The International Chamber of Commerce (ICC) has developed a set of international commercial terms (Incoterms) to be used as an international standard for the delivery of goods internationally. If you are a business that enters into international contracts to buy or sell goods, you should consider whether or not using these terms in your contract can be beneficial. In this article, we explain what Incoterms are and how you can use them in international commerce.

What Are Incoterms?

Incoterms are commonly used in contracts for the sale and purchase of goods internationally. Generally, they set out the obligations, risks and costs for both sides of a transaction at various delivery stages. These obligations and costs vary according to what terms you use.

Incoterms also address other factors such as:

- who pays the costs of transportation for each segment;

- who bears the risk of loss throughout the delivery process;

- insurance matters;

- terminal handling costs; and

- security-related clearances.

Incoterms are not compulsory trade requirements. Rather, they are standardised concepts to ease the transfer of goods across borders. On 1 January 2020, the Incoterms® 2020 came into effect, updating the 2010 version. In particular, the previous Delivered at Terminal (DAT) rules have been renamed Delivered at Place Unloaded (DPU).

List of Incoterms

You can use the following terms from the current version of Incoterms ( Incoterms® 2020) for sea or waterway transportation:

- FAS – free alongside ship;

- FOB – free on board;

- CFR – cost and freight; and

- CIF – cost insurance and freight.

You can use the following Incoterms for any mode of delivery:

- EXW – ex works;

- FCA – free carrier;

- CPT – carriage paid to;

- CIP – carriage and insurance paid to;

- DAP – delivered at place;

- DPU – delivered at place unloaded; and

- DDP – delivered duty paid.

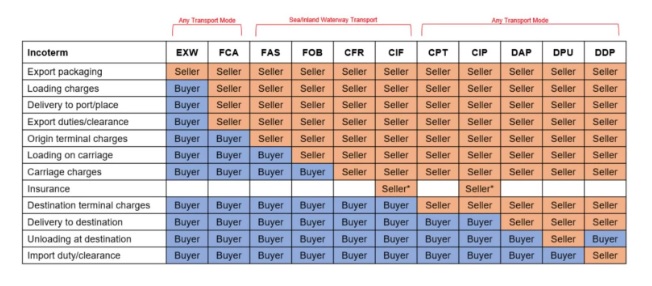

The chart below explains the key differences between the Incoterms:

Why Should I Know About Incoterms?

If you are a business that sells or purchases goods internationally, understanding Incoterms is important if you:

- want to use these terms in your contracts; or

- are thinking about entering a contract that uses Incoterms.

You should be aware of the characteristics of each Incoterm, so you have a clear idea of:

- when to use the term;

- the transfer of risk between you and the other party; and

- who will be responsible for the various costs in the process.

Without clearly understanding the term you want to use, you risk entering a contract without properly knowing how the goods will be transferred.

How to Use Incoterms in a Contract?

Both parties to a commercial contract can negotiate the terms of the contract, including:

- costs;

- quantities; or

- specifications of any traded products.

During negotiation, parties can also decide whether they should incorporate an Incoterm in the contract. Incoterms will not apply unless both parties agree to its incorporation in the contract. You should expressly set this out in a written agreement. Make sure you also reference the current version of the terms (currently the Incoterms® 2020) and ensure that none of your contractual clauses conflicts with the Incoterm you use.

Note that Incoterms only deal with the delivery of goods. Your commercial contract should include terms relating to all other aspects of the provision of the goods. You should not infer or assume these terms due to the Incoterms you use.

How Do I Know Which Incoterm to Use?

Each Incoterm is drafted for a specific goods delivery method.

This means that the term you choose depends on:

- the type of goods being delivered (so the details of the size, dimensions and weight of the goods will be relevant); and

- the method of delivery (e.g. whether the goods will be shipped, or fit in an aircraft or container load).

Choosing the Incoterm that best fits your goods and their delivery method is vital. Selecting the wrong term may affect the meaning and interpretation of the contract.

On 1 January 2020, the Incoterms® 2020 came into force, replacing the previous 2010 version. In particular, the new rules:

- accommodate situations where either a seller or a buyer transports goods using their own vehicles or vessels;

- increase a seller's insurance obligations under CIP Incoterms;

- rename the previous Delivered at Terminal (DAT) rules as Delivered at Place Unloaded (DPU);

- require under FCA Incoterms, if agreed, a buyer to instruct a carrier to issue to a seller, at the buyer's cost and risk, a transport document stating that the goods have been loaded (such as a bill of lading with an onboard notation); and

- address transport security-related obligations and associated costs.

It is important to specify the Incoterm's year. Failure to do so may create uncertainty as to which version of the rules applies to your contract.

What Do Incoterms Exclude?

As discussed above, you should not use Incoterms as the entire basis of the contract. They do not cover details such as:

- the ownership and transfer of the title of the goods;

- vessel requirements;

- force majeure;

- termination or insolvency; or

- the payment process.

Key Takeaways

On the whole, Incoterms will only apply to your transaction if the parties in the contract agree to its inclusion. Therefore, ensure you choose the appropriate term for your situation and understand what it means. Note that you should not use these terms as a substitute for a written contract as they only deal with the delivery of goods and not payment or costs.