In December 2019, the Alberta Securities Commission (the "ASC") released its 2019 Corporate Finance Disclosure Report (the "Report"). This bulletin summarizes the ASC's key findings and pursuant to its review of public company filings in 2019 and provides useful guidance for public companies preparing 2020 continuous disclosure filings.

1. Review process and outcomes

The ASC's Corporate Finance division reviews the continuous disclosure ("CD") of Alberta reporting issuers ("RIs") on an ongoing basis. The ASC reports its general findings on an annual basis as well as provides direct feedback to RIs on how they can improve their disclosure.

During 2019, the ASC's CD reviews resulted in the following outcomes:

- 5% of RIs were not required to take any action (down from 6% in 2018);

- 44% of RIs were requested to make prospective changes to their CD (up from 43% in 2018);

- 47% of RIs were requested to file un-filed documents (most frequently relating to material contracts, executive compensation and other corporate governance disclosure) or re-file certain documents (most frequently relating to MD&As and corporate presentations) (up from 43% in 2018); and

- 4% of RIs were (i) placed on a list of RIs in default; (ii) cease-traded; or (iii) referred to the Enforcement Division for further investigation (down from 8% in 2018).

2. Key disclosure issues over the past five years

The ASC identified specific areas where CD can be improved. These include disclosure around liquidity and capital resources, use of non-generally accepted accounting principles ("GAAP") financial measures, forward-looking information and unbalanced and promotional disclosure.

Liquidity and capital resources

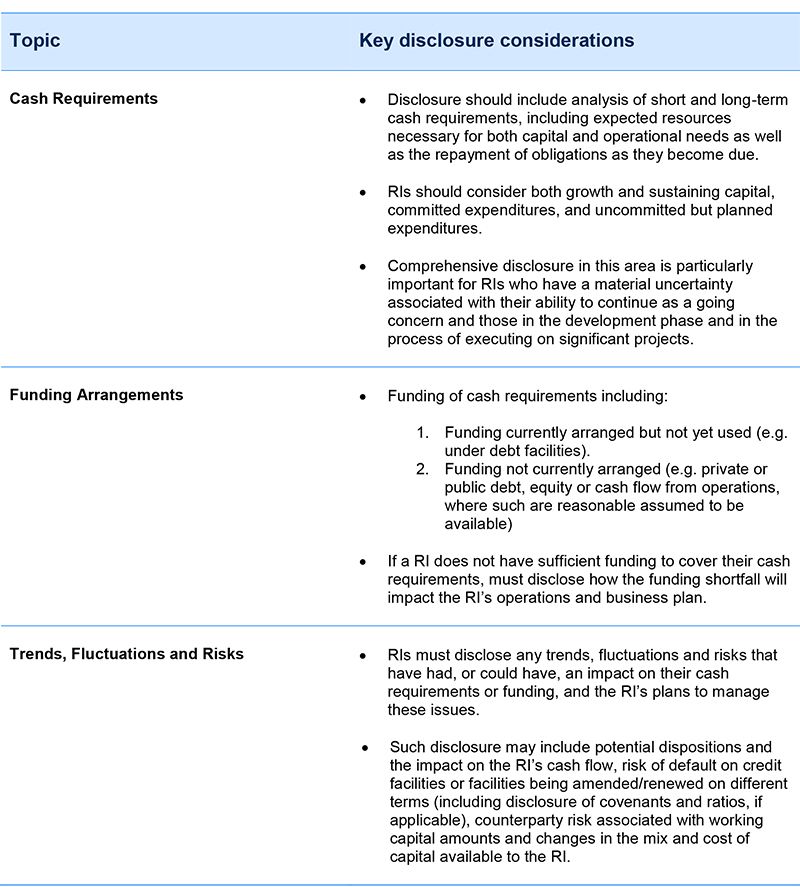

Disclosure of RI's liquidity and capital resources continues to be a focus of ASC reviews. The ASC noted that disclosure in this area should be a focus for all RIs and should discuss specific cash requirements, funding arrangements and trends, fluctuations and risks. In general, disclosure should be complete, fair and balanced with equal prominence to both risks and opportunities, and should avoid the inclusion of boilerplate statements.

Non-GAAP financial measures ("NGMs")

The ASC does not object to the disclosure of NGMs, provided that they are accompanied by appropriate disclosure (i.e., information necessary to understand NGMs in their proper context), do not obscure GAAP results and are not otherwise misleading. For more detailed guidance with respect to the use of NGMs, Rls are encouraged to review CSA Staff Notice 52-306 (Revised) Non-GAAP Financial Measures ("SN 52-306").

The likelihood of comments from ASC staff is reduced where RIs have satisfied the following in their disclosure:

- clearly identified NGMs;

- explained that NGMs do not have standardized meaning under GAAP and that there are limitations on the comparability of NGMs to similar measures presented by other Rls;

- named NGMs in such a way that they are distinguishable from GAAP disclosure items;

- explained why the NGM provides useful information to investors and the additional purposes, if any, for which management uses the NGM;

- presented the most directly comparable measure specified, defined or determined under the RI's GAAP with equal or greater prominence to that of the NGM;

- provided a clear quantitative reconciliation from the NGM to the most directly comparable GAAP measure presented in the RI's financial statements;

- confirmed that the disclosure does not describe NGM adjustments as non-recurring, infrequent or unusual when a similar loss or gain is reasonably likely to occur within the next two years or occurred during the prior two years; and

- presented the NGM on a consistent basis from period to period or, if the composition of the NGM has changed, explained the reason for the change and restated any comparative period presented.

Forward-Looking Information ("FLI")

The ASC has observed an increase in the disclosure of FLI in combination with NGMs in recent years. The ASC reminds RIs that NGMs disclosed on a forward-looking basis are subject to the guidance in SN 52-306 and the requirements of Parts 4A and 4B of National Instrument 51-102 Continuous Disclosure Obligations. Many RIs fail to provide the required NGM disclosure (including a usefulness description, an understanding of the composition of the NGM and an appropriate quantitative reconciliation). The most common omission is failing to include material factors or assumptions used to develop the FLI.

The ASC reminds RIs that required disclosure surrounding FLI applies in both voluntary and required filings. With voluntary disclosure, RIs frequently fail to:

- discuss material differences between actual results and previously disclosed FLI. For example, one RI disclosed in its corporate presentation an adjusted funds flow forecast of $40 million, however the actual result of this measure was $5 million. The RI failed to disclose or discuss this material difference in its annual MD&A; and

- disclose the events and circumstances that led them to withdraw previously disclosed FLI, including the assumptions underlying the FLI that are no longer valid.

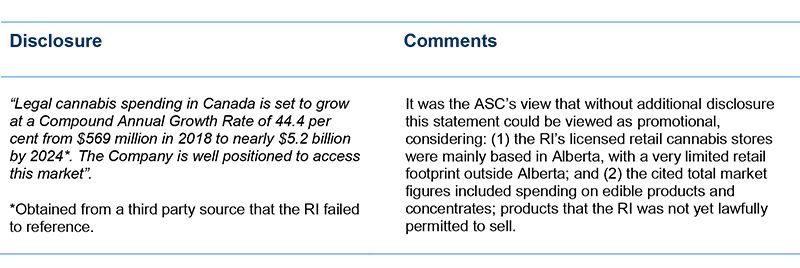

Balanced disclosure

While the ASC has generally seen more balanced disclosure in RIs' recent regulatory filings, they continue to observe less balance in disclosure provided on social media platforms. The ASC reminds RIs that the requirement to provide factual and balanced disclosure extends to social media platforms, even if these activities are not directly intended to communicate with investors. The ASC provided the following useful example of a RI's unbalanced disclosure:

Material changes and related disclosure considerations

RIs are reminded to be mindful that additional disclosure requirements may be triggered when they change their business, enter into new businesses or undertake restructuring transactions.

3. Other CD issues

Climate change-related risk disclosure considerations

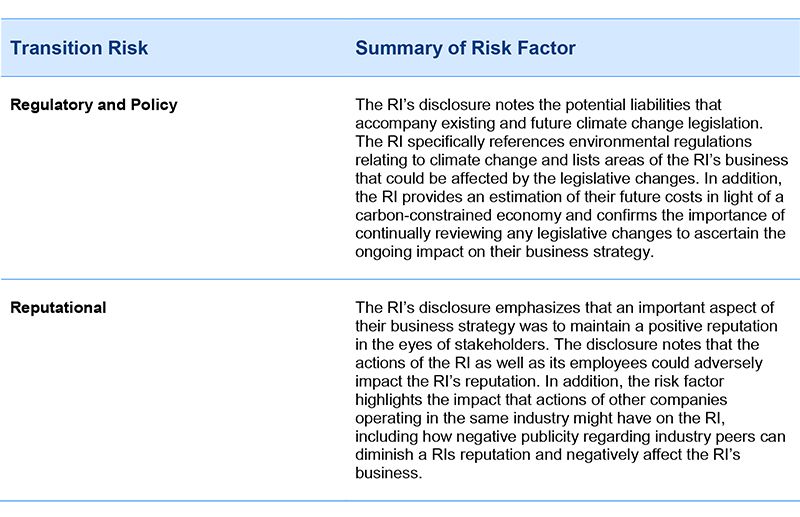

In response to investors' increasing focus on climate change-related risks, the CSA published Staff Notice 51-358 Reporting of Climate Change-related Risks ("SN 51-358"). SN 51-358 provides guidance on the application of existing disclosure requirements in the context of climate change-related risks. SN 51-358 reinforces and expands upon the guidance in CSA Staff Notice 51-333 Environmental Reporting Guidance ("SN 51-333"). RIs are encouraged to review both notices in preparing annual disclosure.

SN 51-358 describes the major climate change-related risks in two categories: (1) physical risks (risks that a change in climate itself could have on an RI's business); and (2) transition risks (a broader set of risks associated with the consequences of the global transition to a less carbon-intensive economy). In the Report, the ASC provided two examples of transition risk disclosure that met their expectations:

Adoption of International Financial Reporting Standards 16 Leases ("IFRS 16")

The ASC reminds RIs that the new leasing standard, IFRS 16, was adopted for financial reporting periods beginning on or after January 1, 2019. RIs should review the Financial Reporting Bulletin published by the ASC in response to the implementation of IFRS 16.

Related party transactions and multilateral instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101")

MI 61-101 imposes enhanced disclosure requirements to protect the interests of equity securityholders against potential conflicts of interests that may arise when a RI participates in certain transactions. The ASC conducts real-time reviews of transactions to assess compliance with MI 61-101, as well as assesses compliance through its CD review.

The ASC notes that most MI 61-101 issues have arisen in the context of private placements where a director, senior officer or insider subscribes for securities and the news release and material change report ("MCR") contain deficiencies. Such deficiencies include a failure: (1) in the news release and MCR to state the RI's reliance on the minority approval and valuation exemptions and the facts supporting such reliance, and (2) in the MCR to include a discussion of the transaction review and approval process and a description of the interests of interested or related parties.

The ASC reminds RIs that, even if a related party transaction is not subject to MI 61-101, disclosure regarding such transaction should still discuss the potential conflict and outline any steps the RI is taking to manage these conflicts.

Early warning reporting requirements

The early warning reporting system is intended to inform the marketplace of actions taken by insiders or securityholders who have beneficial ownership of, or control or direction over, 10% or more of any class of securities of an RI. The ASC reminds reporting insiders that they are required to report any changes in their beneficial ownership, interest, control or direction over securities of a RI via SEDI (www.sedi.ca) within five days following the transaction.

4. Offering documents

New listings - capital structure

In an effort to add certainty to the initial public offering process, the ASC advises that a potential initial public offering to be conducted by an issuer that has an unusually large number of shares outstanding issued for nominal cash consideration (or for assets or business development where the value is not readily supportable) may raise public interest concerns or result in an objection to the issuer's capital structure. The ASC noted that it will discuss proposed capital structures with prospective issuers ahead of a prospectus offering.

Restricted securities

Restricted securities are equity securities that carry restricted voting rights, a lower number of votes per share, or that are entitled to more limited participation in the earnings or assets of an issuer than another class of equity securities. The ASC reminds issuers with restricted securities outstanding, proposed to be offered under a prospectus, or securities that may be converted into or exchanged or exercised for restricted securities, that they are subject to additional disclosure requirements, as more fully set out in the ASC's Report.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.