ASIC has initiated proceedings in the Federal Court against Westpac Banking Corporation (Westpac). The allegations revolve around Westpac's purported failure to promptly address customer hardship notices, a violation of the National Consumer Credit Protection Act 2009 (Cth) (NCCP Act) and the National Credit Code. The instances span a period from 2 October 2015 to 20 March 2022, marking a concerning lapse of several years.

The allegations against Westpac:

ASIC's claims against Westpac (filed in September 2023) encompass a range of violations. It is alleged that, due to a technological glitch, Westpac failed to transmit 448 customer hardship notices to its Customer Assist team for processing. Moreover, Westpac did not provide written responses to customers' hardship notices on 229 separate occasions.

ASIC asserts that Westpac, on at least 34 occasions, rejected customers' hardship notices on the grounds of insufficient information. These rejections occurred even when the information in customers' online hardship notices was compromised by the earlier system malfunction.

Westpac also faces other allegations, including:

- the improper recording of adverse repayment history information on the credit files of affected customers on more than 22 occasions;

- recording default information on the credit files of affected customers on an unspecified number of occasions; and

- selling accounts belonging to affected customers to third-party debt purchasers on at least 21 occasions and initiating proceedings to repossess mortgaged properties from these customers on at least three separate occasions.

What are your statutory obligations as a Credit Licensee?

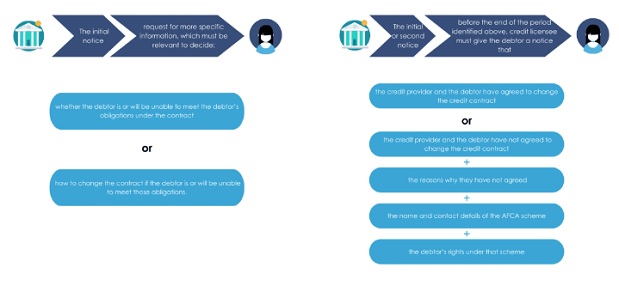

For credit licensees, the legal action against Westpac serves as a reminder of the obligations that must be met. Section 72(1) of the National Credit Code stipulates that when a debtor finds it impossible to meet their obligations under a credit contract, they may notify the credit provider or debt manager of their hardship. This notification, known as a hardship notice, imposes specific legal obligations on the credit provider or debt manager, including the duty to provide a timely and reasonable response.

Timeframe to respond to a hardship notice:

How to respond to a hardship notice:

Failure to meet these obligations can result in severe consequences, including the suspension and cancellation of your credit licence, along with potential fines or imprisonment for your company and its representatives.

Significantly, on 23 February 2023, the Federal Court made a decision that favoured ASIC in a case similar to the breach alleged against Westpac. In this case, Membo Finance Pty Limited (ClearLoans) incurred a substantial penalty of $6 million for misconduct related to financial hardship and various violations of the NCCP Act. The Federal Court's decision in favour of ASIC in this instance has established a noteworthy precedent within the industry. This case serves as a stark reminder of the seriousness of such breaches.

How can we help?

If your business requires assistance in meeting its obligations to promptly address vulnerability and financial hardship notices from customers, Sophie Grace is here to help.

Don't hesitate to contact us for more information or to initiate a discussion about how we can support your business. Ensuring compliance with these critical obligations is paramount for financial institutions.

Further Reading:

Q&As for lenders – dealing with financial assistance requests

23-242MR ASIC sues Westpac for failing to respond to hardship notices