Carey Olsen has been confirmed as the leading legal adviser to Jersey domiciled funds, according to the latest findings of independent fund industry research group Monterey Insight.

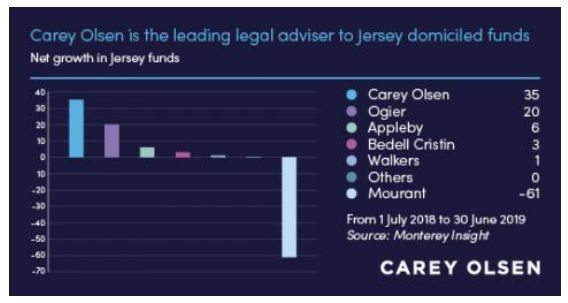

The 25th edition of the annual report, which provides a comprehensive analysis of the performance of all funds serviced in Jersey and their primary service providers, reports that for the year ending 30 June 2019, Carey Olsen has moved into first place among legal advisers to Jersey domiciled funds by both number of funds and assets under management (AUM).

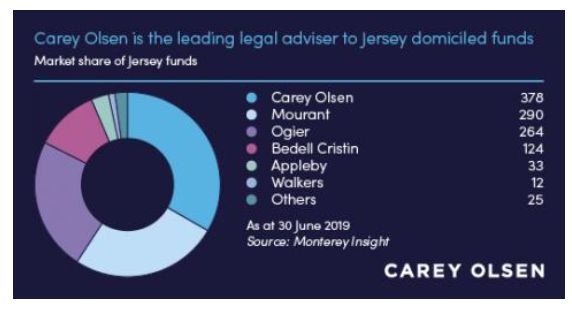

The firm now advises 378 Jersey domiciled schemes, up from 343 a year previously, and 88 ahead of its nearest competitor. These 378 funds total US$132.5 billion, which represents 40.2% of the market by AUM and an increase of US$40.3 billion over the year. It is also US$15 billion more than Carey Olsen's nearest competitor.

By pure number of funds, Carey Olsen advises on 33.6% of the Jersey domiciled fund market.

James Mulholland, a partner in Carey Olsen's Jersey investment funds team, said: "The latest figures from Monterey Insight are a tremendous endorsement of our investment funds practice and the calibre of advice our team provides to new and existing fund promoters. We've enjoyed sustained market growth over the past several years, particularly in relation to new investment funds business, and to finally cement our position as the overall leader in respect of legal advice to Jersey domiciled funds is incredibly satisfying.

"The results also speak volumes for the ability of our team, both in terms of strength and size, to provide the bespoke services required by institutional mega-funds, fledgling managers and everyone in between."

Just some of the fund assignments Carey Olsen has worked on in the past year include advising Quinbrook Infrastructure Partners on the US$1.6 billion launch of the Quinbrook Low Carbon Power Fund, acting for Kreos Capital on the launch of its largest ever growth debt fund, which secured €700 million of committed capital, and supporting Falko Regional Aircraft on the launch and final closing of Falko Regional Aircraft Opportunities Fund II at US$650 million.

Jersey funds partner Daniel O'Connor added: "It's great to be recognised as the top adviser to Jersey funds by both number and AUM but we never take our clients for granted and are working hard to keep the momentum going for next year. Our research indicates that in 2020, clients will want to talk to us about the impact of new substance requirements, the effect of Brexit on fund marketing and whether Jersey structures can help solve issues caused by new UK capital taxes on real estate. Our partners sit on key working groups and industry bodies and are ready to give confident and clear advice on the very latest developments for each of these topics."

Overall, Monterey Insight found that the number of serviced schemes (including both domiciled and non-domiciled Jersey schemes) increased to 1,336 at the end of June 2019 – up 4.5% compared to 2018. The total value of fund assets serviced in the island also rose to US$481.2 billion – up 17% from a year previously.

Monterey Insight is a leading independent fund industry research company that provides the only comprehensive statistical analysis of service providers for all investment funds serviced in the UK, Luxembourg, Ireland, Jersey and Guernsey. The company's research covers around 37,000 investment funds and its annual reports are considered to be the reference point for the entire funds industry in each of these five jurisdictions.