The case against Mr Tyson Scholz shows how seriously ASIC takes its position on finfluencers. Anyone posting financial commentary on social media or online must be aware of the licensing requirements and position themselves either as financial product advice providers who are appropriately licensed, or limit their information to factual information only.

The Case against Mr Scholz

ASIC alleged Mr Scholz was carrying on a financial services business without a licence by providing financial product advice, regarding share trading on the ASX via:

- delivering training courses and seminars during which he made recommendations about share purchases;

- promoting those courses and seminars on Twitter and Instagram; and

- making share purchase recommendations on private online forums (that he administered) and on Instagram.

The Federal Court found Mr Scholz's business constitutes a contravention of s911A of the Corporations Act by carrying on a financial service business (between March 2020 and November 2021) without an AFSL. Justice Downes noted in her judgment:

"the advice given by him (Mr Scholz) was not a one-off but formed part of the continuous and systemic business operations by which Mr Scholz derived profit."

.through his lifestyle posts and 'life story' posts on the Instagram account, Mr Scholz had established a reputation as a successful share trader who had the ability to identify worthwhile companies in which an investment should be made. It did not matter that the stories did not contain any overt recommendation to acquire the shares: it was enough that Mr Scholz referred to a company or which share in the stories, which was usually done in a way which indicated that he liked that company."

Overseas Regulators Cracking Down Celebrities

ASIC isn't the only regulator taking enforcement action against finfluencers. The Securities and Exchange Commission (SEC) (ASIC's American counterpart) alleged that Kim Kardashian failed to disclose a $250,000 payment to publish a post on her Instagram account promoting E'hereumMax's crypto asset security EMAX tokens.

Kardashian settled the charges by paying $1.26 million in penalties, disgorgement (repayment of profits from illegal transactions) and interest. She has also agreed to cooperate with the SEC's ongoing investigation.

Matt Damon's TV commercial for Crypto.com is also widely considered to be problematic in relation to the very limited disclosure, though it currently seems unlikely he will charged by the SEC.

What next for finfluencers?

ASIC has provided advice for social media influencers who discuss financial products and services online (see INFO 269). It includes references to the licensing requirements for those that do provide financial product advice and also explains the obligations in relation to misleading and deceptive representations.

When you discuss financial products and services online or promote affiliate links, make sure you understand your legal obligations, including whether:

- you are providing financial product advice or arranging for your followers to deal in a financial product; and

- your content is accurate and balanced.

Finfluencers should:

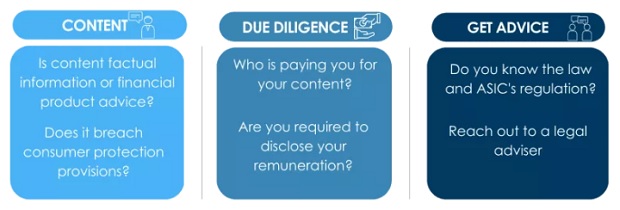

- Consider your content - is it factual, or is it financial product advice? Does it breach other consumer protections, such as the prohibition on misleading and deceptive representations?

- Get advice - do you know the law and ASIC's regulation? If not, reach out to a legal adviser to review your content and explain where it might be breaching the law.

- Do your due diligence - who pays you, is there a documented agreement in place and are you required to disclose the remuneration you receive to your followers?

If you are unsure of your obligations or require assistance to get yourself licensed, please do not hesitate to reach out to us.

Background

ASIC's focus on finfluencers (financial social media influences) has been escalating in the past few years, with ASIC publishing Info Sheet 269 in March 2022, putting finfluencers on notice to ensure they were operating within the law.

In December 2021, ASIC filed proceedings to restrain social media 'finfluencer' Tyson Robert Scholz from promoting or carrying on any financial services business in Australia as Mr Scholz does not hold an Australian financial services licence (AFSL). On 16 December 2021, Mr Scholz was banned from conducting his business by an interim order from the Federal Court.

Further Reading

22-371MR Federal Court makes findings against social media 'finfluencer' Tyson Scholz

Information Sheet 269 Discussing financial products and services online