In this edition of Duff & Phelps' European Chemicals Update, we evaluate current trends for key raw materials, prevailing investor sentiment and valuation developments in the featured Industrial Specialty sub-sector.

Our top insights are detailed below:

Key raw materials in the chemicals sector were impacted by fears over an economic slowdown in Q4 2018, with petrochemicals feedstock being the most affected. Additionally, oil supply will likely continue to outpace demand throughout 2019. U.S. shale will likely lead in output growth, even as slower economic growth in some countries further suppresses demand.

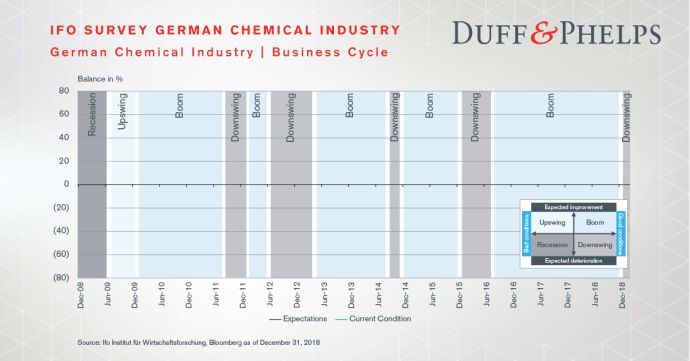

Next, the ifo Business Climate Index for the German chemical industry entered a downswing as current conditions and expectations deteriorated in Q4 2018, falling 32% month-on-month. This is the first time the Index indicated a downswing since H1 2016.

Finally, in the Industrial Specialty sub-sector, market capitalization decreased for the featured companies. Most share price drawdowns materialized in H2 2018 as capital market sentiment deteriorated. Investment activity (measured by the Capex/Depreciation ratio) for Industrial Specialty ranked third behind Consumer Specialty and Agriculture Chemicals. On the other hand, research and development activity (in % of sales) were found to be the lowest in the Industrial Specialty segment, only ahead of industrial gases.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.