1 The regular rate is 15% but a 10% surcharge is applicable to taxable profits exceeding BRL 240,000 per year (approximately USD 130,000 - estimated exchange rate: BRL 1.80 for each USD 1.00). The 9% (or 15%) Social Contribution on Net Profit (CSLL) is also levied on corporate profits.

2 See Section 1.1.2.3.

3 The applicable rate to financial institutions and insurance companies is 15%.

4 Tax losses offsetting shall not reduce taxable profits in more than 30% in any given period.

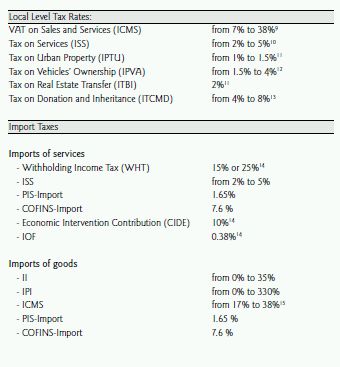

5 The tax rate varies according to the tax classification number and, in general, the bottom rate is applicable to food and medicine meanwhile the top rate is applicable to superfluous products, such as cigarettes.

6 Pharmaceutical, automotive, beverage, tobacco and fuel industries, among others, are subject to specific taxation regimes.

7 Financial institutions and insurance companies are subject to a 4% rate of COFINS.

8 Provisory Contribution on Financial Transactions (CPMF) – a contribution that was levied (0.38%) on actual or virtual withdrawals from Brazilian bank accounts - was eliminated on December 31, 2007. To ensure the tax collection after the CPMF elimination, IOF rates were increased by 0.38% in several cases.

9 The tax rates vary according to the State and the type of good or service. We informed the lowest and the highest ICMS rates considering all Brazilian States.

10 The tax rate varies according to the Municipality and the type of service rendered.

11 The tax rate varies according to the Municipality. The tax rates mentioned apply to the city of São Paulo.

12 The tax rate varies according to the State. The tax rates mentioned apply to the State of São Paulo.

13 The tax rate varies according to the State, subject to a maximum rate of 8%. In the State of São Paulo, a 4% rate applies.

14 WHT rate is 15% if the service is technical or 25% if not. CIDE is only charged in case of technical service. IOF is levied on the amount of the foreign currency exchange agreement.

15 The ICMS rates generally applicable on imports vary according to the State where the importer is established and the goods imported.

Additional Remarks

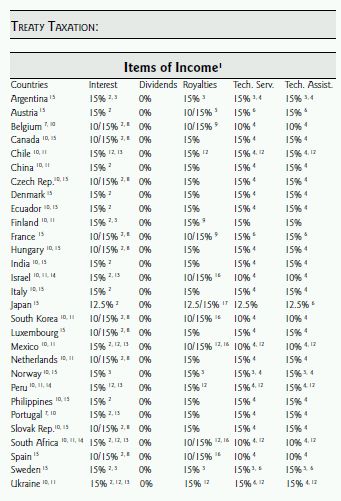

Brazil has signed tax treaties with the following countries which have not been ratified yet and, therefore, are not currently in force: Paraguay, Russia, Trinidad and Tobago and Venezuela.

In some specific cases, the tax treaties may not impose an actual reduction of the taxation nor provide for a more beneficial treatment in Brazil. By way of example, since payment of dividends by a Brazilian company is taxed at a zero rate according to Brazilian rules currently in force, the treaty provisions that limit the rate applicable to such payments in the source State do not produce any practical effect.

1 This table provides information about the applicable taxation on remittances of funds overseas from Brazil. When the domestic rate is lower than the rate applicable based on the relevant treaty, we informed only the local rate.

2 Exemption is granted if the beneficiary is the government of the other State, its political subdivisions or government owned entities.

3 There is no specific limitation in the treaty, thus the domestic tax rate applies.

4 Deemed as royalties according to the corresponding royalties article of the treaty or the treaty protocol.

5 The 10% rate applies to royalties arising from the use of, or the right to use, any copyright of literary, artistic or scientific work, but not including cinematographic films, films or tapes for television or radio broadcasting and the 15% rate applies to all other cases.

6 Deemed as royalties according to a local ordinance.

7 The treaty does not apply to the CSLL.

8 The 10% rate applies to loans that meet some conditions (e.g., minimum repayment terms).

9 The 10% rate applies to royalties arising from the use of, or the right to use, any copyright of literary, artistic or scientific work, including cinematographic films, films or tapes for television or radio broadcasting and the 15% rate applies to all other cases.

10 Such reductions are only applicable to the beneficial owner of the income.

11 The treaty applies to the CSLL.

12 Such reduction is not applicable if the main purpose or one of the main purposes of any party involved in the transaction from which the income arises is taking advantage of the treaty provisions.

13 Applies to interest on net equity.

14 A legal entity that is a resident of a Contracting State and derives income from sources within the other Contracting State will not be entitled in that other Contracting State to the benefits of the treaty if more than 50% of interest in such legal entity is held by persons who are not resident of the first-mentioned State or of any of the Contracting States. However, such limitation of benefits does not apply if that legal entity carries on a substantial business activity in the Contracting State of which it is resident.

15 It is possible to argue that the treaty applies to the CSLL. However, Brazilian tax authorities may not have the same understanding.

16 The 15% rate applies to royalties arising from the use, or right to use, trademarks and 10% for other cases.

17 The 15% rate applies to royalties arising from the use of, or right to use, trademarks and any copyright on cinematographic films, films or tapes for television or radio broadcasting. The 12.5% rate applies to all other cases.

Overview

1.Income Tax

1.1. General Aspects

1.1.1. IRPJ and CSLL Rates

The general statutory IRPJ rate for Brazilian entities (including Brazilian branches of foreign companies) is 15%. A surcharge of 10% is applicable for taxable income exceeding BRL 240,000 per year (approximately USD 130,0001) or BRL 20,000 per month (approximately USD 11,000) in case of base periods shorter than one year. CSLL is due at a 9% rate (except for financial institutions and insurance companies which are subject to a 15% rate).

1.1.2. Taxable Base

Brazilian legal entities may use one of the three following systems to calculate their taxable income: (a) the Actual Profit; (b) the Deemed Profit 2 or (c) the Arbitrated Profit 3. Since the most usual is the Actual Profit, the considerations below relate to this system. Generally speaking, the taxable income is based on the net profit reported in the company's financial statements (according to the Brazilian Generally Accepted Accounting Principles – "BR GAAP"), adjusted in accordance with the additions and exclusions set forth by the tax legislation.

Laws 11638/07 and 11941/09 introduced relevant changes in the BR GAAP, seeking the convergence of the Brazilian rules with international standards. Such rules have already been:

(i) considered in the latest instructions and opinions of the Brazilian Securities Exchange Commission ("CVM") and the National Accounting Committee ("Comitê de Pronunciamentos Contábeis" or "CPC"); and

(ii) regularly approved by the Brazilian Federal Accounting Council ("Conselho Federal de Contabilidade" or "CFC"), being, thus, applicable to all Brazilian companies.

As from 2010, all companies, regardless of the taxation regime adopted (Actual, Deemed or Arbitrated Profit system) must use the Transitory Tax Regime ("RTT"), established by Law 11 941 /09. Under this regime, the calculation of the IRPJ, CSLL, PIS and COFINS is made using the net profits ascertained according to the accounting rules in force on December 31 , 2007 (i.e., prior to the changes mentioned above).

A summary of the calculation of the IRPJ and the CSLL taxable basis could be illustrated as follows:

Net profit before IRPJ and CSLL

[+] Additions

[-] Exclusions

[=] Taxable income before tax losses offsetting

[-] Tax losses offsetting (up to 30% of the taxable income)

[=] Taxable income

[x] 15 % IRPJ rate

[x] 1 0% IRPJ surcharge (on taxable income exceeding BRL 240,000 per year)

[x] 9% or 15% CSLL rate

1.1.2.1 Deductions

As a general rule all costs and expenses paid (or accrued) for the performance of the company's activities/undertakings (necessary, normal or usual expenses) are tax deductible, even if related to excluded and/or exempted income. Some expenses, however, are subject to some deductibility requirements or limitations among which we highlight the following.

(A) Provisions: even if necessary for accounting purposes, they are not regarded as deductible expenses for IRPJ and CSLL purposes, except for those expressly authorized by law (e.g., vacations, 13th month salary and certain technical provisions).

(B) Fringe Benefits: fringe benefits paid to the companies' administrators, officers, managers and/or their assistants can be considered tax deductible expenses provided that the values are included in the taxable income of the corresponding beneficiaries, which shall be individually identified.

(C) Taxes: these expenses are deductible on accrual basis, except for: (i) taxes that are being discussed in Courts and (ii) the IRPJ and CSLL.

(D) Royalties: for deductibility purposes, payments must be done under agreements registered with the Central Bank of Brazil ("BACEN") and the Brazilian Patent and Trademark Office ("INPI"). Moreover, the sum of all royalties, technical assistance and other technology transfer payments due cannot exceed percentages varying from 1% to 5% of the net revenues derived from the sale of products manufactured or sold with the use of the relevant industrial property rights or technological knowledge. Technical assistance payments shall only be tax deductible for the first five years of operation of the relevant company or in the case of introduction of a special production process. Limits are not applicable to the CSLL.

(E) Bonus or Profit Sharing: if paid to officers is not tax deductible for IRPJ purposes; whereas, if paid to employees are fully tax deductible4.

(F) Depreciation: straight-line method must be used. The main rates acceptable by tax authorities are5:

Rates may vary depending on tax classification

Depreciation may be accelerated: (i) by use (16 hours of use: additional of 50% on the depreciation rate; 24 hours of use: additional of 100%); or (ii) by incentive (sometimes also applicable to the CSLL).

(G) Losses Resulting from the Equity Pick-up Method of Accounting: such expenses are non-deductible.

(H) Amortization of Premium ("ágio") paid for the acquisition of equity stakes in Brazilian companies (investments subject to the equity pick-up method of accounting): with the changes introduced in the BR GAAP, the amount of premium will probably be different from the one that should be registered in accordance with the accounting rules in force on December 31, 2007. Therefore, the rules that allow the earlier deduction of the premium (e.g., in case of merger of the invested company into the investor or vice-versa) must be carefully analyzed in order to determine its tax treatment. If the earlier deduction is not enjoyed, the premium paid (defined as the difference between the price paid and the equity value of the investment) will only be deductible at the time the investment is sold, disposed or written-off.

(I) Payments (of any kind) to beneficiaries domiciled in tax havens or under privileged tax regimes6: only deductible if the following cumulative requirements are complied with: (a) the beneficial owner of the foreign entity, who is entitled to the relevant payment, is identified (the beneficial owner is defined as the individual or legal entity that is not incorporated with the main or sole purpose of achieving a tax saving and that earns income in their own account, rather than as an agent, fiduciary manager or attorney-in-fact acting on behalf of a third party); (b) the operative ability of the non-resident to carry out the transaction is proved; and (c) any documental evidence of the payment of the price and the receipt of the goods, assets, rights or the use of the services is presented.

1.1.2.2. Exclusions (non-taxable income or income with deferred taxation)

(A) Profits arising from the sale of fixed assets: IRPJ and CSLL may be ascertained and paid on a cash basis in case the price is agreed to be paid, partially or entirely, after the termination of the tax base period following the one in which the sale was performed.

(B) Premium received in the issuance of shares or other kind of securities: exempt from taxation provided that the issuer is a corporation ("Sociedade Anônima") and that the amount received is registered in a special or capital reserve.

1.1.2.3. Tax Havens and Privileged Tax Regimes

Before 2009, the concept of "tax haven" only encompassed (i) a country or location that does not tax income or that taxes it at rates lower than 20%, and (ii) a country or location which ensures the secrecy regarding the shareholding structure or ownership of legal entities. Law 11727/08 broadened the concept of "tax haven" to reach, as from 2009, not only the countries and locations described above, but also any country or location whose legislation does not allow the identification of the actual beneficiary of the income paid or credited to a nonresident.

Normative Instruction 188 of the Federal Revenue Service, dated August 6, 2002, still in force, lists the countries or locations that must be considered tax havens, as follows: American Samoa, Andorra, Anguilla, Antigua and Barbuda, Aruba, Bahamas, Bahrain, Barbados, Belize, Bermuda, British Virgin Islands, Campione D'Italia, Cayman Islands, Channel Islands (Alderney, Jersey, Guernsey and Sark), Cook Islands, Costa Rica, Cyprus, Djibouti, Dominica, Gibraltar, Grenada, Hong Kong, Isle of Man, Lebanon, Lebuan, Liberia, Liechtenstein, Luxembourg (applicable only to holding companies governed by law dated 7/31/1929), Macau, Madeira Island, Maldives, Malta, Marshall Islands, Mauritius, Monaco, Montserrat, Nauru, Netherlands Antilles, Niue, Oman, Panama, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, San Marino, Seychelles, Singapore, Tonga, Turks and Caicos Islands, United Arab Emirates, US Virgin Islands, Vanuatu, Western Samoa.

Most Brazilian scholars consider it as an all inclusive list, i.e. only the countries or locations expressly mentioned therein should be considered "tax havens".

Law 11 727/08 also introduced the concept of "privileged tax regimes", which are those that meet one or more of the following requirements: (a) do not tax income or taxes it at rates lower than 20%; (b) grant tax advantages to non-residents without requiring the performance of substantial economic activities in the relevant jurisdiction or conditioned to the non-performance of substantial economic activities in the relevant jurisdiction; (c) do not tax the income earned outside the relevant territory, or tax it at rates lower than 20%; and/or (d) do not allow access to information about the shareholding structure of legal entities, ownership of assets and rights or economic transactions performed.

The concept of privileged tax regime is broad and gives room to a certain level of subjectivity in its analysis. The Federal Revenue Service is expected to issue a new black list describing the cases that fall under the new concept of tax havens and privileged tax regimes. Meanwhile, doubts may arise regarding the scope of such concepts.

1.1.2.4. Transfer Pricing Rules

Such rules apply to the following transactions, if carried out with related parties, parties domiciled in tax havens 6 or under a privileged tax regime 6:

- import or export of assets, goods, services and rights; and

- interest revenues or expenses arising from transactions not registered with the Central Bank of Brazil.

Transfer pricing rules do not apply to acquisitions or import transactions involving royalties and the remuneration for the transfer of technological know-how (the Federal Revenue Service has extended such exemption to their exports).

Brazilian tax law adopts a mathematical approach when describing the methods to calculate the transfer pricing benchmarks and, although the domestic transfer pricing rules are inspired by the OECD guidelines, there are relevant differences which must be considered.

The most relevant relates to the concept of related parties, which is broader than the concept of associated enterprises used by the OECD and includes not only the transactions between the legal entity and its branches; headquarters; controlled companies; controlling shareholders; managers and their relatives, but also the transactions with (among others):

- affiliated companies, as defined by Law 6404/76 (Corporation Law);

- companies that participate with the legal entity in a joint enterprise, under a "consortium" or "condominium";

- foreign legal entities that grant to the Brazilian legal entity (as their agent, distributor or dealer), exclusive rights to buy or sell assets/goods/services/rights; and

- foreign agents, distributors or dealers of the Brazilian legal entity, to whom the latter has granted exclusive rights to buy or sell assets/goods/services/rights.

1.1.2.5. Thin Capitalization Rules

Such rules apply to: (i) interest paid to related parties (as defined by transfer pricing rules) or beneficiaries domiciled in tax havens 6, (ii) transactions under privileged tax regimes 6, (iii) transactions whose guarantor, trustee, attorney-in-fact or any other intervening party is a related party, a resident in a tax haven or a party subject to a privileged tax regime.

The interest paid or credited to foreign related parties shall only be tax deductible (IRPJ and CSLL) if, concurrently:

- the relevant debt of the Brazilian legal entity, on the interest accrual date, does not exceed twice the net worth value of the related party's investment in the Brazilian legal entity (individual limit); and

- the total debt of the Brazilian legal entity, on the interest accrual date, does not exceed twice the total net worth value of all investments of related parties in the Brazilian legal entity (collective limit).

The interest paid or credited to residents in tax havens or arising from transactions carried out under a privileged tax regime shall only be tax deductible if, concurrently:

- the relevant debt of the Brazilian legal entity does not exceed 30% of its net worth (individual limit); and

- the total debt of the Brazilian legal entity with residents in tax havens or arising from transactions carried out under privileged tax regimes, does not exceed 30% of the Brazilian legal entity's net worth (collective limit).

Thin cap rules is to be further regulated by the Federal Revenue Service and have already raised several doubts about its scope.

1.1.2.6. Profits and Other Revenues Earned Abroad

The IRPJ and the CSLL are levied on the worldwide income, which means that Brazilian companies must also consider, when calculating such taxes, the capital gains and profits arising from Brazilian investments abroad, including profits of branches, affiliate or controlled companies abroad. Such income must be taxed on December 31 of the year when they are accrued and, in the case of profits from the investment in foreign branches, controlled or affiliate companies, according to the balance sheet of the invested legal entity. Exchange variations must be studied on a case-by-case basis.

Losses from Brazilian investments abroad cannot be offset against local profits, but they can be offset against foreign profits derived from the same investment. The legality of the taxation of profits of foreign legal entities is being discussed before the Brazilian Supreme Court, based on some articles of the Federal Constitution and the Brazilian Tax Code. However, a final decision on this matter has not been granted yet. It is important to note that if the investment is made in a country with which Brazil has signed a treaty to avoid double taxation, its provisions must be analyzed to determine the tax treatment of such income in Brazil.

1.1.2.7. Foreign Tax Relief

Taxes paid abroad on profits of foreign subsidiaries or branches, which are included in the taxable basis of IRPJ and CSLL, can be offset against IRPJ and CSLL due (limits must be observed).

1.1.2.8. Tax Losses Carry-forward / Carry-back

Tax losses can be carried forward without any statute of limitations, provided that the offsetting does not exceed 30% of the taxable basis ("actual profit") of any given period. No carry-back is allowed.

Non-operating tax losses (i.e., negative results from the disposition of permanent assets) may be offset only against non-operating profits, except in the tax base period when the non-operating tax losses accrue (such losses are subject to the 30% limit mentioned above).

A restriction to the tax losses offsetting is imposed in case of change of control and business activities. Accordingly, a company cannot offset its tax losses if from the date of the accrual of such losses to the date of their offsetting, a change in the control of the company and in the company's business activities occur concurrently. In case of a spin-off, the company's tax losses forfeit proportionally to the spun-off part of its net worth. In the case of merger, the merged company's tax losses cannot be offset against the profits of the company in which was merged.

1.1.2.9. Dividends and Capital Reductions

Distribution of profits/dividends arising as of January 1, 1996 is exempt from income tax, regardless of the beneficiary of the income (individual or legal entity, resident or nonresident). The capital increase with profits arising prior to that date is exempt but subsequent capital reductions can be taxable according to specific provisions. Capital refunds in assets are allowed either at book or market values. In the latter case, the difference between the market value and the book value shall be considered as a taxable capital gain for the invested company, rather than for the recipient shareholder (individual or legal entity).

1.2. Payment and Filing

Under the "Actual Profit", the IRPJ and the CSLL may be quarterly or annually calculated (according to the taxpayer's option) 7.

Taxpayers that calculate their corporate taxes quarterly must pay such taxes up to the last business day of the month following the end of each quarter.

Taxpayers that calculate their corporate taxes annually must make advance monthly payments until the last business day of the month following that on which the taxable event occurs. Such advance payments are calculated on either the actual or estimated income 8, whichever is lower (at the option of the taxpayer). The difference between the IRPJ and the CSLL calculated on the annual tax return and the advance payments must be paid up to the last day working day of January or March following the end of the fiscal year, increased, in the last case, by legal interest as from February 1 or, if negative, can be offset against taxes due by the taxpayer as from January 1.

In general, the Corporate Income Tax Return must be filed up to the last business day of June following the end of the fiscal year (Brazilian fiscal year coincides with the calendar year).

1.3. Penalties for Unpaid Tax or Tax Paid Belatedly

Unpaid taxes or taxes paid belatedly are charged with interest calculated by an index, known as SELIC ("Sistema Especial de Liquidação e Custódia" – Special System for the Settlement and Custody). For 2009, the SELIC corresponded to 9.5%.

Fines are also imposed on the principal. At the federal level, the following fines apply: (a) delayed payments: daily 0.33% up to a maximum of 20%; (b) tax assessments: 75% (general rule), 112.50% (cases in which the taxpayer does not present documentation if requested by the tax authorities), 150% (clear evidences of fraud) and 225% (fraud and refusal by the taxpayer to collaborate with the tax authorities). Discounts can be granted if the payment is made within certain deadlines.

1.4. Cross-border Payments

1.4.1. Withholding Tax (WHT)

The WHT is levied on the income earned by non-residents from a Brazilian source (income paid, transferred, credited, delivered or otherwise made available to a non-resident).

1.4.1.1. Dividends

Remittances of dividends arising from profits generated as of January 1, 1996 are not subject to WHT, regardless if the beneficiary is an individual or legal entity, resident or non-resident.

1.4.1.2. Royalties, Technical Assistance and Technical / Administrative Services

Such remittances are subject to a general 15% WHT (other taxes are levied on such remittances as shown in the Highlights above – Imports of Services). Such 15% rate may be reduced by applicable provisions of Double Taxation Treaties. A higher 25% rate is applicable to remittances made to tax havens. According to local legislation, technical service is any work which execution depends on specialized professional knowledge, regardless any technology transfer.

1.4.1.3. Other Services

Remittances for services not qualified as technical services or not included in the previous item are subject to a 25% WHT (other taxes are levied on such remittances as shown in the Highlights above – Imports of Services).

1.4.1.4. Interest

Payments of interest on foreign loans are generally subject to a 15% WHT (such rate may be reduced by applicable provisions of Double Taxation Treaties). A higher 25% rate is applicable to remittances made to tax havens.

1.4.1.5. Capital Gains

Capital gains are subject to a 15% WHT (rate is increased to 25% if the seller is domiciled in a "tax haven"). Until Law 10833/03 was passed, capital gains deriving from the sale of a Brazilian asset closed between two non-residents were not subject to taxation. However, article 26 of this law provides that the attorney-in-fact of the non-resident buyer is responsible for the payment of the income tax on the capital gains earned by the non-resident seller, thus raising controversies regarding this matter. 1.4.1.6. Tax Treaties Treaties to avoid double taxation generally limit the WHT on certain remittances to 15 %.

2. Other Taxes

2.1. Excise Tax (IPI)

IPI is a federal tax charged on the import or shipment of goods imported or manufactured. The law defines that, for IPI purposes, manufacturing is the process which modifies the nature, functioning, finishing, presentation or purpose of a product or that improves a product for consumption, such as its conversion, improvement, assembly, packaging, repackaging or restoration.

The taxable basis on imports is the cost, insurance and freight (CIF) price (in compliance with customs valuation rules), plus custom duties. The taxable basis on the shipment of goods in the domestic market is the value of the relevant transaction, as provided by the law.

The transactions between related parties are subject to a minimum taxable basis defined by law. IPI rates vary according to the essentiality of the good (pharmaceutical products, for instance, are subject to zero rates, whereas sumptuous or superfluous articles can be taxed by rates of up to 33 0%) and its classification under the IPI Table of Rates ("TIPI"), which adopts the same nomenclature used in the Mercosur Common Nomenclature / Harmonized System ("NCM/SH"). IPI rates generally range from 5% to 30%.

IPI is a value added tax, calculated by netting of credits for imports and domestic purchases, and debits from taxable transactions. Exports are not taxed by IPI, but the exporters have the right to keep the related tax credit. The purchase of fixed assets does not imply the appropriation of IPI credit.

2.2. VAT on Sales and Services (ICMS)

ICMS is a state tax levied on:

(A) imports of goods;

(B) domestic circulation of goods (note that the tax triggering event is the shipment of the goods instead of the closing of sales or other taxable transactions);

(C) inter-municipal or interstate transport services (including services originating from abroad); and

(D) communication services (including services originating from abroad).

Exports of goods and services and financial transactions with gold (financial asset) are not subject to ICMS. Export exemptions shall not impair the taxpayers' ICMS credit rights, as provided by the Constitution.

Transportation services rendered within the territory of the same municipality are not subject to ICMS, but rather to the ISS. ICMS can be levied on services rendered with the sale of goods, if such services are not reached by the competence of the municipalities to charge the ISS.

Generally, ICMS taxable basis are:

(A) for imports of goods: the CIF price, plus II, IPI, PIS/COFINS and ICMS (which must be included in its own taxable basis);

(B) for the circulation of goods: the sales price or value of other taxable transactions, as provided by the law, including PIS and COFINS (IPI shall not be included in the ICMS taxable basis in case of goods for resale or manufacturing inputs; IPI must be included in ICMS taxable basis on transactions with end customers);

(C) for transportation and communication services: the remuneration charged by the service provider, plus ICMS, PIS and COFINS (which must be included in its own taxable basis).

Applicable rates on imports, circulation of goods within the territory of the same State and interstate transactions whenever the recipient is not an ICMS taxpayer vary from state to state.

Generally ICMS rates are:

(A) 1 7% (North, Northeast and Middle West states), 18% (South and Southeast states) on imports and circulation of goods within the territory of the same State and interstate transactions whenever the recipient is not an ICMS taxpayer;

(B) 25 % on communication services; and

(C) 12 % on transportation services.

According to the Brazilian Constitution, a Senate resolution shall provide for interstate rates on transactions executed between ICMS taxpayers. Currently, such rates are:

(A) 7% on shipments from taxpayers based on the South/Southeast to taxpayers based in the North/Northeast/Middle West and state of Espírito Santo; and

(B) 12% on other interstate transactions.

In case of imports of goods, ICMS shall be paid to the state where the importer is based.

Disputes among States arise when the recipient is not the ultimate importer.

Regarding the circulation of goods, the tax shall be paid to the state of origin of the goods, as a general rule, except for interstate transactions with petroleum, liquid gas and energy. In case of transportation services, ICMS shall be paid to the state where the service starts, irrespective of the place where contractors and service providers are based.

In case of communication services, ICMS shall be paid to the state: (i) where the user is domiciled, when the service is rendered through satellite; (ii) where the service is charged; or (iii) where the service provider is based, in case the service is pre-paid by card or similar.

ICMS has also been designed based on the principle that the overall tax burden shall be the same, irrespectively of where the goods are produced or the services are performed. For this reason, in case of interstate transactions with fixed assets and goods for own consumption between ICMS taxpayers, the recipient of the goods must pay the ICMS for the state of destination on the value of the transaction at a rate corresponding to the difference between the internal rate and the interstate rate.

ICMS is a value added tax. Hence, taxpayers shall book (i) credits for the ICMS paid on imports or passed on to the price of goods and services and (ii) debts for sales or other taxable transactions. Generally, the tax related to the domestic circulation of goods and services to be periodically collected shall be calculated by netting credits and debts.

Generally, taxpayers cannot book ICMS credits for exempt or non-taxable operations and services and will cancel ICMS tax credits in the case of subsequent exempt or non-taxable operations.

Currently, several transactions are subject to ICMS tax substitution rules. This system consists in the collection of the ICMS by certain participants in the supply chain, determined by law, that shall calculate and pay the tax due in former or subsequent transactions with the goods.

In general, the manufacturers and importers are subject to the tax substitution system. They shall pay the ICMS levied on their own operations, as well as the tax levied on subsequent taxable operations within the State until the product is delivered to the end consumer (ICMS due by tax substitution).

In case of interstate sales, if the state where the supplier/taxpayer is based does not impose the tax substitution system, the company's establishments based in said State only shall pay the tax levied on their own operations (interstate circulation of products).

As determined by Supplementary Law 87/96, in general, the State of destination, where this system is applicable, charges the ICMS-ST (for subsequent taxable transactions carried out within the State until the product is delivered to end consumers) from the purchaser upon the arrival of the goods in its territory.

ICMS incentives and benefits can only be granted by Conventions signed by all federal states to avoid a tax war between different states. Several Brazilian states, aiming at attracting new investments, grant ICMS incentives, such as ICMS refunds, deemed credits, tax exemptions, without such approval.

Parties interested in such incentives shall consider related risks, as the states that receive services or goods from the states that granted the incentives irregularly may challenge the benefit, by means of, for instance, refusing to grant tax credits for the relevant transaction. Because this subject is a source of several disputes, it is being discussed in the proposals under analysis for the Brazilian tax reform.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.