Over the past few years growth and profitability in the private banking market have been very strong. However, shifting external conditions are likely to make the future more challenging and complex. They include intensifying competition and consolidation emerging technology adoption, increasingly demanding clients and therefore higher sophistication of the private banking service offering. Against the background of these developments, what will it take to grow and sustain revenue while keeping margins at attractive levels in such an environment?

Taking on the Challenge

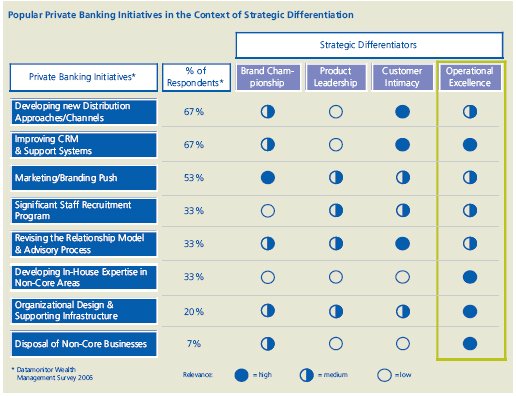

To take on the challenges, private banks are pursuing a multitude of initiatives and strategies for differentiation in competition. As illustrated below, strategic differentiators are covering specific sets of these popular private banking initiatives. Our analysis demonstrates that Operational Excellence (OE) is the most comprehensive and balanced strategic differentiator as it is most relevant with regards to coverage of the initiatives.

|

Comprehensive and integrated framework - Stakeholders are shaping and driving the future

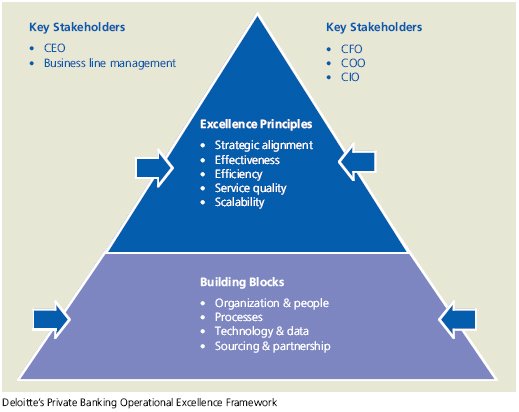

Deloitte developed a unique approach to OE especially targeted at the unique characteristics of private banking. As illustrated on the right, Deloitte's Operational Excellence Private Banking Framework covers three dimen-sions: Excellence Principles, Key Stakeholders, and Building Blocks.

- Excellence principles provide strategic guidance to the bank's development and management from an operational perspective

- Key stakeholders' views have to be considered to ensure a balance between diverging strategic and operational targets, as well as frontand back-office functions

- Building blocks cover all operational areas ensuring the framework's comprehensiveness

OE affects most parts of the bank and involves major changes. Therefore, buy-in and involvement of all stakeholders to the program is crucial.

Bottom line impact - Unlocking enterprise value

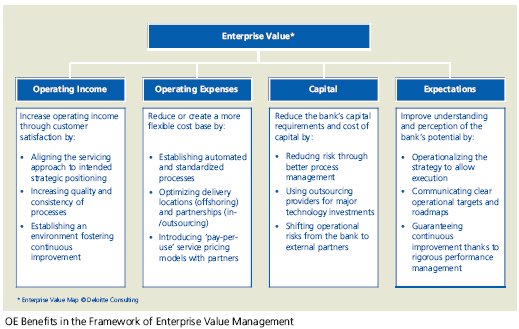

OE is a strategic initiative because its ultimate goal is to increase the bank's enterprise value by aligning and optimizing its overall organization, processes, technology and partnerships.

Deloitte's OE Private Banking Framework increases a bank's enterprise value. By means of Deloitte's Enterprise Value Map, the benefits include:

- Expectations: OE improves the understanding and perception of the bank's potential by its stakeholders

- Capital: OE reduces the bank's deployed capital and cost of capital

- Operating expenses: OE creates a more favorable and flexible cost base

- Operating income: OE increases revenues through higher customer satisfaction

Instilling OE will also allow the bank to pursue new strategic options, such as insourcing of operations and technology.

A proven implementation approach - Making it happen

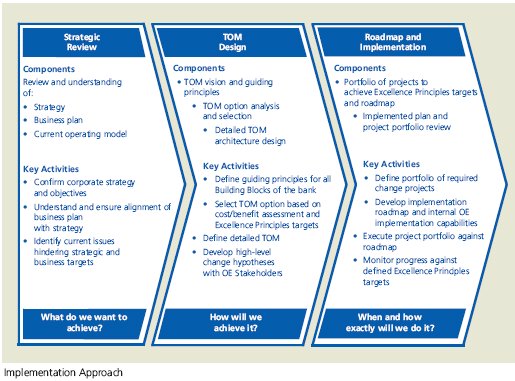

The key benefit of applying Deloitte's approach to Operational Excellence (OE) is that it aligns and integrates changes in all Building Blocks of a bank and balances the Excellence Principles. In order to ensure that this core benefit is captured, a comprehensive and proven implementation approach is required. The three key phases towards realizing Operational Excellence are:

- Strategic review to define the bank's goals, assess its current set-up and ensure future alignment of all operational areas to support this vision

- Target Operating Model (TOM) design to lay out a detailed map of the bank's future operations and identify changes required to achieve the defined targets

- Roadmap and implementation to define the project portfolio, roadmap for change, and execute the implementation

Key for success is that the bank continuously monitors success in achieving Excellence Principles.

Financial services case study - A real life success story

The Client's Initial Situation

The growth of the structured credit market over the last 10 years made the establishment of a credit business a vital element of any large bank's business portfolio. In response to this development our client built a new debt capital markets division by blending legacy business divisions with strategic acquisitions.

Deloitte's Mandate

Deloitte was engaged to develop the division's market strategy, TOM, and implementation roadmap, as well as to manage the implementation project portfolio and several work streams. The Deloitte team consisted of multiple capabilities, including corporate strategy, operations, and technology. In addition, legal and compliance specialists as well as experts in enterprise risk management supported the engagement.

The Deloitte Difference

Choosing the right combination

Combined Expertise

In today's complex business environment, it takes a team with our broad knowledge base in many areas to advise clients and individuals with strong principles and values to do it the right way. Deloitte consultants bring the right combination of multi-disciplinary experience and core values to deliver insights that help banks unlock the potential of their business.

We combine in-depth industry knowledge and strategic, operational, and technical expertise with proven methodologies and tools to deliver high value advisory services to the financial services industry. We are also fully independent to any technology solution or supplier.

Long-Term Client Relationships

Deloitte's strength lies in the successful and hands-on execution of projects with clearly measurable results. We cultivate long-term relationships with our clients and assist them in creating sustainable values.

Our client list includes banks, trust companies, insurance companies, investment management groups and pension plans, finance and leasing companies, merchant banks, securities firms and brokers.

Financial Services Industry Experience

What distinguishes us from our competitors is our in-depth knowledge of the financial industry. Our qualified professionals work alongside practitioners and policy makers in the financial services industry to offer outstanding service to our clients.

Global Access – Local Touch

We believe that we perform at our best because we have a local face. Our international network provides access to a wealth of insight, but we rely on local market understanding to ensure the suitability of our recommendations.

Interested?

Our financial services team would be pleased to advise you on how to apply Deloitte's Private Banking Operational Excellence framework to your specific business. For further information and enquiries please do not hesitate to contact our expert.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.