a The 5% rate applies if the interest is derived from loans granted by banks or insurance companies; or is derived from bonds or securities that are regularly and substantially traded on recognized securities market or with respect to sales by suppliers of machinery and equipment. The 15% rate applies to other interest.

aa The 5% rate applies if the interest is derived from loans granted by banks or insurance companies.

b The 10% rate applies if the interest is derived from bonds or securities that are regularly and substantially traded on recognized securities market or with respect to sales by suppliers of machinery and equipment. The 15% rate applies to other interest.

c The 5% rate applies to royalties for the use of, or the right to use, industrial, commercial, or scientific equipment.

1. Income Tax

1.1. General Aspects

1.1.1. Income Tax Rate

The general statutory corporate income tax (First Category Tax) rate for Chilean entities including Chilean branches of foreign companies is 17%.

1.1.2. Taxable Basis

Taxable basis is determined according to the generally accepted accounting principles, including all profits. Dividends received by resident companies from other resident companies are exempt from corporate tax.

1.1.3. Deductions

As a general rule all costs and expenses are deductible provided that they are related, proportional and necessary to the income producing activity. Any costs or expenses related to Excluded and/or Exempted Items of Income are not deductible.

However, automobile expenses are not deductible.

1.1.4. Depreciation

Depreciation of fixed assets is allowed according to the useful life determined by the Chilean IRS. Accelerated depreciation may be elected by the taxpayer with respect to new or imported assets, applying one third of the regular period of depreciation.

1.1.5. Transfer Pricing

Chile has special transfer pricing rules applicable to all transactions between a Chilean party and a foreign related party. Under such transfer pricing rules, the Chilean party must keep and file supporting documentation with the tax authorities. Parties

in tax havens are deemed as related parties for these purposes. The Chilean transfer pricing regime has a list of situations where two parties are deemed related which is complex and its application should require a more detailed analysis on case-by-case basis.

1.1.6. Inflation Adjustments

Chile has an inflation adjustment or monetary correction system applicable to certain assets and liabilities annually, based on changes in the consumer price index (CPI) and foreign exchange rates. The difference between the taxable income and the expenses originated in the yearly inflation adjustments should result either in a net item of taxable income or a net loss for inflation (this loss is deductible).

1.1.7. Tax Loss Carry-forward / Carry-back

A Chilean taxpayer can carry-forward indefinitely. Losses must be carried-back offsetting undistributed profits from prior years.

Tax losses cannot be transferred to other taxpayers (not even to the shareholders). Keep in mind that in all cases, inflation adjustments are applicable to update the tax loss amounts and deduction is computed on the adjusted amounts.

1.1.8. Tax-Free Reorganizations

A Chilean group of companies may implement statutory mergers and spin-offs, stock-for-stock and assets-for-stock reorganizations tax free, including Income Tax and VAT taxes.

1.2. Payment and Filing

For any given taxable year the corresponding income tax return and tax liability must be filed and paid on the first date of the next year, according to the filing and payment dates set out by the tax authorities in the corresponding schedules (e.g., the filing corresponding to the 2010 taxable year must be verified in 2011).

All entities including corporations must file their income tax return and pay the corresponding tax liability every April regarding the prior taxable year.

1.3. Additional Tax / Withholding Tax

There is a 35 % remittance tax on any distribution, dividends, profit income and branch profits remitted abroad to non-resident alien entities or individuals. It applies only on all dividends remitted abroad, and on taxable profits actually remitted or distributed abroad. The 17% First Category Tax may be offset to 35 % Additional Tax, thus resulting in an actual 18% tax rate and the final tax burden for shareholders is 35 %.

If profits are capitalized in another Chilean company, the withholding tax is deferred until they are withdrawn from the same or the second company. Law No 20154, reduces the Withholding Tax rates in order to facilitate access to Chile of state-of-the-art technology from overseas as well as to drive the development of the software industry.

This reform specifically reduces the Withholding Tax rate from 30% to 15%, as provided in the Income Tax Law, that levies the amounts associated to the use, enjoyment or exploitation of invention patents, models, drawings and industrial designs, layout sketches or layout of integrated circuits, and new vegetable varieties. On the other hand, the Withholding Tax rate applicable to the use, enjoyment or exploitation in Chile of software is reduced to 15 %, where software is defined as a set of instructions to be used directly or indirectly in a computer or notebook in order

to make or obtain a given process or outcome contained in a cassette, diskette, disc, magnetic tape or any other material tool or means pursuant to the definition or specifications contemplated in the Intellectual Property Statute. It is worth noting that prior to the Law amendments, the Internal Revenue Service through a great number of pronouncements sated that for customized software the applicable withholding tax rate was 20% for the same was deemed a "technical assistance". On the contrary, the payment for the use of standard software was subject to a 30% withholding tax rate for it was considered as a payment for the use of intangible assets.

Likewise, according to the last amendment to the law , the Withholding Tax rate on the remuneration paid abroad for engineering or technical services as well as professional or technical services rendered by a person or entity knowledgeable in a science or technique through advice, a report or plot, whether they are rendered in Chile or overseas, is 15 % unless such services are rendered to related parties or beneficiaries located in a country deemed a tax haven in which case the withholding rate goes up to 20%

1.4. Cross-border Payments

14.1. Withholding Taxes

When Chilean source income is remitted abroad to a beneficiary that is a non-resident alien individual or entity, the payment should be subject to a withholding tax.

14.1.1.Royalties

Royalty payments are subject to an effective 30% withholding tax for income and remittance taxes.

1.4.1.2.Technical Services, Technical Assistance and Consulting Services

Whether rendered in Chile or abroad by a non-resident, technical services and technical assistance payments are subject to 15 % withholding for income and remittance taxes.8

1.4.1.3.Other Services

If services are rendered from abroad and do not qualify as technical services, technical assistance or consulting services, then an effective 35 % withholding should apply.

1.4.1.4.Interest Payments

As a general rule, payments made pursuant to foreign debt agreements are subject to a 35% effective withholding for income and remittance taxes. A reduced 4% withholding for income and remittance taxes applies in some specific cases to banks and financial institution foreign loans.

1.4.1.5 Leasing

Payments made to cross-border leasing agreements are subject to a 35 % withholding on a deemed basis equivalent to 5% of each installment, resulting in an actual 1.75% tax rate.

1.4.2. Tax Treaties

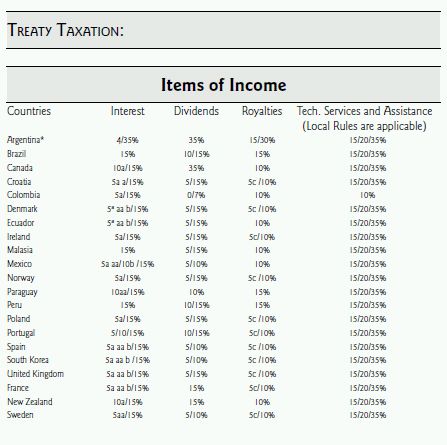

To January 2010, Chile has Tax Treaties to avoid the Double Imposition with Argentina, Brazil, Canada, Colombia, South Korea, Croatia, Denmark, Ecuador, Ireland, Spain, France, Malaysia, Mexico, Norway, New Zealand, Paraguay, Peru, Poland, Portugal, United Kingdom, and Sweden. They are subscribed but noneffective tax treaties with Australia, Belgium, Russia, Thailand, United Estates of America and Switzerland. Is in stage of negotiation concluded and pending of subscription tax treaty with South Africa. Finally, Chile is in process of negotiation with the following countries: Austria, China, Cuba, a, Finland, Holland, Hungary, India, Italy, Kuwait, Czech Republic, Uruguay, and Venezuela.

2. Value Added Tax (VAT)

2.1. General Aspects

VAT is applied on the sale of corporeal movable goods or corporeal immovable goods owned by a construction company completely built by the same or that have been partially built by a third party on its behalf, a portion of domain over such goods or real rights on the same and certain services associated with activities specified in numbers 3 and 4 of article 20 of the Income Tax Law as well as some special taxable events.

2.1.1. Tax Rates VAT general rate is 19%.

Please keep in mind that in Chile there are some exempted and zero-rated goods and services, i.e. export of goods. The lists of Zero-rated and exempted goods are limited and should be checked in detailed on a case-by-case basis.

There are also some VAT exemptions for specific entities within the national or local territory, which may or may not be relevant depending on the entity that will act as a contracting party in any given project.

2.1.2. Taxable Transactions

These are: sale and import of movable tangible property and services other than such of an independent or professional nature rendered in Chile.

The sale of movable tangible property that is a fixed asset for the seller, is not subject to VAT under some conditions and requirements.

2.1.3. Taxable Basis

As a general rule, the taxable basis is the price or value of the consideration paid for the goods or services, which should correspond to their Fair Market Value (FMV).

2.1.4. Creditable VAT

As a general rule the VAT taxpayer is entitled to credit to the VAT payable all such VAT paid to its suppliers for tangible movable property bought or imported and for services hired, provided that they constitute a cost or expense of the taxpayer's income producing activity.

The VAT paid in the acquisition of goods that will become fixed assets for the buyer is creditable to VAT.

There are limitations to the VAT credits available for VAT paid on costs and expenses, when incurred in a VAT exempted or VAT zero-rated activity.

2.3. Payment and Filing

VAT has a monthly taxable period. Therefore, the tax must be assessed and a VAT return filed monthly. The VAT return must be filed and paid in full on the filing dates scheduled by the tax authorities for these purposes, which are usually within the first 12 days following the corresponding month end.

3. Other Taxes

3.1. Property Taxes

There is a property tax on real estate. This tax rate is 15 per thousand a year calculated on a fiscal basis fixed by the Chilean IRS under a real estate appraisal procedure, paid on a quarterly basis.

3.2. Municipal Tax

There is a municipal tax applicable to all industrial commercial and service activities carried out in the territory of said municipality. The taxable basis is the net equity of the taxpayer. The tax rates vary from county to county and range from 2,5 to 5 per thousand with a minimum of one Monthly Tax Unit (US$ 60 approximately) and a maximum of 8,000 Monthly Tax Units (US$ 500,000 approximately). This tax is usually paid twice a year.

3.3. Stamp Tax

This is a documentary tax applicable to all written agreements with includes the effects triggered by loans in Chile or for a Chilean party. The Stamp Tax levies the total amount of a cash loan equivalent to 0.1% per each month or fraction from the loan granting up to a ceiling of 1.2%.

However, Law No 20.32 6 provides for a transitory reduction of rates equivalent to a 50% rate applicable to taxes accrued from 2010 through June 30, 2010, both inclusive.

3.4. Estate and Gift Taxes

Estate and gift tax is a unified tax assessed in brackets and at progressive rates. Residents are subject to this tax on their worldwide assets. Nonresidents are subject to this tax on their local assets only. Rates vary from 1 to 25%.

3.5. Customs Duties

A general 6% rate is assessed on the CIF value of imported goods, including fixed assets to build pipelines, construction materials, machinery, etc. However, most goods from free trade agreements subscribed by Chile with i.e. Mercosur, CEU countries, EFTA countries, Canada, Mexico, United States and other countries are

enjoying a zero rate. Charges made with regards to technical services separate from the price of imported goods, are not subject to customs duties.

3.6. Taxable Basis

Customs duties are computed on the CIF value of the goods, while import VAT is computed on the CIF value plus the appropriate customs duties.

3.7. Transfer Pricing

Chile has special transfer pricing rules that use the three basic methods established by the OECD, namely: uncontrolled prices among unrelated parties method, cost plus profit margin method and resale price method. In general, the burden of proof to determine the arms's length prices is on the Internal Revenue Service. These rules apply to transactions between related parties situated in Chile and overseas.

The term "relation" is rather unrestrictive and includes, amongst others, ownership relations, control or administration, but also expressions like economic or financial dependency, joint venture agreements, exclusive contracts, etc.

3.8. Filing and Payment

An import return must be filed upon nationalization of the goods. As a general rule, under the ordinary import regime, customs duties must be paid upon importing the goods. Import VAT must be paid within the month following the arrival of the goods to Chilean customs jurisdiction.

4. Payroll Taxes / Welfare Contributions

4.1. Retirement Contributions

The employees are subject to private pension funds. The contribution must be equal to at least 0.95% of the employee's wages up to 66 Unidades de Fomento (UF) which is approximately US$ 2,600. The UF is a monetary unit expressed in Chilean pesos that varies according to the CPI on a monthly basis. Employees can make additional and voluntary contributions. Contributions must be paid to the pension funds on a monthly basis. The employees must cover 100% of the contribution.

The employer is responsible for withholding the monthly contribution in the pension fund. Filing and payment is made on a monthly basis.

4.2. Health Care Contributions

The employees must be affiliated to a general Health Care Plan. Contributions to the HCP administering entity must be equal to 7% of the employees' wages up to 66 UF, which is approximately US$ 187. Contributions must be computed and paid to the HCP administering entity on a monthly basis. The employees must cover 100%. The employer is responsible for withholding and paying to the HCP administering entity 100% of the monthly health contribution. Filing and payment is made on a monthly basis.

4.3. Labor Risk Insurance System

Employers must be affiliated to a labor risk insurance system of their election.

This contribution must range between 0.95% and 8.7% (depending on the activity) and is computed and paid on a monthly basis. Employers must cover 100% of this contribution and are responsible for paying it to the insurer.

4.4. Unemployment Fund Contribution

Employers must contribute to the unemployment fund 2.4% of each employees' monthly wages (for employees under a fixed term employment contract, a work or service employment contract, this percentage goes up to 3%) while they must contribute 0.4% of such wages with a ceiling in both cases of 90 UF to the unemployment fund elected by each employee. This contribution has to be withheld and paid by the employer on a monthly basis.

Footnotes

1 If the shares of stock are sold on a non customary per thousand basis, otherwise, capital gains are taxed with regular taxes.

2 Withholding tax on dividend distribution is taxed with 35% withholding tax, however the 17% First Category Tax could offset this tax, which results in a real 18% tax rate.

3 Idem.

4 4% on bank or financial institution loans; 35% as a general rule.

5 Legal presumed income equivalent to, 35% applied on 5% of each rental payment of the good

6 Notwithstanding, Law No 20.326 provides for a transitory reduction of rates equivalent to 50% rate applicable to taxes accrued from 2010 through June 30, 2010, both inclusive.

7 Calculated on the Tax Owner's Equity up to 8,000 MTUs (equivalent to approximately US$ 500.00 with an exchange rate of US$ 1 = 500 Chilean pesos)

8 With the exception indicated in the last paragraph of No 3 above.