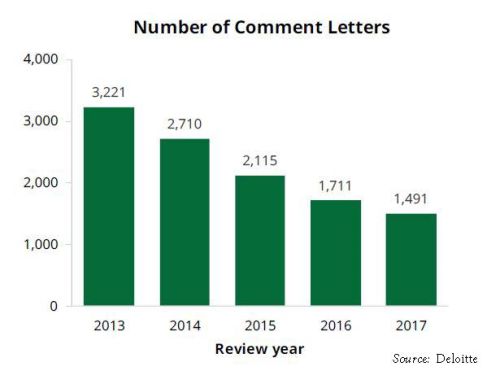

This month, Deloitte & Touche LLP released its annual study on the Securities and Exchange's ("SEC") recent comment letters. The 2017 study notes a decline in the overall number of SEC reviews with comment letters and in the number of SEC comments issued over the past several years. In 2017, 1,491 comment letters were issued by the SEC, a 13% decline from 2016 and 54% decline over the prior five-year period. The SEC has attributed this trend to the effectiveness and transparency of the review process and improved financial reporting by issuers. The number of comments per review has also declined steadily over the five-year period, with 1.33 comments received on average by registrants, and only 20% of issuers receiving two or more comments in a review.

In the report, Deloitte identified the most frequently addressed areas in SEC comment letters:

- Non-GAAP financial measures overtook MD&A as the top topic addressed in reviews with comment letters and overall comment letters issued by the SEC. 474 reviews with comment letters relating to non-GAAP measures accounted for 43% all reviews in 2017. The number of comment letters on this topic represented a decline from the prior year, however, as registrants have revised annual disclosures to address prior SEC comments.

- MD&A disclosures have continued to be a leading source of SEC comments (18% of all reviews in the past year), with a particular focus on uncertainties affecting results of operations, estimates in critical accounting policies, liquidity and capital resources, disclosure of contractual obligations, early-warning disclosures and income tax disclosure.

- Additional topics heavily represented in SEC comment letters issued in 2017 include disclosures relating to fair value, segment reporting and revenue recognition.

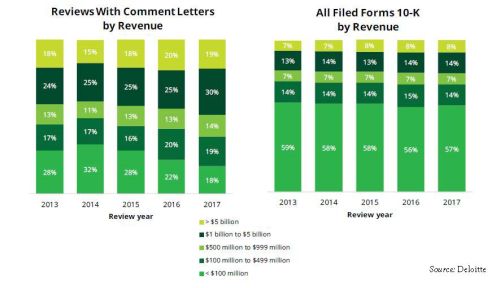

Last, the report offered an analysis of the specific filing status and revenues of issuers who received SEC comment letters in recent years:

- While large accelerated filers have consistently been subject to the most reviews with comment letters since 2013 (56%), large accelerated filers have only accounted for 29% of the filed 10-Ks over the same five year period.

Companies that have generated more revenue have received a disproportionately higher number of reviews with comment letters than companies generating less revenue. Since 2013, on average, issuers generating $1 billion or more revenue accounted for 44% of the reviews with comment letters, although they only represented 21% of the filed Form 10-Ks eligible for review.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved