Overview

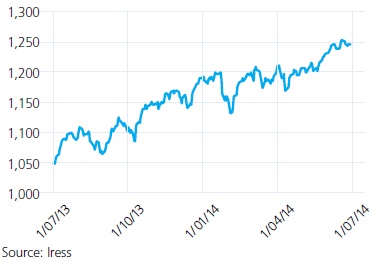

Over the year ending 30 June 2014 the ASX 200 Accumulation index rose by 17.43%.

S& P ASX200 Accumulation

Valuations

Despite its numerous shortcomings, the Price/Earnings (P/E) ratio is one of the more common valuation metrics. As at 30 June 2014, the P/E for the Australian sharemarket (ASX 200) is around 15.6 times earnings (i.e. the weighted average earnings by market capitalisation of the market as a whole), while the long term average is around 15 times earnings. This infers that the sharemarket is modestly overvalued at the current time but when taking into forecast 2015FY earnings, we would expect fair value to be around 5600 for 30 June 2015, implying potential upside of 3.8% over the next 12 months.

Outlook

With limited upside expected in the next 12 months, the outlook for Australian equities is not compelling. Share prices are driven by expectations about future corporate profitability, risk and long term growth. It follows that the market can rise if future earnings expectations increase. If earnings expectations do not increase but the market rises regardless, this is referred to as a multiple re-rate (the market multiple, or P/E, rises) and is usually because overall market risks are perceived to decrease.

Since the depths of 2009, the market rally has been driven by a combination of improving corporate profits and because the market multiple has risen (back to over 15 times earnings). At this point it is clear that any further rise in the market multiple is probably unjustified. A market multiple above 15 is potentially sustainable, but only if risks are likely to remain lower than historical long term averages. In our view, this is definitely not the case so the only way the market can sustainably rise is if corporate profits continue to improve.

In the short term profits may well continue to rise given the underlying momentum in the economy. However, with the market relatively fully priced, it will be much more sensitive to any bad news or external shocks that may emerge.

Conclusion

As a result, the risks/reward equation has moved from favourable to marginally unfavourable and so we would advocate a move from an overweight allocation back to a slightly underweight allocation to Australian equities.

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2014 Moore Stephens Australia Pty Limited. All rights reserved.