2016.

- Manitoba co-op education and apprenticeship tax credit – the Apprentice Hiring Incentive and Journeypersons Hiring Incentive are enhanced after 2012.

- Quebec tourism tax credit – proposed 25% refundable tax credit (annual maximum of $175,000) can be claimed for renovating or improving tourist accommodations outside Montreal and Quebec City before 2016.

- Saskatchewan corporate income tax rebate on new rental housing – new 10-year rebate equal to 10% of the rental income from newly constructed multiunit rental projects that are available for rent before 2017, and registered under a building permit dated after March 20, 2012, and before January 1, 2014; the rebate does not apply to rental income that is subject to the small business rate.

To read this Planner in full, please click here.

Footnote

1. However, depending on the jurisdiction of residence, paying non-taxable capital dividends should be inserted as the second or third preference.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.