Keywords: pay versus performance, SEC, disclosure

The US Securities and Exchange Commission (SEC) has proposed a "pay versus performance" rule in accordance with a Dodd-Frank Wall Street Reform and Consumer Protection Act mandate to require SEC reporting companies to disclose in a clear manner the relationship between executive compensation actually paid and the financial performance of the company.1 If adopted as proposed, the rule would require disclosure in proxy or information statements in which executive compensation information is required to be included pursuant to Item 402 of Regulation S-K. Comments on the proposed rule must be submitted by July 6, 2015.

Description of Proposed Rule

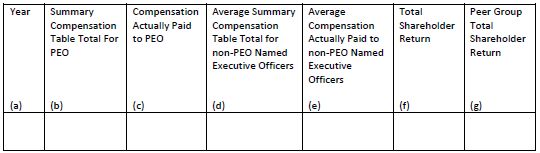

The proposed rule would add new subsection (v) to Item 402 of Regulation S-K, requiring a new compensation table, showing the relationship between compensation actually paid and performance, with performance measured both by company total shareholder return (TSR) and peer group TSR. The disclosure would also have to include a description of the pay versus performance relationship. The table is required to be in the following format:

Pay Versus Performance

The new table would contain data for up to five years. Companies would have flexibility as to the exact placement of the table within the proxy or information statement, although the proposing release indicates that the SEC generally expects this new table to appear as part of the executive compensation disclosure section.

Companies Covered. As proposed, the pay versus performance rule would apply to all SEC reporting companies, except:

- Foreign private issuers,

- Registered investment companies and

- Emerging growth companies.

Business development companies (a category of closed-end investment company that are not registered under the Investment Company Act) and smaller reporting companies would be subject to the rule, although the disclosure requirements for smaller reporting companies would be scaled down.

Filings Covered. Pay versus performance disclosure would be required in proxy or information statements that are required to contain executive compensation disclosure pursuant to Item 402 of Regulation S-K. The new pay versus performance information will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934 unless the company specifically incorporates it.

Executives Covered. Under the proposed rule, the pay versus performance table would have to separately provide compensation information for the principal executive officer, on an annual basis, for each of the past five fiscal years (three in the case of smaller reporting companies). If more than one person has served as principal executive officer in any year included in the new table, the compensation of all persons serving in that capacity would be aggregated. In addition, the table must provide average compensation, on an annual basis, for the named executive officers, other than the principal executive officer, identified in the summary compensation table (Remaining NEOs) for such years.

Pay Covered. For the purposes of the new pay versus performance table, executive compensation actually paid would consist of total compensation as reported in the summary compensation table, modified to adjust the amounts included for pension benefits and equity awards.

The aggregate change in actuarial present value of the executive's accumulated benefit under all defined benefit and actuarial pension plans set forth in the summary compensation table would be deducted from the total to calculate compensation actually paid, with only actuarially determined service costs for services rendered by the executive during the applicable year added back. Smaller reporting companies would not have to make this pension adjustment because their scaled disclosures do not include pension plan disclosure.

In addition, equity awards would be considered actually paid on the date of vesting, whether or not exercised. They would be valued at fair value on the vesting date, rather than fair value on the date of grant as reported in the summary compensation table. Accordingly, the stock and option award amounts shown in the summary compensation table would be subtracted from total compensation and the vesting date fair value amounts for these equity awards would be added back to calculate compensation actually paid. Vesting date valuation assumptions would have to be disclosed if they are materially different from those disclosed in the financial statements as of grant date.

The new pay versus performance table also would disclose, in an accompanying footnote, the amount of compensation deducted from, and added to, summary compensation table total compensation in determining compensation actually paid for both the principal executive officer compensation and average Remaining NEO compensation.

Measure of Performances. The proposed rule would require that TSR be the performance measure used in the pay versus performance table, calculated, in accordance with Item 201(e) of Regulation S-K, by "dividing the (i) sum of (A) the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and (B) the difference between the company's share price at the end and the beginning of the measurement period; by (ii) the share price at the beginning of the measurement period." TSR must be presented in the table both for the company and for a peer group which the company has identified either in its stock performance graph or its compensation discussion and analysis. Smaller reporting companies do not need to provide peer group TSR.

Description of Pay Versus Performance Relationship. A clear description of the relationship between pay and performance must accompany the table in narrative or graphic form, or a combination of both. For example, the proposing release indicates that the relationship could be expressed as a graph providing executive compensation actually paid and change in TSR on parallel axes and plotting compensation and TSR over the required time period. Another approach identified in the proposing release would show the percentage change over each year of the required time period in both executive compensation actually paid and TSR, with a brief discussion of that relationship.

Companies may supplement the required disclosure by also showing pay versus performance using "realized pay," "realizable pay" or another appropriate measure. However, any such supplemental disclosure may not be misleading and may not be presented more prominently than the required disclosure.

XBRL. As proposed, the values in the pay versus performance table would have to be tagged in XBRL and the related footnotes would have to be block text tagged. This would be the first time the SEC's interactive financial data requirements would be applied to proxy statements.

Phase-In. The general phase-in for the rule will require pay versus performance disclosure for three years in the first proxy or information statement in which such disclosure is required. In each of the two subsequent years, another year of disclosure would be added.

Smaller reporting companies would only need to provide information for two years initially, adding the additional year in their next annual proxy or information statement that requires executive compensation disclosure. Also, smaller reporting companies will not have to comply with the XBRL requirement until the third annual filing containing pay versus performance disclosure.

Newly reporting companies would not need to include pay versus performance information for fiscal years prior to their last completed fiscal year.

Practical Considerations

Realized Pay. Many companies have already been including realized or realizable pay in their proxy statements. These companies will need to consider whether to conform their existing presentation formats to that required by the proposed rule or to retain their presentations in addition to that required by the proposed rule. To the extent companies choose to retain their existing disclosures, they will also have to consider whether any presentation changes are needed so that their supplemental realized or realizable pay disclosures are no more prominent than the mandated pay versus performance table. Companies that do not currently include realized or realizable pay will want to consider whether there are additional measures that they want to provide if the rule is adopted in order to better explain their compensation decisions.

Peer Groups. For the purposes of pay versus performance disclosure, companies would have to include peer group TSR in their tables, using either the peer group for the stock performance graph or the peer group identified in the compensation discussion and analysis. Therefore, companies should consider which peer group would be more appropriate for a pay versus performance analysis and whether they want to make any adjustments to either of these two peer groups.

Proxy Advisory Firms. It is too early to tell if the new pay versus performance disclosure requirements will lead to proxy advisory firms or investors targeting a pay versus performance correlation that they will seek to apply across the board. Companies may want to consider in advance how they would respond to such treatment in light of their particular facts and circumstances.

Cause and Effect Problem. If TSR is required to be used for pay versus performance disclosure, and this disclosure in the proxy statement becomes the measuring stick for a company's success in linking pay to company performance, companies may need to consider whether, as a practical matter, they should use TSR as the relevant performance criteria in all performance-related equity grants. While many companies already use TSR (both absolute and relative), many other companies like to use TSR in combination with other performance measures and others do not use TSR at all. However, if a company uses a combination, or a measurement for vesting other than TSR, it will run the risk of future disclosure of increased pay at a time when the TSR may not have increased proportionally (or, of course, decreased pay at a time when the TSR has increased). Based on the requirement for companies to disclose pay for company performance based on TSR, companies that do not use TSR (or only use it as one of many factors) will at least need to consider how their choice of performance conditions in equity awards will need to potentially be disclosed under the proposed rule.

Performance Period Timing Issue. Even if a company uses TSR as the way to measure performance for an equity award, the disclosure of the fair value upon vesting for a performance award may not result in the intended result of showing the relationship between pay and performance for many performance shares or performance share units. This is because the vesting often does not occur until the calendar year following the last calendar year of the performance period.

For example, a company may grant performance share units to an executive with cliff vesting at the end of five years, based on TSR over a five-year performance period. It is possible that TSR may increase greatly over each of those five years (resulting in vesting) but that TSR may drop greatly during the sixth year. Because public companies typically do not vest awards and distribute vested shares until the compensation committee can certify the results following the end of the performance period (because of requirements for federal tax issues requiring such certification), it is possible that this equity award may not be considered vested until the sixth year and included in the new table in the sixth year when the TSR has actually decreased. This is the type of example that companies will need to consider as they design future grants of equity awards in relation to the required disclosure in this new pay versus performance table.

Definition of Vesting. The vesting date of equity awards is not defined in the proposed rule, and the limited guidance on this topic leaves questions regarding the correct timing for when an award would be considered "vested" for purposes of this disclosure. For federal tax purposes, vesting is generally analyzed as occurring at the point in time when the equity award is no longer subject to a substantial risk of forfeiture (although the concept is defined differently in different sections of the Internal Revenue Code). Under the proposed rule, it would be necessary to include the fair value on the vesting date of all equity awards "for which all applicable vesting conditions were satisfied during the covered fiscal year," but the proposed rule does not offer any guidance on the complexities of analyzing when all applicable vesting conditions would be satisfied in many equity award grants or in identifying which conditions constitute vesting conditions.

To illustrate how complicated a vesting date determination can be, consider a company that grants restricted stock units that become fully vested on the earlier of the three-year anniversary of the date of grant or the executive's retirement, and the grant is made to an executive who meets the criteria for retirement. Additionally, the restricted stock unit grant provides that shares will be distributed to the executive one year following the year in which the restricted stock units become vested, and the shares distributed are subject to a clawback for two years following the date of distribution. If the executive remains employed through the entire three-year vesting period and receives such shares in year four (one year after the date of vesting), it is unclear when such restricted stock units should be considered vested for purposes of the proposed rule. In this example, the restricted stock units would be considered vested on the date of grant for federal tax purposes because the shares would no longer be considered to be subject to a substantial risk of forfeiture, and the executive would be taxed on the fair market value of the shares in year four when distributed.

Under the proposed rule, it is not clear when this restricted stock unit award would be considered to have satisfied all applicable vesting conditions. The restricted stock units could be considered vested on the date of grant if the fact that the executive met the conditions of the retirement definition on the date of grant was analyzed as the point in time where the applicable vesting conditions were satisfied (similar to the federal tax analysis leading to the conclusion that this equity award was substantially vested on the date of grant). Alternatively, the restricted stock units could be considered vested on the completion of the three-year vesting period or when the executive receives the fully vested shares in year four and is able to realize the economic gain of the shares by selling them. Finally, the restricted stock units could be considered vested only after the end of the clawback period because until such period is complete there is a possibility that the executive will forfeit the shares. Hopefully, the SEC will provide additional guidance as to which is its intended interpretation.

Average Pay Disclosure. Although the proposed rule only requires tabular disclosure with respect to the Remaining NEOs on an aggregate basis, companies may want to consider whether also providing information for each such person on an individual basis provides investors with a more meaningful picture of their "realized" compensation and, if so, where to add this disclosure.

Say-On-Pay. Because the new pay versus performance disclosures would be an element of executive compensation disclosure pursuant to Item 402 of Regulation S-K, they would expressly become part of what is voted upon in the say-on-pay advisory vote. Companies should begin to reflect on how these disclosures may impact advocacy for favorable say-on-pay results.

Informing the Board. Companies should inform their boards of directors, and particularly their compensation committees, of the SEC's pay versus performance proposal.

Effective Date. The SEC did not indicate a proposed effective date for the pay versus performance rule. However, it is possible that final rule could be adopted in time to be applicable to the 2016 proxy season.

Draft Sample Table. Although the rule is still in the proposal stage, and it is not clear when the final rule will be adopted or become effective, it would be useful to prepare a draft table based on the proposed rule so that adequate disclosure controls and procedures can be developed to gather the additional required compensation information. For example, individuals who prepare executive compensation disclosure for proxy statements will need to start tracking vesting date valuations for equity awards. Also, average Remaining NEO compensation may include different individuals, and different numbers of individuals, in each year presented in the table. Mocking up a sample table may generate helpful experience for the creation of the actual table when the rule is finalized. In addition, practical issues that may arise may suggest comments that would be productive to submit to the SEC.

Comments. The SEC is actively seeking comments on its pay versus performance proposal. Companies that have concerns about any aspect of the proposal—such as the one-size fits all approach of requiring TSR as the table's performance measure or requiring of XBRL data tagging in the proxy statement—should consider submitting comments to the SEC on the proposed rule.

Technical Points. There are a number of technical points that practitioners will need to keep in mind if the pay versus performance rule is adopted as proposed. For example, the pay versus performance disclosure does not need to be incorporated into the Form 10-K. Companies will want to be careful not to unintentionally incorporate the section by reference by incorporating the entire executive compensation section into Part III of their annual reports on Form 10-K. Also, the interactive financial data requirement means that the XBRL exhibit would need to be filed with the proxy statement and posted on the company's website.

Originally published May 13, 2015

Footnote

1. Release No. 34-74835, available at http://www.sec.gov/rules/proposed/2015/34-74835.pdf.

Learn more about our Corporate & Securities and Employment & Benefits practices.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2015. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.