By Alex Moglia (Moglia Advisors), Paul R. Brown, (Karr Tuttle Campbell), James Faulkner, (Kroll) and Kenneth Krys (KRyS Global).

Posted with permission of National Association of Federal Equity Receivers (NAFER)

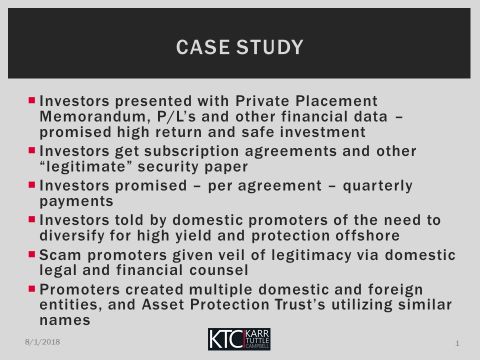

FACT PATTERN

Prepared by Paul R. Brown, Esq., Karr Tuttle Campbell

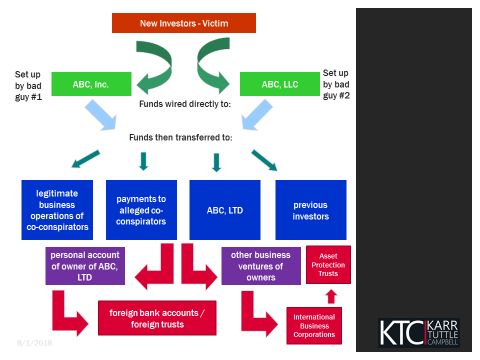

Receiver: appointed as US based receiver for distressed financial services entity; purported investments were for domestic investment(s); entity defaulted on loans; money missing, unaccounted for. There are legitimate business activities commingled with illegitimate conduct.

Receiver: calls counsel outlining above.

Counsel: facts as follows:

- Confirm Receiver's legal right/title to assets

- Missing account information – unable to verify

- Confirmation at least USD$40 million - unaccounted for

- Movement of funds appears to occur to unrelated entities

- Unrelated entities have suspicious ownership structure

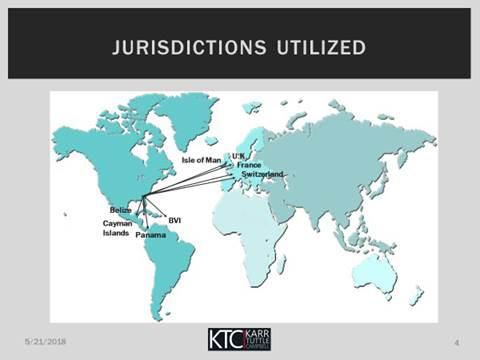

- Some of the funds appear to have been moved to foreign locations – unable to confirm if any funds remain at those locales

Receiver/Counsel next steps:

- Contact known team of investigators

- Outline above - to come up with an

outline of the following:

- Budget

- Deliverable time schedule – depends on liquidity of assets and potential additional movement of same

- Decision tree – depends in part on what jurisdictions are involved

Investigator information vetted with counsel (as obtained from Receiver) now reveals the following:

STRATEGIC CONSIDERATIONS

NAFER Training Camp in Chicago

"Where Has All The Money Gone?"

October 18, 2018

Kenneth Krys, Krys Global

Look Both Ways before Crossing the Street

One of the things you will want to do early in the assessment of tracing the money and determining the litigation strategy is to consider your options outside of the United States, particularly in situations where there is fraud. Cash is fluid and it is not unusual for persons who obtain fraudulently derived receipts to find ways to move that outside the United States and either open foreign bank accounts, acquire real estate, yachts, aircraft, jewelry (for example) or put it into corporate vehicles or trusts. However it may not be something so obvious. There may also be persons or information of interest that are located outside the United States, which if interrogated or collected could assist with your overall litigation plan. The critical aspect is to be cognizant that there may be options beyond the US borders.

What options are available will depend on a number of factors:

- Are you looking for information to assist with proving the fraud, information on assets, to depose a potential witness/target, pursue an asset or potentially litigate against another party?

- What jurisdictions are you considering, and in particular whether they are civil law or common law? What local legislation or nuances will you need to navigate?

- What is your budget? How will your strategy affect the overall cost?

- What potential risks to the Receiver need to be considered before making a decision in pursuing certain strategies?

We look at these in greater detail below.

1. Information/documentation (including the examination of individuals)

The United States is recognized internationally as having a robust legal system for getting information and documentation, particularly when a Receiver has been appointed and needs to investigate a fraud or trace money. The US legal system is not too dissimilar to that of the UK; both share the same historical common law roots, and for that reason have similar legal remedies available. However, seeking information and discovery is one of those matters where, while the legal processes are a little different, the overall objective can be achieved.

In the UK a party investigating a fraud can apply for a disclosure order (also known as a Norwich Pharmacal order) of documents or information that is available in the United Kingdom. It is granted against a third party which has been innocently mixed up in wrongdoing, forcing the disclosure of documents or information, which may identify another person (for example a wrong-doer or a potential beneficiary), or so as to identify the nature of a wrongdoing, both of which may be the subject of subsequent legal proceedings. To the extent the disclosure identifies additional wrongdoing by the third party – it may be possible to use those documents but that cannot be the purpose for which they were sought.

Moreover, one can, where appropriate, apply for a "gag order" when seeking disclosure. A "gag order" directs the party to not disclose that they have been ordered to provide information to a third party. This is particularly helpful where the respondent is a bank or a professional who may have duties to give notice to their client of such matters.

In order to obtain a Norwich Pharmacal Order, applicants will need to show:

- that there is a "good arguable case" that a wrongdoing has occurred;

- that the person against whom the disclosure request is sought be involved, albeit possibly innocently, in the wrongdoing as more than a mere witness;

- that the respondent is likely to have the information sought (i.e. it is not a fishing expedition); and

- the order must be necessary and proportionate and in the overall interests of justice.

Some key points to consider when exploring this option:

Firstly, consider the geographical location of the assets. Many Commonwealth nations and former colonies or current protectorates have similar remedies. That means that these disclosure orders can also be obtained in places like Canada, Australia, Ireland, Scotland, Hong Kong, Cayman Islands, the Bahamas, British Virgin Islands, the Channel Islands, and Gibraltar, just to name a few.

Conversely these remedies do not exist in civil law countries, for instance France, Germany, Switzerland, and most of South America. Therefore obtaining discovery in these jurisdictions is more problematic. Normally, to the extent one wishes to seek discovery from innocent parties, the application to court must be done simultaneously with a criminal proceeding. That means that you need to involve the local authorities in the investigation, which also risks them taking control of the investigation, making you hostage to their timetable and in some cases getting in the way of your efforts. My general rule is to think hard before pursuing discovery in a civil law country. It can be difficult and frustrating.

Secondly, where a Receiver is concerned that information may be removed or destroyed, there may be additional options. In English and English-derived legal systems, an Anton Piller order can be obtained that provides the right to search premises and seize evidence without prior warning due to their clandestine nature. Applications for Anton Piller orders are made ex parte (without the presence or notification of the respondent). In order to obtain an Anton Piller order, you will need to demonstrate that:

- there is prima facie evidence of the wrongdoing;

- that the potential or actual damage must be very serious; and

- there must be clear evidence that the respondent has incriminating evidence in their possession, and there is a real possibility they may destroy this material if they were to become aware of the application.

An Anton Piller order prevents destruction of relevant evidence and is particularly useful in ensuring electronic evidence on computers or mobile devices is preserved. These take a little coordination with attorneys and sometime local law officials, but can be particularly helpful in certain types of cases such as alleged trademark copyright or patent infringement.

Thirdly, be cognizant of the data protection laws of certain jurisdictions, particularly in Europe. I am currently pursuing litigation against a Dutch Big 4 firm and was successful in getting the court in directing the audit firm to provide its working papers. However the audit firm went back to the court and raised concerns with data protection. The result was that the court directed that the documents had to remain in the Netherlands and my team was required to travel to the Netherlands to review the working papers. My team could not take copies or notes. All evidence had to remain in the Netherlands. Whilst pleased I had access to the working papers, it turned into a costly exercise and one where it was not possible to use the documents for any other purpose (for example pursue other assets).

Fourthly, there are still countries where seeking certain information or commencing a proceeding is considered a criminal offense. Just last year, it was reported that a UK insolvency professional and expert in fraud investigations had his passport confiscated and was under house arrest in the United Arab Emirates over a unspecified complaint against him by a defendant in UK criminal proceedings. You want to avoid those types of situations.

Two final thoughts: A remedy, called section 1782 discovery, is available in the United States and has become more popular in recent years. Section 1782 of Title 28 of the United States Code is a federal statute that allows a litigant or "interested party" to a legal proceeding originating outside the United States to apply to an American court to obtain evidence for use in the non-US proceeding. The benefit of this remedy is two-fold. First it is pre-trial discovery. It however has to be with respect to a foreign proceeding and the proceeding is before a foreign "tribunal". Second the potential litigation only needs to be contemplated. Therefore it is not necessary that a cause of action should already be in progress in a foreign court.

Also, I have had some success with letters of request from the court. This is a relatively inexpensive process, and usually involves asking your judge to write a letter to the court in another jurisdiction for assistance. I asked the British Virgin Islands court to send a letter to the Israeli court requesting assistance in getting access to bank documents from an Israeli bank and records and examinations of the directors and their legal advisor in Israel. Not only did the court obtain this information, but permitted me to conduct the examinations in court.

2. Pursuit of an Asset

One of the options that is not normally available to American litigants is the ability to freeze assets. In the UK and the Commonwealth, it is standard practice. Where there is a concern that an asset may be dissipated or moved out of the Receiver's reach, a Receiver can apply for a temporary injunction, also known as a Mareva injunction, that freezes the assets of a party pending further order or final resolution of the Court. While it is not advisable to obtain such an injunction on purely strategic grounds it can have a particularly persuasive effect if the objective is to bring the fraudster to the table to negotiate a settlement and a return of the assets.

Of particular note when considering this option, is that British Commonwealth Courts that grant a Mareva injunction can have worldwide effect. That means if a Receiver can obtain such an order in say the UK, he/she could then seek have it recognized and enforced in any other Commonwealth country. It also means that to the extent the respondent is in a common law jurisdiction, and he seeks to move or transfer assets without approval of the court, he can be found in contempt and in some extreme cases, be denied to provide a defense until he brings himself in compliance.

In addition, a Mareva injunction will normally compel an accounting from the respondent of his assets. That is, not only do you freeze the known assets, but the respondent is ordered to provide you information as to any other assets he owns, possesses or controls. This can be particularly helpful in assessing the potential pool of assets that may be available or potentially other targets of litigation.

Finally, the Court can require that the party applying for the order provide security or a bond, also known as a cross-undertaking. The rationale for this is that because it is such a draconian remedy, to the extent the Receiver's claim is not successful, then the respondent may be entitled to damages for financial or reputational loss caused by having the injunction placed upon him/her. This can sometimes be a hurdle to obtaining this remedy.

3. Recognition of the Receiver or assistance granted by the Foreign Jurisdiction

As a court appointed Receiver, there is the possibility that you can be recognized in a foreign jurisdiction and assume the powers that would be available to a trustee or liquidator in that jurisdiction. In the UK and Commonwealth, court appointed liquidators have broad powers to examine parties and seek information. Often in these jurisdictions, the remedy of choice to investigate fraud is the insolvency law.

Recognition is not automatic. An application must be made to the foreign court to seek recognition. In some jurisdictions there are laws specifically geared for foreign recognition, similar to Chapter 15 of the US Bankruptcy Code which allows foreign representative outside the United States to be recognized onshore1. In other jurisdictions it might be necessary to apply common law precedent. One of the critical aspects some foreign courts will consider is the wording of the order appointing the Receiver, and whether the role and actions contemplated are consistent with the role of a court appointed liquidator2. Therefore it may be necessary to seek from the US courts an order that assists with this. In other instances recognition may be limited to assistance with getting information or examining third parties.

If recognition is not necessarily an option, or available to the Receiver, then another possibility is to apply to commence a winding up proceeding in the foreign jurisdiction, and have a local representative and possibly yourself appointed as joint liquidators. This will allow the Receiver to utilize the powers and remedies available in that jurisdiction and, assuming appropriate protocols and protections are in place to address any local laws, use that information elsewhere. In some jurisdictions, like the UK however, only licensed insolvency practitioners can act as liquidators. It may in this situation be that a Receiver commence proceedings in that jurisdiction, appoint "friendly" liquidators who are minded to work with the Receiver, and enter a protocol agreement with the selected liquidators to share information and legal strategies. These latter options come with a cost. The Receiver will have duties to report to the court, appoint a creditors committee, pay court fees and seek approval of your fees. Therefore you will want to weigh these potential costs against the benefits of such a remedy.

4. Litigation Options and Remedies

One of the biggest benefits of considering your options offshore is that the legal remedies and potential causes of action expands exponentially. Not only that, the application of what constitutes a defense may be different.

In most instances the potential causes of action that can pursued in the United States can similarly be pursued elsewhere. The terms used may be different and processes different, but the actions ring a similar tone. Thus where there are significant assets or deep pockets outside the United States, a Receiver will want to review his options and seek legal advice abroad. There are however some differences that a receiver will want to consider.

One is that the defenses that can pursued by the defendant may be different. In my experience, one of the biggest obstacles to pursuing deep pockets and other parties in the United States is in pari delicto3. While a similar defense can be pursued in England, described as ex turpi causa non oritur actio, it is not accepted by the UK courts with the same vigor and as extensively as the US courts (particularly New York courts) apply in pari delicto4.

Another point to note is that should a separate liquidation proceeding be commenced by the Receiver as discussed in the last section, there may be additional causes of action available to that liquidator that do not exist in contract. For example, there may be preference5 and avoidance remedies available for transactions that took place for a set period up to the liquidation, providing the ability to pursue assets and recover further sums. Assets that appear to have been transferred at undervalue (or gifted for nil consideration) can also be unwound6.

But be careful. There also can be hidden consequences as well. The most serious is adverse costs. In most jurisdictions outside the US, particularly in the UK and Commonwealth, the losing party to legal proceedings has to pay the costs of the successful party. In significant cases this can amount to millions and millions of dollars. ATC ("after the event") insurance is available and something that insolvency practitioners who work in these jurisdictions will often consider.

Another is the cost. London solicitors are not inexpensive and there is a practice that where a case is complex or significant, one brings in a barrister who specializes in courtroom advocacy and litigation. Their tasks include drafting legal pleadings, researching the philosophy, hypothesis and history of law, and advocating the matter before the court. They are not cheap. They charge flat fees (called briefing fees) and depending whether they are a silk and their reputation, seeing briefing fees in the tens of thousands of dollars or even hundreds of thousands is not unusual. Of course, remember, if unsuccessful, you pay the other side's barrister costs as well.

The third point worth mentioning is that when assessing legal options and determining your legal strategy, select the remedy that has the greatest opportunity to bring in recoveries. I cannot tell you the number of times I hear from litigants pursuing claims (and maybe even having successful judgements) that they made no recoveries of assets. Litigation is not a guarantee. We get that. But there is no use pursuing causes of action and incurring the time and expense of those proceedings (including the risk of adverse costs being order against you) if you are not ultimately pursuing a recovery. For example, possibly avoid jurisdictions where historically it is difficult to recover assets or the security of your team is at risk eg China and Russia. In addition be cautious of jurisdictions where the courts may not be sophisticated in international litigation or where there are laws to protect local persons (eg certain Africa and Asian countries). Research countries where historically pursuing certain litigation has been difficult (eg piercing trusts in Nevis).

This doesn't mean you do not consider the options in these jurisdictions. You certainly should. But apply some professional skepticism in deciding whether the options being put forward will result in recoveries and money back in the estate.

And lastly, a word of advice. Do not pursue multiple litigation in multiple jurisdictions. Some attorneys tend to think that using a "shot gun" approach to litigation (that is pursuing as many claims as possible all at once) will have the best effect as it puts the defendant on the back-foot and in theory suggests many multiple avenues for recovery. But in my experience the opposite actually occurs. While initially you may have the upper hand, to the extent the Receiver finds himself in lengthy contentious proceedings, a good defense counsel will use various tactics to give their clients the best chance of success. Defendants may select your weakest case and push it forward hoping for a successful defense or dicta that assists in the other proceedings. They also know that a Receiver has the risk of litigation fatigue if they can drag the proceedings out. An experienced defense attorney will also know how to use information you may argue in one case (for example arguing that one defendant is responsible for the fraud) against you to argue that his client is not responsible. The general rule is that your litigation strategy should be focused. Less litigation is better than more. Deeper pockets are likely more successful than those without assets. This will ensure you maximize the opportunity to procure and collect in assets while at the same time mitigating a large legal bill at the end.

5. Fees, Expenses and Costs

Many of the common law jurisdictions have champerty and maintenance laws7 that mean that attorneys are not permitted to be retained based on the success of the case. This can also apply in some instances to insolvency practitioners. A Receiver will therefore will want to consider this when exploring remedies.

However in some jurisdictions attorneys and/or insolvency practitioners can take a percentage of recoveries or enter into mixed fee arrangements. Also some professionals have come up with creative ways to comply with the law while attempting to align the client's expectations with theirs. You should explore with your professionals what fee arrangements they may be willing to enter to get involved in your case.

6. Local Experience and Reputation

Probably the best advice anyone can give you is to seek input and guidance from reputable local professionals. Particularly in smaller, more remote jurisdictions, having access to someone who knows their way around the legal system and who has experience (and had some success) in pursuing fraud litigation or tracing money is priceless. Too often we hear stories of wasted money and time spent pursuing a remedy that was not viable, or worse obtaining a judgement but failing to bring in a recovery. It is critical therefore that you do some research upfront to ensure those advising you offshore have the knowledge and experience to get you the best result.

TACTICAL STEPS

"The Hallmarks of a Successful Asset

Investigation"

Jim Faulkner & Glen Harloff

Managing Directors, Kroll

National Association of Federal Equity Receivers (NAFER)

Seventh Annual Conference, Chicago, IL

October 18, 2018

THE TEAM APPROACH

As with any investigation, having a cohesive multi-disciplinary team that enjoys working with one another, is absolutely critical. Each team member should respect one another as an equal, with the goal of maximizing individual expertise to achieve the desired result. The team typically consists of legal counsel, a forensic accountant, an investigator, and a team leader.

Legal Counsel

Legal counsel will often be the first person the Receiver calls. Legal counsel's job will be to protect the confidentiality and privilege of the investigation and to develop the legal strategy as the investigation begins to uncover what happened to the assets.

Legal counsel will have the responsibility of dealing with multi-jurisdictional issues in trying to trace and recover assets from other countries. As an example, misappropriated assets are often transferred to or flow through the Caribbean, which can involve legal proceedings governed under US, British Commonwealth (including former colonies), Netherlands, and French laws. Legal counsel may have to engage local counsel and will need to co-ordinate proceedings to gather and preserve evidence, and to identify and secure assets.

Forensic Accountant

The forensic accountant provides the integration of accounting, auditing, and investigative skills. The role of the forensic accountant may include the examination and analysis of company records, as well as the meeting and interviewing of witnesses, especially those associated with the financial operations. The forensic accountant is integral to proving the fraud, which will eventually become the basis for the tracing, freezing, and seizing of misappropriated assets.

The forensic accountant may be required to prepare an expert report summarizing how the fraud occurred, quantifying the loss to the victim, tracing the assets and funds, and providing damages analysis. The forensic accountant may be required to testify at trial or in other legal proceedings.

Field Investigator

The field investigator also plays a crucial role in proving of the fraud - i.e., who, what, where, when, and why. This includes the identifying of documentary and other evidence, the interviewing of witnesses, and making local inquiries. The investigator typically has the ability to make inquiries in other jurisdictions including the conducting of public records searches, and the obtaining of public record documentation to assist in the tracing and identification of foreign assets.

The field investigator is also trained in the art of inspiring key witnesses to cooperate and even "flipping" ones who are partially responsible for the losses.

Team Leader

It is imperative that there be a team leader with experience in asset recovery. Although this is typically the role of legal counsel, there may arise situations where it makes more sense for the forensic accountant or investigator to take on this role, based on the circumstances of the case and experience. Even if a non-lawyer team leader is chosen, appropriate legal direction can be taken from legal counsel in order to preserve the attorney client privilege.

The team leader will be responsible to devise and implement the overall strategy behind the recovery effort. Although the objective is to recover as much as possible, strategic decisions have to be made on a continuing basis including the cost versus benefit of pursuing certain assets and on which countries to focus recovery. Consideration has to be given as to the easiest assets to recover initially, which may help in financing further investigation. Also, there is often a logical order to pursuing assets, as evidence from one jurisdiction may be necessary to provide evidence to pursue an asset in another jurisdiction.

CONFIDENTIALITY

The receiver, his or her attorney, the forensic accountant and the investigator must adhere to rigorous confidentiality in the investigation and the sharing of information on a need to know basis only. Confidentiality shall not be compromised until when appropriate and after the investigation has provided a strategy roadmap for success.

COMMITMENT TO LEGALITY

The team will commit itself to adhering to the highest legal and ethical standards in the investigation. Illegally obtained evidence will not only be admissible, but may also taint other legally obtained evidence. Finally and most importantly, any illegal conduct could result in permanent and irreparable reputational damage to the investigative team, the Receiver and counsel, and could cause devastating harm to the action in litigation and the successful recovery of assets.

THE INTERNAL INVESTIGATION

Before we begin searching the world for assets, we must make sure we have first collected, analyzed and understood all available information at our disposal, as follows:

Evidence Preservation

Our initial role as investigators will be to coordinate the preservation, and prevent the escape hatches, of evidence. We will conduct covert office searches, gather and index all available documentation, and preserve all email, electronic and financial data.

Internal Financial Review

In this work stream we are looking at the books and records, if available, to determine how money came in and how money went out, whether assets listed in the financials are real, and whether there are payments to strange vendors, for example large payments within six months before bankruptcy.

Email Review

Review of emails through key word searching on an e-discovery platform like Relativity may reveal intentional conduct, consciousness of guilt, fraud strategies, or shell companies.

Background Investigations on Initial Suspects

Background investigations on suspects and family members, triangulating with corporate records research on suspicious vendors, may reveal related party transactions. The goal will be to identify all of the suspects' and suspects' family members' entities, and running their criminal and civil priors. Identifying those who have been involved in previous frauds will assist in narrowing the pool of suspects.

Public Records Research on Suspicious Entities

The initial internal investigation may uncover strange clients, vendors, or third parties who can be researched in public records databases, revealing relatives or straw owners connected to the perpetrators.

Personnel Files

A review of personnel files may reveal biographical information and other connections between people and entities that may assist in connecting the dots between internal wrongdoers and external facilitators.

Social Networking Research

Social networking research may likewise assist in making connections between internal wrongdoers and external facilitators.

Internal Investigative Interviews

The internal investigative interviews are the last phase of the internal investigation, after all evidence gleaned from the work-streams identified above have been analyzed and understood. Multiple simultaneous interviews should be conducted by investigators gifted in the art of coaxing the truth and flipping marginally guilty parties into confidential informants who may be able to assist in a proactive external investigation.

THE EXTERNAL INVESTIGATION

Information gleaned in the internal investigation will help lead the external investigation.

The Three Classes of Assets

We shall take a broad approach to the identification of assets, which we can categorize into three classes:

- Financial assets: bank accounts; trust accounts; securities; brokerage accounts; investment assets; other financial instruments; debt proceeds; bond proceeds; receivables and receivable streams.

- Business assets: ownership interests in business entities, such as corporations, partnerships, and joint ventures.

- Hard assets: real property; aircraft; watercraft, such as yachts; automobiles; and lease-holdings.

Proprietary Information Databases

We will begin the investigation with intensive research in information databases, as this is the most cost effective means of identifying assets. In the U.S. and many other jurisdictions, state and local governments record property ownership, business registrations, evidence of debt, lawsuit filings, motor vehicle titles and other proof of ownership in publicly available databases.

Media reports and social networking sites also can be valuable indirect sources of information on assets.

Investigative firms like Kroll have access to thousands of sources through information databases maintained by governments, commercial publishers and their own proprietary files. These databases include those commonly used in law and business, but also databases of a specialized and relatively obscure nature that may have captured asset-related information. Specialized firms have developed strategies to use these databases in support of complex asset search investigations.

Types of Records to Search

Depending on the jurisdiction, we may look for the following types of records:

- Records of business associations – corporations, partnerships and other business entities

- Property records

- Motor vehicle, watercraft and aircraft registrations

- Internet research of social networking sites, bulletin boards, chat rooms and other Internet portals

- Research of media sources (newspapers, magazines, journals and other relevant publications) on a local, regional, and national level

- Federal civil litigation, bankruptcy, criminal and US Tax Court proceedings

- State civil litigation and criminal proceedings, judgments and liens

- Regulatory agency proceedings

It is possible, but not customary, to find evidence of bank accounts or bank relationships in the initial search. This sometimes occurs if a lawsuit, property transaction or debt filing reports a bank name or bank account number.

The goal in this work-stream is to provide the Receiver with the best possible documentation of the subject's ownership, control or benefit of identified assets. The findings in this phase will assist the team in developing a strategy for further investigation.

Field Investigation

Subsequently we will want to conduct discreet interviews of persons whom we believe could have knowledge of the subjects' assets. The names of such persons may be suggested by other human sources, or by the database and public records research we have previously conducted. Discreet sources may include bankers, litigation adversaries, government officials, former employees, vendors, clients, suppliers and the like.

AGGRESSIVE DISCOVERY TOOLS

At the appropriate juncture, we may have to rely on appropriate discovery tools to get behind the wall of shell entities we have been unable to penetrate. Such instruments include the following:

Norwich Pharmacal Order

This order is used in Commonwealth based jurisdictions to obtain evidence from a third party, typically a financial institution for the obtaining of banking and other records. The order can be obtained without the knowledge of the fraudster and typically will include a provision preventing the financial institution from disclosing the order, thus the term "gag and seal" order. These types of orders are also referred to as Discovery Orders or Bills of Discovery in the US. Similarly, individuals may be compelled to furnish testimony by statement or production of documents through US Federal Statute Title 28, Part V, Chapter 117, § 1782.

Anton Piller Order

Often referred to as a civil search warrant, this order is used in Commonwealth based jurisdictions to enter and search the premises of a fraudster for evidence of the fraud. This could be a residence or business. The Courts have imposed strict guidelines in issuing these orders and execution procedures, which you will have to be familiar with before pursuing such an order.

Bankruptcy & Insolvency Act

Fraudsters will often incorporate a business or other entity, typically in an off-shore jurisdiction, to use as a vehicle to try and muddy the asset trail and hinder and prevent the disclosure of information vital to tracing of assets. Although information can be obtained through examination for discovery and other legal proceedings, the fraudster is often able to delay this process, sometimes for years. The Bankruptcy & Insolvency Act, which is similar in most Commonwealth based jurisdictions, can be a very useful tool in obtaining control of the business or entity and in turn the financial and other records. The Court appointed Receiver is afforded significant powers, which may be readily recognized by other jurisdictions and extremely advantageous in the tracing of assets.

Chapter 15 of the U.S. Bankruptcy Code

This represents a potentially very powerful tool in the tracing and recovery of assets when there is a bankruptcy or insolvency proceeding in a country other than the USA. In essence, it provides discovery powers to foreign representatives including the examination of witnesses, the taking of evidence, and the tracing of assets.

Mareva Injunction

When an asset is identified, a Mareva Injunction or "freezing order" is issued by the Court to prevent the asset from being moved, transferred or otherwise dissipated. Mareva Injunctions are now recognized on a world-wide basis.

WISDOM WITH LAW ENFORCEMENT

One of the most difficult questions that arises in an asset investigation is whether to engage law enforcement.

On the one hand, engaging law enforcement early may protect the Receiver from allegations by victims that he was negligent in not reporting an obvious fraud. Moreover, for those with limited resources, law enforcement's legal tools and superior resources may uncover evidence that would have been impossible for the Receiver to find. Having a former federal prosecutor on the asset search team will assist the Receiver in cooperating and generating trust with law enforcement, which in turn will assist in diplomacy efforts with law enforcement, which may result in receiving more valuable information on the government's investigation's results.

The risks of advising law enforcement, however, are also well known. When reporting the matter to law enforcement, it is difficult to limit the amount of information that law enforcement will request. If prosecutors and federal agents are interested in the matter, they may request more and more from the Receiver and her team, which may bring unwanted scrutiny and even publicity to the Receiver's actions, not to mention the sacrifice in time of having to participate in an official investigation. Perhaps the greatest risk of all, however, is that law enforcement (if successful) may forfeit the hidden assets to government coffers, denying the Receiver's victims of their fare share.

Footnotes

1. The leading precedent in Chapter 15 is Morning Mist v. Krys re In Fairfield Sentry

2. An important case in this respect is Stanford International Bank Limited (acting by its joint liquidators) v Director of the Serious Fraud Office

3. This doctrine provides that courts will not enforce an invalid contract and that no party can recover in an action where it is necessary to prove the existence of an illegal contract in order to make his or her case.

4. The situation has been different, however, for some U.S. receivers.

5. An unfair preference (or "voidable preference") is a legal term arising in bankruptcy law where a person or company transfers assets or pays a debt to a creditor shortly before going into bankruptcy, that payment or transfer can be set aside on the application of the liquidator or trustee in bankruptcy as an unfair preference or simply a preference.

6. For example in the UK an administrator or liquidator may apply to the court for an order avoiding any transaction made at an undervalue in the two years before the administration or liquidation if the company was then (or as a result of the transaction became) unable to pay its debts as they fell due.

7. The purpose of this is to avoid frivolous litigation being pursued.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.