Overview

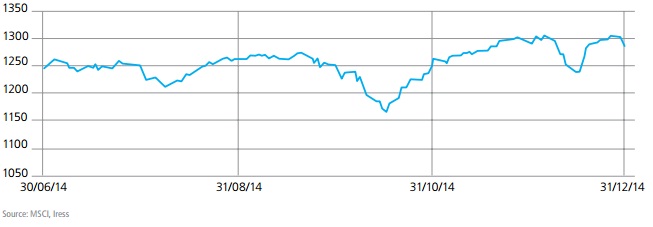

The MSCI World Index (ex-Aust) in local currency returned 3.40% over the six months ending 31 December 2014.

Outlook

Despite a deterioration in the global growth outlook, US equities reached new highs in December as third quarter economic growth was subject to a sharp upward revision. Notwithstanding, company valuations remain stretched despite the positive fundamentals. The end of Quantitative Easing together with the prospect of rising interest rates is likely to limit any sharemarket gains.

European equities are also unattractive. Valuation metrics do not reflect the very poor economic fundamentals. Valuations in China appear cheaper, but downside risks to earnings remain high.

Valuations

Consensus earnings growth expectations for the top 500 US companies (S&P 500) now approximate 8.8% for CY14 and 12.3% for CY15. Our fair value estimate for the S&P 500 for CY14 is 1751 and 1967 for CY15. As at 31 December, the S&P 500 index is trading at 2059 points.

Conclusion

Over the last 18 months, Australian investors in global equities have benefitted from rising corporate profitability and the falling Australian dollar. Although we expect the Australian dollar will continue to fall over the coming 12 months, global equities no longer offer compelling value. Indeed, should growth in the United States disappoint, then a sharp equity market correction would be likely. Thankfully, this is not our base case expectation but in the absence of value, we recommend investors maintain a modest underweight position.

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2014 Moore Stephens Australia Pty Limited. All rights reserved.