The revamped Cyprus International Trust (CIT), provides for the highest possible degree of asset protection internationally, extensive tax benefits and strong confidentiality capabilities.

LEGAL FORM

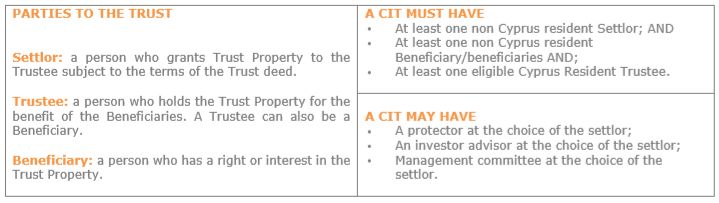

A CIT is a legal arrangement created by the Settlor who transfers property/assets to a legal or physical person, called the Trustee, who holds the property for the benefit of the beneficiary/ beneficiaries in accordance with the terms of the "Trust Deed".

CORE BENEFITS OF A CIT

TAX ADVANTAGES

- No Tax on non-Cyprus income and profits of a CIT;

- Beneficiaries may be taxable in their country of residence, only upon actual distributions;

- No capital gains tax on sale of titles;

- No inheritance or wealth taxes applicable;

- Low stamp duty;

- Possible disapplication of CFC Rules.

ASSET PROTECTION

- Cyprus courts have exclusive jurisdiction as to the validity of CIT;

- The provisions of CIT Law have express Superiority of over any other law, or treaty applicable in Cyprus;

- No claim can be filed in relation to the assets of the Trust in the case of bankruptcy or liquidation of the Settlor/ Beneficiary or in cases of institution of legal proceedings against the Settlor/ Beneficiary by his creditors;

- Foreign or local succession laws do not apply - Avoidance of forced heirship rules and certainty of succession: Any distribution of Trust property shall be made in accordance to the terms of the Trust deed in the event of death of Settlor or Beneficiary.

FLEXIBILITY

- Possibility to grant extended powers to Settlors;

- Ability on changing the jurisdiction of the Trust;

- No statutory limitations on mode of operation, objects, activities or mode of distribution of the Trust;

- Flexibility on investments and perpetual accumulation of income;

- May be fixed or discretionary.

ADDITIONAL BENEFITS

- High protection-The legal time limit to challenge the Trust is two years;

- Quick to set-up: usually within 2 working days; " No public registries for Trusts;

- No filing requirements;

- Strict confidentiality: disclosure of any details relating to a CIT is only allowed after a relevant court order

EXAMPLES OF USAGE OF A TRUST

OUR SERVICES

- Provision of Trustee, Protector, Advisor;

- Advising, Drafting, Structuring & Management of Trusts;

- Legal representation in Court Proceedings;

- Advising on Tax & Compliance matters.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.