The Government proposed some changes to the Age Pension in the 2015 Federal Budget. As with all changes, there will be winners and losers. The Government estimates that around 50,000 part pensioners will qualify for a full pension while some 170,000 will gain a modest increase to their pensions under the proposed reforms. However, a greater number (235,000) will have their current pension reduced and almost 91,000 pensioners will lose their entitlements entirely.

What are the changes?

An individual who has reached pension age can qualify for the Age Pension after being Centrelink income and assets tested. The income test remains unchanged. The Government has proposed two changes to the assets test:

- Taper rate

A full pension is payable when your total assets (excluding the family home) are within the assets-free area. The 'taper rate' is the rate at which your pension will reduce when your total assets exceed the assets-free level. Currently, yourpension will reduce by $1.50 per fortnight (i.e. $39 per annum) if you have an additional $1,000 of assets above theminimum asset threshold. The new rules will see the rate of reduction doubled to $3.00 per fortnight for every $1,000of assets above the lower threshold.

- Assets test thresholds

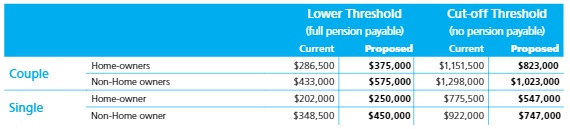

Under the proposed reforms, the lower asset thresholds will be raised, however, the cut-off thresholds will be scaledback. The table below shows the lower and upper assets thresholds under the current and proposed rules:

When do the changes start?

The changes have not been legislated yet. The proposed commencement date is 1 January 2017, if the changes become law.

Are you affected by the proposed changes?

The majority of pensioners will be affected under the proposed reforms but the extent of the impact will depend on the family situation and whether you own your own home. In this article, we will focus on (1) single and (2) couple pensioners who own their own home. While the discussion revolves around the assets test in this paper, it must be noted that the Age Pension also depends on the income test as well.

- Pensioner couple home-owners

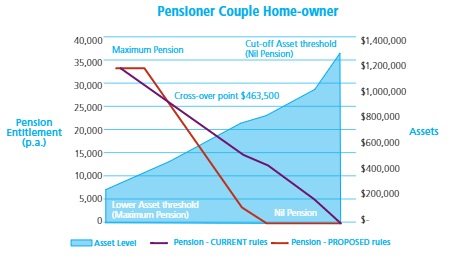

The graph below shows that in general, the pension entitlements will reduce as the couple's assessable assets rise. Assessable assets do not include the family home. The relevant asset threshold where such a couple is no better or worse off under the current or new rules is $463,5001. This is shown as the cross-over point on the graph (below).

- Assetsbelow $463,500

If the total assets fall below $463,500, then the couple will be better off under the new system due to a higherassets-free area. A couple with assets up to $375,000 (the new assets-free area) are entitled to the maximumpension payments whereas under the current system, their pension starts to reduce once their assets exceed just$286,500.

- Assetsabove $463,500

A couple's pension will reduce at a faster pace under the proposed reforms if their assets exceed $463,500. Thecouples whose assets are close to the scaled back cut-off threshold of $823,000 are impacted the most. Thechanges would render these couples with little or no Age Pension whereas currently they would receive more than$12,000 per annum in support from the Government.

Below, the table shows the impact on a pensioner couple's entitlement at differing levels of assets where they are home-owners:

- Single pensioner home-owners

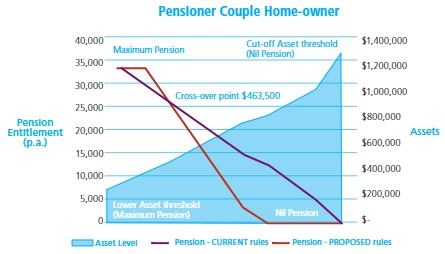

The graph below shows the interaction of the current and new rules for a single pensioner home-owner. Individuals with assets of $298,000 will be neutrally affected by the new rules.

- Assets below $298,000

-

If a single pensioner has total assets below $298,000 then they would receive a higher level of pension paymentsunder the new rules.

- Assets above $298,000

However, if their assets are over $298,000, they would lose some of their pension entitlements. The worstaffected are singles with accumulated assets of just over $547,000. They would go from receiving a pension ofaround $8,910 per annum to nothing under the proposed reforms.

The table below shows how a single pensioner may be impacted by the changes at different levels of assets:

What is the impact of the proposed changes on your retirement capital?

Those pensioners adversely impacted by the proposed changes are likely to increase the drawdown of their own capital to cover the reduction in benefits.

Examples that illustrate the potential impacts of the changes follow:

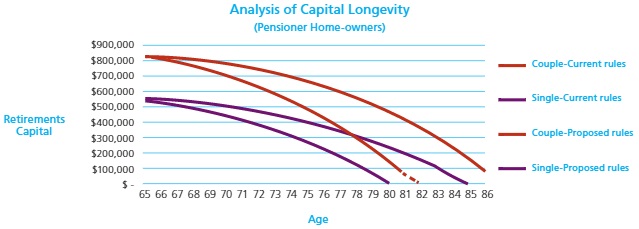

Example (1) Couple Pensioners:Jordan and Jade are both 65 and retired, living in their own home. They have total assessable assets of $823,000 made up of superannuation assets of $793,000 and $30,000 in home contents and car. They require an after-tax income of $60,000 per annum to fund their lifestyle.

Example (2) Single Pensioner:Jack is a single 65 year old pensioner who owns his own home. He has total assets of $547,000 and needs an income of $40,000 per annum to live comfortably.

The graph below shows that in order for Jordan and Jade to maintain their retirement lifestyle under the proposed reforms, they need to fully fund it from their own capital as they will not qualify for any Age Pension assistance. As a result, their retirement capital has been estimated to deplete around 4 years earlier than under the current system.

Similarly, Jack's capital is also expected to be exhausted 5 years earlier under the new rules.

Those adversely impacted by the Age Pension changes may have no choice but to reduce their expenditure to extend the longevity of their capital.

Do you lose the health care card?

To alleviate the impact of the changes, the Government has guaranteed those pensioners who will lose their Pensioner Concession Card under the new rules will automatically become entitled to the Commonwealth Seniors Health Card (CSHC).

Conclusion

At this stage the changes are not yet legislated. Nevertheless, it is important to start considering how these changes may impact your personal circumstances and make plans accordingly.

Assumptions:

- Net earnings rate of 5% p.a;

- All living expenses, pension payments and income drawdowns are indexed by 3% p.a;

- Pension payments are based on rates current at the time of writing;

- Centerlink income test is ignored

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2014 Moore Stephens Australia Pty Limited. All rights reserved.