As we know, the national budget from tax revenue set by the

Directorate General of Taxation (DGT) was set at IDR 1.296 billion

for 2015 and up until the first quarter, 13.65% of the target had

been reached (tempo.com 1 April 2015). Furthermore, in 2015, the

DGT has set this year to be the year of educating taxpayers.

Referring to the facts above, within this year, the DGT had issued

two regulations regulating the elimination of administrative

penalties which is Regulation Number 29/ PMK.03/2015 and Regulation

Number 91/PMK.03/2015 which more commonly known as the Sunset

Policy 2015.

Below are the summaries of the abovementioned regulations:

Regulation Number PMK 29/PMK.03/2015 (Elimination of

Administrative Penalties Art 19 Paragraph 1 General Tax

Law)

ADMINISTRATIVE PENALTIES WHICH CAN BE ELIMINATED

In this regulation, administrative penalties that can be eliminated by the DGT are on late tax underpayment payments as stated in the Tax Underpayment Assessment Letter, Additional Tax Underpayment Assessment Letter, and Revisions on Tax Decision, Tax Objection Decision, Tax Court Decision or Judicial Review Decision.

PROCEDURE

Taxpayer can submit the applications to the DGT via taxpayer's registered office, with one of the conditions being the requirement to settle the principal tax payable amount.

PROCESSING TIME

The decision will be issued at a maximum of six months after the application/request has been received.

This applies on tax payables arising before 1 January

2015.

PMK 91/PMK.03/2015 (Elimination Penalties Art 7, 8

Paragraph 2, 8 Paragraph 2a, 9 Paragraph 2a, 9 Paragraph 2b or 14

Paragraph 4 General Tax Law)

PENALTIES THAT CAN BE ELIMINATED

Article 7: Penalties on late submissions of the Monthly Tax

Returns or Annual Tax Returns

Article 8 Paragraph 2 and 2a: Penalties on underpayment arising

from the revision in the Monthly Tax Returns or Annual Tax Returns

(2%/Month)

Article 9 Paragraph 2a and 2b: Penalties on late payments stated

in the Monthly Tax Returns or Annual Tax Returns

Article 14 Paragraph 4: Penalties caused by not preparing,

incomplete, and not reporting on time on the Tax Invoices.

PROCEDURES

- Tax Payer submits Annual or Monthly Tax Return for fiscal year 2014 and earlier

- Tax Payer receive Collection Letter (Surat Tagihan Pajak) from Tax Office

- Taxpayer submits an application to the registered tax office using the format as disclosed in the provided attachment

- Applications can be submitted twice at a maximum

- The applications will be processed at a maximum of six months upon submission

PENALTIES THAT CAN BE ELIMINATED

- Penalties from late submission of the Monthly or Annual Tax Returns for fiscal years 2014 and earlier

- Penalties arising from tax underpayment stated on the revision of the Monthly or Annual Tax Returns Which were conducted during 2015

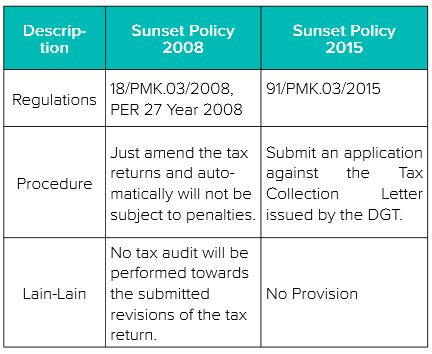

There are several basic differences to the Sunset Policy of 2008 and 2015. Following are the differences:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.