For the last 5 years, general partner (GP)-led secondary transactions have been continually singled out as the transactions to watch in the secondary space. They represented about 30% of total secondaries deal volume in 2019,1 and industry experts only expect this figure to grow.

But despite becoming more mainstream, GP-led transactions still remain particularly complicated transactions, requiring significant amounts of time and attention from GPs and investors. Although the premise is simple – offer investor liquidity while preserving investment upside – hitting the winning formula still requires careful planning and attention.

This article follows our initial piece on secondary transactions (available here) in a series that explores developing trends in the private funds industry and explores the growing attraction towards secondary transactions.

A BRIEF HISTORY

Historically reserved for "zombie-funds" that could not realise their final investments, GP-led transactions were seen as a way for GPs to "rebrand and reset" their ailing funds. Unrealisable assets were transferred to new funds with updated terms and objectives, in the hope an influx of fresh capital would revitalise the fund.

These early transactions were (perhaps rightfully) met by investors with hesitation and reservation, as their benefits were not immediately visible. If an asset could not be realised through traditional means (eg third party sale, IPO or otherwise), why should investors be asked to warehouse it in a new fund for a potentially indefinite period?

Although it is easy to dismiss the attraction of these transactions when they relate to undesirable portfolios, they suddenly become an inviting proposal when the concept is applied to well-performing assets. They can be structured to simultaneously allow electing investors to exit their positions (by having a secondary buyer underwrite the transaction), while retaining future upside for these assets in a new fund to be managed by the same GP. Over time, some of the industry's most established GPs have seen the merit of these transactions and are now using them as important tools in their fund-management strategies.

More recently, in April 2019 the Institutional Limited Partners Association (ILPA) published guidance setting out considerations for GPs and investors with the goal of establishing best-practices in the space.2 The guidelines were generally well-received by the industry as they sought to regroup the common issues experienced by investors presented with GP-led transactions and we remain hopeful they will serve as an important reference point for the industry.

EXAMPLE TRANSACTIONS

There is no one-size-fits-all GP-led transaction – each is carefully tailored to the underlying assets, investors and GP's specific goals, but they will generally involve (i) investors electing to participate (or not participate) in the transaction, and (ii) a secondary buyer underwriting the transaction and any corresponding purchase price.

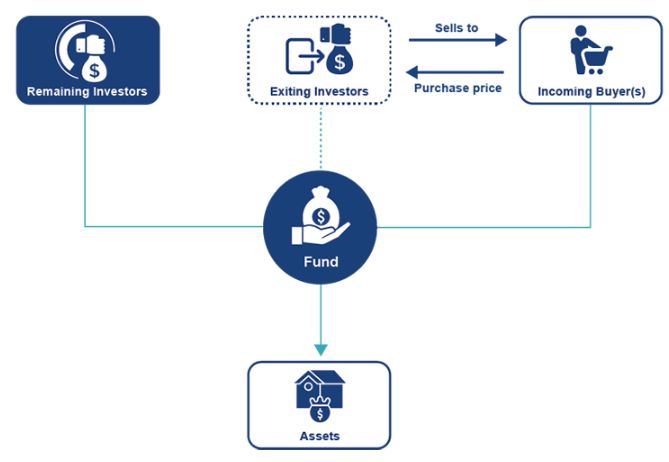

Liquidity Opportunities

Liquidity opportunities involve a secondary buyer offering to purchase fund interests from existing investors in a fund. This generally coincides with an increase to the fund's term and a "reset" of the fund's economics (eg new carry arrangements and/or reduced/no management fee), to re-incentivise the GP's goals in respect of the underlying portfolio. A reset of the economics is particular important if the fund is "out of the carry" and unlikely to create profit for the GP since the updated economics will re-align the GP's interests. The offer is usually made at a pre-determined price or set through a auction process, but the sale terms are not typically negotiated as between selling investors and the buyer.

Participating investors can exit their position in the fund instead of waiting several years for its wind up whereas non-participating investors can remain invested in the fund (thereby retaining the status quo).

Notable transactions involve Ardian's tender offers to Bridgepoint's 2005 and 20083-vintage funds and Lexington's tender offer for BC Partner's 2011-vintage fund.4

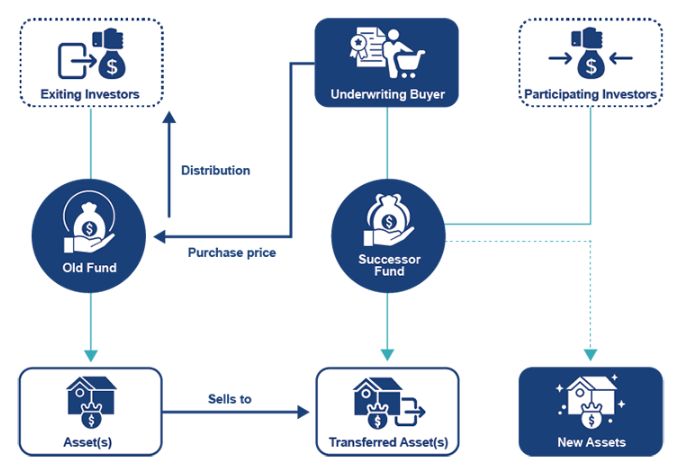

Fund Restructures

Fund restructures involve the transfer of portfolio companies by a mature fund to a successor fund raised by the same GP. Participating investors can elect to "rollover" into the successor fund, allowing them to continue to remain indirectly invested in the relevant portfolio companies, while also committing new capital. Non-participating investors can be "exited" from the mature fund through proceeds received from the transferred assets.

The purchase of the underlying assets by the successor fund is funded by capital raised from rolling investors and secondary buyer(s) who will underwrite the transaction. The continuing investors and underwriting buyer will usually commit additional capital to the successor fund (ie conduct a stapled primary).

As these transactions involve related-party dealings, investor approvals may be required depending on relevant fund terms. That said, GPs have been known to carefully structure these types of transactions to eliminate conflicts of interest (and the need for corresponding approvals) as best as possible.

Notable transactions include the establishment of Nordic Capital IX with seed assets from Nordic Capital VII, with the transaction being underwritten by Coller Capital and Goldman Sachs.5

Single-Asset Sale

A variation on "Fund Restructure" transactions, these transactions involve a cherry-picked asset being sold by one fund to another a fund managed by the same GP. Rather than being sold to a third party, this restructure option allows assets with anticipated upside to be retained by the GP and the new vehicle can concurrently raise additional capital for re-investment in the asset (or complementary assets).

Notable examples include TDR Capital's sale of Stonegate Pubs to Goldman and Landmark,6 Warburg Pincus's sale Allied Univesral to Alpinvest7 and Blackstone's sale of the Phoenix Tower International to Landmark.8

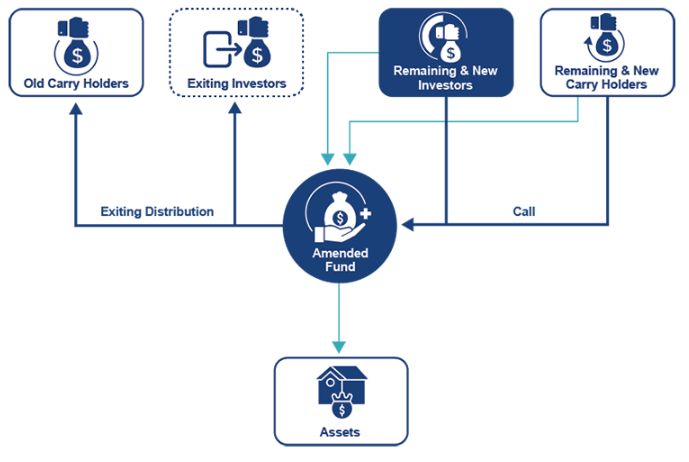

Fund Amendments

Fund amendments do not involve the establishment of a new vehicle, but rather amendments to a fund's existing terms (typically focusing on the economics) and a new fundraise to re-invest in existing assets or target new investments.

A liquidity opportunity may be presented to existing investors and carry holders, which can be funded out of a one-off capital call from continuing investors and carry holders.

This option is usually preferable compared to Fund Restructures for tax reasons, however as it will involve an amendment to fund terms, minimum investor approval will likely be required.

PREVAILING ISSUES

Despite the different types of transactions, common issues arise across all GP-led transactions since the competing tensions between the GP, investors and secondary buyer(s) largely remain the same across the board.

- Navigating conflicts

– The related-party aspect of these transactions will

necessarily create conflicts which needs to be adequately disclosed

to and potentially approved by investors. Actual investor approval

may be needed depending on the relevant fund terms and particular

attention is needed for:

- new carry / management fee incentives for the GP (particularly if they do not appear in fund terms but are in background documents between the GP and secondary buyer);

- any obligations to commit capital to other funds managed by the GP (ie stapled primaries);

- sale terms between related funds, including analysis on whether or not they are on arms' length terms; and

- necessary investor / advisory board / other investor-related consents that are required to implement the transaction.

- Keeping the status quo – A GP-led transaction should not give the GP a cart-blanche to restructure their fund at the cost of existing investors. Even if a restructure can be implemented without unanimous investor approval, no investor should be forced to participate in a restructure, and if an investor does not respond to a restructure process, they should not be put in a materially worse position by failing to respond. Accordingly a "status quo" option should be the default option available for investors to ensure they can continue to hold their investment without change. That said, there is a risk these "status quo" investors may find themselves the subject of lesser focus since the GPs may become overly focused on deploying the new commitments it has generated from the restructure (and which they may not have the benefit of).

- Valuation issues – Best practice will involve engaging a third-party valuer to assist in pricing the assets subject to the restructure. If a third party buyer has been invited to purchase / underwrite the interests directly from electing investors (ie in a Liquidity Opportunity), it is arguable the independent valuation will not be needed since it will be up to the buying and selling parties to consider what is a fair value in the circumstances.

- Relevant timeframes – When assets are valued on a regular (eg quarterly) basis, GPs and secondary buyers are incentived to impose short timeframes for investor election periods since there is a risk pricing could materially change following receipt of a new valuation. The market has trended towards a 20 business day election period (which is also noted in the ILPA Guidelines), but our experience shows this may not be sufficient for some institutional investors who are themselves subject to lengthy internal approval processes.

Regardless of the issues involved in any transaction, it is important for all parties to step back and consider its overall goals.

The best transactions should aim to be "win-win" for all parties, allowing exiting investors to reap a timely return, continuing investors and secondary buyers to benefit from future upside and the GP to realise additional economic incentives.

However in our experience, this is not always the case. It is exceptionally important to understand the motives and desired outcomes for the parties involved – particularly as these types of transactions become more and more prevalent.

Footnotes

1. https://link.secondariesinvestor.com/view/5c77aaba3f92a468448ddbbdbhxvs....

2. https://ilpa.org/gp-led-restructurings/

3. https://www.secondariesinvestor.com/ardian-back-bridgepoint-credit-fund-...

4. https://www.wsj.com/articles/lexington-seals-1-billion-secondary-deal-wi...

5. https://www.privateequityinternational.com/coller-confirms-nordic-capita...

6. https://www.secondariesinvestor.com/goldman-joins-landmark-in-tdr-pub-de...

7. https://www.secondariesinvestor.com/alpinvest-to-back-warburg-single-ass...

8. https://www.infrastructureinvestor.com/landmark-to-lead-blackstone-phoen...

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.