Overview

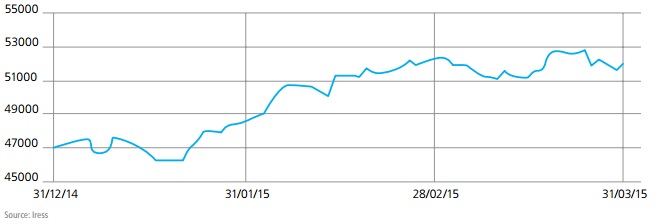

The ASX 200 Accumulation Index returned 10.33% over the quarter ending 31 March 2015.

S&P ASX200 Accumulation

Industrials and banks recorded moderate earnings growth during the February reporting season, offsetting falls in resources.

Valuation Metrics

Valuation metrics suggest that the sharemarket is modestly overvalued.

| Current | Long Term Average | |

| ASX 200 Price/Earnings (actual 12mths) | 17.0 | 15.0 |

| ASX 200 Price/Earnings (1 yr Forecast) | 16.7 | 14.1 |

Outlook

Our outlook for key market sectors is as follows:

Banks

Conditions have been very favourable for the banking sector given the low interest rate environment, strong demand for residential property loans and benign level of bad debts. The strong level of bank profitability however hides significant looming risks. Unfortunately house prices (certainly in Sydney and Melbourne) are in bubble territory and household debt is at or near record levels, which means the risks for lenders (banks) are clearly rising. Loan defaults would escalate if we either see a sharp rise in interest rates (a 2% increase would result in a 40% increase in mortgage repayments) or a moderate rise in unemployment. Although a sharp rise in interest rates does not currently look likely, a moderate rise in unemployment cannot be ruled out given Australia's uncertain economic outlook.

Resources

Despite sharp falls among the miners, valuations based on current spot prices imply further downside risk if commodity prices stay lower for longer than most analysts expect. Given the significant overinvestment in property and infrastructure in China, the risk of a protracted downturn cannot be ruled out. As a result we remain cautious on the sector in the near term.

Infrastructure & Utilities

The low interest rate environment has heightened demand for perceived lower risk yield based investments such as infrastructure and utilities. Valuation metrics now look stretched (well above long term averages) for many stocks in the sector.

Cyclical Industrials

With most sectors screening as expensive on valuation metrics, this is one of the very few sectors that still offers value. Typically earnings in this sector can be reasonably leveraged to any incremental improvement in demand. As an example, stocks exposed to residential housing construction have already appreciated but the approval process significantly lags construction activity so further profitability is likely. On the flipside, these stocks tend to react very quickly to any bad news and can turn negative well before peak profitability is reached.

Australian Real Estate Investment Trust (AREITs)

The demand for yield has led to sharp gains in AREIT share prices in recent years. The demand has not just been domestically driven either. Overseas investors have shown a particular interest in residential and commercial property, helping to boost asset prices. This has occurred despite relatively subdued fundamentals. Office and industrial markets are generally suffering from an excess of supply. Bricks and mortar retail is suffering from the duality of below trend sales growth and convenience of online shopping. Residential markets are either suffering from the downturn in mining (Brisbane and Perth) or the bubble that is Sydney and Melbourne. Notwithstanding, those quality property trusts that have relatively low debt and long term leases in place in areas of high employment should continue to perform well.

Conclusion

Australian equities are modestly overvalued and therefore remain more vulnerable to any deterioration in earnings. An improvement in underlying earnings is needed to justify current valuations. We recommend investors marginally reduce exposure into the current strength.

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2014 Moore Stephens Australia Pty Limited. All rights reserved.