INTRODUCTION

Cayman is one of the leading international domiciles for funds offering a variety of fund structures with differing levels of subscription requirements, service provider requirements and authorisation timeframes depending on the structure and the targeted investor profile for a particular project.

There are no restrictions imposed in terms of strategy with Cayman funds being suitable for directional equity / long short equity products, equity arbitrage, equity statistical arbitrage, event driven, fixed income and fixed income arbitrage, global macro, managed futures, distressed securities and convertible arbitrage strategies, amongst others. Furthermore, there are no restrictions on investment in underlying funds. In addition to being a leading international domicile for funds, Cayman is also one of the main service locations (fund administration, audit, legal and consulting services) for funds.

Regulatory Regime

The Cayman Islands Monetary Authority ("CIMA") is the competent authority responsible for the initial authorisation and on-going supervision of all registered and licenced Cayman fund structures. The legislative basis for funds in the Cayman Islands is found in the Mutual Funds Law (Revised), the Securities Investment Business Law (Revised), the Companies Law (Revised), the Trusts Law (Revised), the Partnership Law (Revised) and the Exempted Limited Partnership Law (Revised).

Due to the types of investors which are generally targeted by promoters of Cayman funds, these funds are most frequently established as registered or exempted schemes or schemes which fall outside the Mutual Funds Law (Revised).

The categories of regulation applicable to funds in Cayman are based on certain factors including the minimum subscription amount applicable to an investment in the fund, whether and where the fund's interests are listed, the location of the principal office of the fund, the number of investors in the fund and their control over the fund's operators, the liquidity of the fund's interests and the type of interests issued by the fund.

Authorisation

No regulatory review is required of the constitutional or offering documents of a registered fund or a fund which is exempted from registration or which falls outside the ambit of the Mutual Funds Law (Revised). This allows for the launch of such a fund, the acceptance of subscriptions and the commencement of trading as soon as the terms of its constitutional and offering documents are settled, its service providers are appointed and, where applicable, the offering document and certain prescribed particulars are filed with CIMA.

Principal Legal Structures

The legal structures within which regulated funds can be housed are companies, unit trusts and limited partnerships. Segregated portfolio companies can be established with statutory based segregation of assets and liabilities between the segregated portfolios established by the company.

Liquidity Options

Cayman funds can be structured as open-ended or closed-ended schemes. Gates, deferred redemptions, holdbacks, in-kind redemptions and side pockets can all be facilitated within these types of funds.

Service Providers

The use of managers, administrators, custodians and/or prime brokers for Cayman funds is well established and many leading names in these fields are available to provide the necessary services whether from within or from outside Cayman. A Cayman regulated or licensed fund will need to appoint Cayman based and CIMA approved auditors. A Cayman fund structured as a unit trust will generally need a Cayman based and regulated trustee. A Cayman corporate fund, a Cayman incorporated general partner of a limited partnership fund and the limited partnership itself will need to appoint registered office service providers based in Cayman.

Stock Exchange Listing

Cayman fund shares, interests or units can easily be listed on the Irish Stock Exchange within the same timeframe as the fund's establishment, if a listing is required or considered beneficial.

A listing on the Irish Stock Exchange (the "ISE") meets the "exchange listed" criteria of many European counterparts/investors.

Other Dillon Eustace Guides

Other investment fund related guides available from Dillon Eustace are available at www.dilloneustace.ie

CAYMAN

Set out below are some of the reasons why Cayman is one of the leading international jurisdictions for the establishment and domicile of funds.

Tax Neutrality

The primary reason for Cayman's popularity is its tax neutral platform for investment structures. A Cayman fund will generally not be liable for any direct taxes in Cayman and therefore not add a tax layer to any taxation imposed in the jurisdictions where it holds its investments or where its investors are domiciled.

Legal Framework

Cayman has a common law legal system which is based on the internationally recognised standard of English law. Cayman makes use of specialised commercial court judges and has the Privy Council, which shares some common members with the English House of Lords, as its final appellate court.

Regulatory Framework

Cayman has a regulatory framework, including anti-money laundering, counter terrorism and information exchange regimes which meet or exceed international standards.

Proven Track Record

Cayman has a proven track record of a successful funds industry which has operated for more than 20 years and Cayman currently stands as the 5th largest financial centre in the world.

Service Providers

Cayman has many well established and respected household names in its service providers many of whom who have been operating in Cayman for the last 20 years.

Familiarity

Investors and managers are confident in and familiar with and in many cases prefer dealing with Cayman Islands fund structures.

Political and Economic Environment

Cayman has a stable political and economic environment with its legal framework being based on the English system, with defence matters being in the hands of the English government and with the oversight of a Governor in the Islands who is a representative of the British Crown.

REGULATORY CATEGORISATIONS

As described in the introduction, the categories of regulation of Cayman funds are based on certain factors including the minimum subscription amount applicable to an investment in the fund, whether and where the fund's interests are listed, the location of the principal office of the fund, the number of investors in the fund and their control over the fund's operators, the liquidity of the fund's interests and the type of interests issued by the fund.

Registered Funds

A registered fund under the Mutual Fund Law (Revised) is a fund which is open-ended in respect of redemptions and which either has (i) a minimum applied to the aggregate equity interests purchasable in the fund set at US$100,000 or its equivalent in any other currency or (ii) its equity interests listed on a specified stock exchange1. A registered fund is required to file its offering document and certain prescribed particulars with CIMA and to pay a fee on registration and an annual fee. A registered fund is subject to the supervision of CIMA and will be required to appoint CIMA approved and Cayman based auditors. The appointed auditors will be required to monitor the fund, perform an annual audit on the fund and file an annual report with CIMA.

Master Funds

Master funds which issue equity interests that are redeemable at the option of those investors to more than one investor at least one of which is a registered or licensed fund will need to file its offering document, if any, and certain prescribed particulars with CIMA and pay an annual fee. This category of master fund will be subject to the supervision of CIMA and will be required to appoint CIMA approved and Cayman based auditors. The appointed auditors will be required to monitor the fund, perform an annual audit on the fund and file an annual report with CIMA.

Exempted Funds

An exempted fund under the Mutual Fund Law (Revised) is a fund whose equity interests are held by not more than fifteen investors and a majority of those investors are capable of appointing or removing the directors, general partner or trustee of the fund. An exempted fund will not be subject to supervision by or make any filings with CIMA under the Mutual Funds Law (Revised) and will not need to appoint auditors.

Closed Ended Funds

Funds whose equity interests are not redeemable or repurchasable at the option of its investors before the commencement of the winding-up or the dissolution of the company, unit trust or partnership will not be subject to supervision by or make any filings with CIMA under the Mutual Funds Law (Revised) and will not need to appoint auditors.

Debt Issuers

Funds which do not issue equity interests to investors will not be subject to supervision by or make any filings with CIMA under the Mutual Funds Law (Revised) and will not need to appoint auditors

Licensed Funds

A fund which is open ended in respect of redemptions, issues equity interests to its investors, has more than fifteen investors or has investors who do not control the appointment or removal of its operators, has no minimum subscription amount or a minimum subscription amount of less than US$100,000 or its currently equivalent and whose securities are not listed on a specified stock exchange will need to be licenced by CIMA. The licencing process requires the fund to satisfy CIMA as to the reputation of its promoter and the expertise of its administrator, to file its offering document and certain prescribed particulars with CIMA and to pay an annual fee. An alternative to satisfying CIMA as to the reputation of the funds promoter and expertise of its administrator is to appoint an administrator which is licenced under the Mutual Funds Law (Revised) to provide the principal office of the fund in Cayman and in these circumstances the fund will need to satisfy the licensed administrator as to the reputation of its promoter. A licensed fund will be subject to the supervision of CIMA and will be required to appoint CIMA approved and Cayman based auditors. The appointed auditors will be required to monitor the fund, perform an annual audit on the fund and file an annual report with CIMA.

CAYMAN MASTER FEEDER STRUCTURE FOR MULTI-JURISDICTIONAL SALES

Cayman master-feeder structures (using a combination of Cayman domiciled master funds and a combination of Cayman or non-Cayman feeders) to suit investors are often employed where a promoter:

- expects to generate significant investment from within and outside the U.S.;

- needs to separate distinct pools of investors into different legal structures for regulatory or tax reasons;

- wants to avail of economies of scale by feeding several funds into a single master; and/or

- wants to offer global investors an investment vehicle in a form which is familiar to them, or domiciled in their home jurisdiction, but use Cayman as a centre for making the ultimate underling investments (tax and regulatory reasons).

For global marketing, particularly involving U.S. investors, one way of structuring this type of fund offering is to use a single Cayman "master" fund as a hub and then one or more "feeder" funds as this can optimize the tax treatment which U.S. tax-paying and U.S. tax exempt investors obtain from an investment in the structure whilst at the same time sheltering non-U.S. investors from U.S. tax risks and reporting requirements. With the dual aims of (i) providing U.S. taxable investors on the one hand and U.S. tax exempt and non-U.S. investors on the other hand, with an optimal fund structure, and (ii) creating a structure that is as cost and operationally efficient as possible, a fund that is to be simultaneously offered inside and outside the U.S. is generally structured as a master-feeder.

This structure may take the following form:

- a Cayman limited partnership or a Cayman corporate or unit trust fund (the "Master Fund") which can elect to "check the box" (U.S. Form 8832) to be treated as a partnership for U.S. tax reporting purposes;

- a Cayman feeder fund company, limited partnership or unit trust (the "Feeder Fund") typically used to separate the U.S. tax exempt and other Non-U.S. (global investors) from U.S. taxable investors at the Master Fund level; and

- a Delaware or other offshore feeder fund typically structured as a limited partnership or limited liability company (the "Non-Cayman Feeder Fund"). The Non-Cayman Feeder Fund will be targeted at U.S. taxable investors and is often optional. From a tax and regulatory perspective, U.S. taxable investors could invest directly in the Master Fund instead of investing indirectly through their investments in the Non-Cayman Feeder Fund. It is the common experience, however, that marketing and accounting considerations dictate that U.S. taxable investors invest directly via these feeder funds (e.g. using a Delaware vehicle to act as an onshore conduit), even though they invest all or substantially all of their assets in the Master Fund.

The Master Fund invests directly in the underlying assets availing of Cayman's tax neutrality. The sole investors in the Master Fund will be the feeders and they may invest directly in a single pool at the Master Fund level or in segregated portfolios or sub-trusts, if the master is established as a segregated portfolio company or an umbrella unit trust (e.g. to divide strategies or leverage policies between different fund products). The Master Fund can also offer multiple classes or series of shares, interest or units to the feeders, which in turn can offer mirror shares, interests or units to their investors.

The Cayman Feeder Fund and Non-Cayman Feeder Fund acquire shares, interests or units in the Master Fund which fluctuate in value in accordance with the performance of the assets at the Maser Fund level. The liquidity at the level of the feeder funds and the Master Fund level can be matched.

Fees can be split between the level of the feeder funds and Master Fund to provide for differing management and performance fees. It is also possible to list the shares, interests or units of the feeder funds. There generally is no need to list the shares, interest or units of the Master Fund as the only investors in the Fund will be the feeder funds.

AUTHORISATION PROCESS

Timing

For registered funds there is no requirement for pre-approval from CIMA. As soon as the fund's offering documents, prescribed particulars and annual fee have been filed with CIMA together with letters from the funds auditors and administrator confirming their consent to act the fund is ready to take in subscriptions and commence trading.

For licenced funds the approval of the fund's promoters will take three weeks for CIMA to process and the licence application process will take four weeks. These timescales may be extended where requests for clarification or additional documentation are considered appropriate.

For closed ended, exempted, debt issuer and registered funds the timing for the launch of the funds are determined by the time it takes to settle the terms of the funds offering and constitutional documents and the terms of its service provider agreements.

OPERATIONAL ISSUES

Some of the main operational issues for Cayman funds are outlined below.

Offering Document

A Cayman registered or licensed fund must issue an offering document unless CIMA exempts the fund from this requirement. The offering document must describe the equity interests of the fund in all material respects and contain such other information as is necessary to enable a prospective investor in the fund to make an informed decision as to whether or not to subscribe for or purchase the equity interests. Any material change affecting the terms of the offering document of a registered or licensed fund during any period when there is a continuing offering of its equity interests must be updated in the offering document or a supplement thereto and filed with CIMA together with amended prescribed particulars where applicable. Certain master funds are required to file prescribed particulars with CIMA and, where they issue an offering document will also be required to file their offering document.

For Cayman licensed funds additional requirements relating to the information to be contained in the offering document, the segregation of assets of the fund and the calculation of the fund's net asset value apply.

Cayman funds which are not licensed or registered are not required to issue an offering document but generally, unless the terms of the offering are reflected entirely in the fund's constitutional documents, a promoter will want to issue an offering document as a clear statement of the offering terms including the investment objective, expertise and obligations of the fund's counterparties, net asset value calculation, risk factors, fees, expenses, tax structuring, subscription and redemption procedures, selling restrictions and limits on the liability of the fund's counterparties.

Valuation and Pricing

A Cayman fund is not restricted in relation to the valuation of its assets unless it is a licensed fund which must follow guidance issued by CIMA on the calculation of its net asset value. Promoters of Cayman funds which are not licensed will want to disclose their net asset value calculation policy in their offering document to reduce the scope for misunderstandings with investors and to provide the clarity and transparency in net asset value calculations which is required of its target investor base.

Financial Reporting

Licensed and registered funds and certain master funds are generally required to have their accounts audited annually by an auditor approved by CIMA and based in Cayman and are required to send their audited accounts to CIMA within six months of the end of the financial year to which they relate. An auditor to a licensed or registered fund and to certain master funds is also required to submit an electronic funds annual return to CIMA within six months of the end of the fund's financial year end.

Other Reporting

A Cayman licensed or registered fund is required to comply either with Cayman anti-money laundering laws and regulations which contain reporting obligations in certain circumstances or with laws and regulations which are considered by CIMA to be equivalent to the Cayman anti-money laundering laws and regulations and which are likely to have their own reporting obligations. In each case a Cayman licensed or regulated fund will generally delegate compliance with applicable anti-money laundering laws and regulations to its administrator although the ultimate responsibility for compliance with anti-money laundering laws and regulations remains with the fund and its directors.

CIMA is currently conducting a survey on a confidential basis in coordination with the International Monetary Fund to facilitate international data comparability. All Cayman funds issuing equity interests to investors are required to file by 31 March in each year a confidential report on their holdings of equity, short-term and long-term debt securities issued by unrelated non-residents.

Post-Authorisation Amendments

Whether a Cayman fund is structured as a company, limited partnership or unit trust the voting rights attached to the interests issued to investors can be structured so as to allow the fund to make changes to the offering terms of its interests without the need to obtain the consent of investors.

An exception to this general approach arises in a fund structured as a company where the rights attaching to an investor's shares are varied as a result of the changes to the offering terms. In any case where voting, participation or redemption rights are affected it may be necessary to obtain investor consent prior to implementing those changes. Generally the approach to the interpretation of what is to be considered a right attached to an investor's shares is a restrictive one.

In most other cases a decision needs to be made as to whether investors are likely to consider the proposed changes material, if they are then it is prudent to give all investors prior notice of the changes and the opportunity to redeem their interests before the changes are made. If changes are considered to be immaterial a manger and the fund's directors may feel that they can be made without prior notice and that notice of the changes can be sent to all investors after they have been implemented.

Where a Cayman fund's interests are listed on a stock exchange the rules of that exchange may require specific notices or consents to be obtained before certain changes can be made to the offering terms of the fund's interests.

Regulatory Levies

CIMA imposes a filing fee on registered and licensed funds, an annual fee on certain master funds and an additional fee on any registered or licensed funds structured as segregated portfolio companies. Licensed and registered funds each pay a filing fee of US$3,658.54 and an annual fee of US$3,658.54. Master funds which issue equity interests that are redeemable at the option of investors to more than one investor at least one of which is a registered or licensed fund pay an annual fee of US$3,048.78. An additional fee of US$304.88 per segregated portfolio up to the first 25 segregated portfolios and thereafter US$152.44 per segregated portfolio is payable for any licensed or registered fund or in relevant circumstances their master fund where they are structured as segregated portfolio companies.

AVAILABLE LEGAL STRUCTURES

Cayman Islands funds are available as companies including segregated portfolio companies, unit trusts and limited partnerships.

Choice of Legal Structure

The choice of legal structure for a fund will usually depend on a number of issues, including:

- investor familiarity;

- investor capacity to invest (e.g. Japanese investors may be able to invest higher proportions of their portfolios in unit trusts);

- borrowing/leverage proposals (available in all structures but legal arrangements are often clearer in investment companies);

- operational flexibility (the constitutional documents of unit trusts and limited partnerships are largely left to contractual principles with the Trusts Law (Revised), the Partnership Law (Revised) and the Exempted Limited Partnership Law (Revised) providing very little prescriptive measures whereas companies will need to follow the provisions of the Companies Law (Revised)).

Some examples of the stand alone structure of the company, unit trust and limited partnership fund are set out below.

Company Structure

Companies are corporate vehicles with their own legal personality. Under the Companies Law (Revised) there is no distinction made between a public and private company.

The constitutive document for a company is its Memorandum and Articles of Association and ultimate management authority resides with a board of directors, two of whom must be appointed for a registered or licensed fund but neither of which need be resident in Cayman.

Companies issue shares to investors which do not represent a legal or beneficial interest in the company's assets, those assets being legally held by the custodian and beneficially held by the company or where no custodian is appointed legal and beneficial ownership of the company's assets is held directly by the company.

Shares in a Cayman company can be issued as voting and/or non-voting shares. Where appropriate a company might issue non-voting shares to its investors and issue voting shares only to its investment manager in order to retain flexibility to make non-material amendments to the fund structure without the need to call a meeting of all the investors.

Funds structured as companies will enter into contracts themselves as corporate entities, principally with the investment manager, administrator and custodian.

Segregated portfolio companies benefit from statute based segregation of assets and liabilities between the segregated portfolios of the company and its general assets. Whilst conceptually similar to classes or series of shares with statutory segregation the segregated portfolios can also be split into classes or series of shares for the purpose of differing fee allocations, investment objectives, liquidity provisions, target investors or other matters.

Unit Trust Structure

Unit trusts are contractual arrangements created under a deed or declaration of trust (the "Trust Deed") made either by the trustee alone or between the manager and the trustee. Unit trusts do not have their own legal personality and contracts are entered into by the trustee in its capacity as trustee of the trust. In certain circumstances the power to enter into contracts on behalf of the trust can be delegated to the manager.

Unit trusts in Cayman are subject to the Trusts Law (Revised). Unit trusts issue units to investors and a unit represent an undivided beneficial interest in the assets of the unit trust. The assets are legally held by the trustee in its capacity as trustee of the trust on behalf of the investors.

Changes to the structure of a unit trust fund can be made in accordance with the terms of the Trust Deed and the offering document issued by the trust.

A fund structured as a unit trust may be created with different sub-trusts in order to segregate assets and liabilities between those sub-trusts or to apply different fee terms, liquidity terms, redemption or other terms to those sub-trusts.

A Cayman unit trust can be created under the special trust alternative regime ("STAR") included in the Trusts Law (Revised). STAR trusts can appoint an enforcer who will have the right to enforce the rights of beneficiaries under the Trust Deed rather than those rights resting with the beneficiaries and the STAR trust can be created without limit to its duration.

Limited Partnership Structure

Cayman limited partnerships are contractual arrangements created under a limited partnership agreement made between the general partner and any number of limited partners. Limited partnerships do not have their own legal personality and the general partner enters into contracts on behalf of the limited partnership in its capacity as general partner.

The limited partners generally receive participating partnership interests which entitle them to a share in the performance of the limited partnership while the general partner has a fee interest in the limited partnership and acts in a management role. The assets and liabilities of the limited partnership and the profits derived from those assets belong jointly to the individual partners in the proportions agreed in the limited partnership agreement.

Cayman limited partnerships are subject to the Partnership Law (Revised) and the Exempted Limited Partnership Law (Revised). Generally these laws are permissive and the contractual arrangements within a Cayman limited partnership are largely down to negotiations between its manager and its key investors. Partnership interests can be issued in different classes to apply different fee terms, liquidity terms, redemption or other terms to those classes.

Changes to the structure of a limited partnership fund can be made in accordance with the terms of the limited partnership agreement and its offering document.

Umbrellas, Sub-Funds and Classes

Whichever legal structure is chosen, Cayman funds can offer different share, unit or interest classes within a fund, the normal differentiating factors being target audience management/performance fees, minimum subscription/holding requirements, entry/exit fees and designated currencies.

As noted above, segregated liability can be achieved between sub-funds of unit trusts and statutory segregation of assets and liabilities is available for companies structured as segregated portfolio companies. For limited partnerships it is possible to segregate assets and liabilities between different classes of interests although this would need to be addressed on a contractual basis with each counterparty.

Allocation of Assets and Liabilities Between Different Classes

Cayman law allows the allocation of assets and liabilities to different classes within a fund as a matter of the fund's internal accounting. In circumstances where currency classes are hedged within a fund Cayman law allows the gains/losses on any hedging contracts to be attributed to the relevant hedged classes. In the same way "New Issues" may be allocated to dedicated "unrestricted classes" and other particular forms of asset or income stream can be allocated to particular classes within a fund.

Voting Rights

Cayman funds need not issue voting interests to their investors and this can provide considerable flexibility for minor changes to be made to the fund's structure.

LIQUIDITY OPTIONS

Cayman funds can be structured as open-ended or closed-ended schemes and can utilise a variety of features to address liquidity and/or valuation issues including gates, deferred redemptions, holdbacks, in-kind redemptions and side pockets.

It is also possible to establish sub-funds with different liquidity profiles within a single structure so as to take advantage of operational and other economies of scale.

Liquidity Categories

The terms open-ended and closed-ended are explained below.

- Open-Ended:An open-ended fund is one which provides for the redemption of its equity interests at the option of its investors.

- Closed-Ended:Closed-ended funds are funds which do not provide any capacity for investors to request redemption before the commencement of the winding up or dissolution of the fund.

Whilst a closed-ended fund is not required to have a definite duration, generally an expected duration is specified and at the end of the closed-ended period, the constitutional documents of the fund may provide for any number of actions to take place which may include any of the following:

- a voluntary winding-up of the fund;

- the redemption of all outstanding equity interests of the fund followed by a voluntary winding up;

- the conversion of the fund's equity interests into interests which are redeemable at the option of its investors;

- the successful completion of an IPO of the fund's shares; and/or

- the extension of the duration of the fund for a further period (generally of two years and generally with the consent of a particular majority of investors).

Share Classes

Where a fund is established with separate classes of equity interests, those classes need not offer the same terms and may offer different redemption frequency as well as offering differences across other terms.

Gates

Redemption gates can be applied (in accordance with the fund's constitutional and offering documents) limiting the number of equity interests to be redeemed on a dealing day to a percentage of the equity interests in issue on the relevant redemption day or to a percentage of the equity interests held by the redeeming investor on that redemption day. Gates should generally be applied on a pro rata basis and requests carried over from a prior dealing day as a result of the application of a gate may be processed with or without priority to later requests depending on the terms of the fund's constitutional documents.

Deferred Redemptions

The fund may, if its constitutional and offering documents so provide, refuse to redeem equity interests. This may be considered appropriate where the fund does not expect to be in a position to liquidate sufficient underlying investments to satisfy all redemption requests or where the fund does not expect to be able to liquidate underlying investments at market value in the time frame available to satisfy those redemption requests.

In Kind Redemptions

A fund may, if its constitutional and offering documents so provide, pay redemptions in kind by transferring to investors assets having a value equal to the redemption price for the equity interests redeemed.

Payment of Redemption Proceeds

Payment of redemption proceeds should normally be made by the redemption payment date specified in the offering document. Provided that the fund's constitutional and offering documents allow it, a fund may be able to suspend the payment of redemption proceeds. This may be considered appropriate where redemption payments in respect of investments in underlying assets are not received by the fund within the anticipated timescales.

Holdbacks

A Cayman fund may retain redemption proceeds or a percentage of those proceeds where its constitutional and offering documents so provide. It may in some circumstances be considered appropriate to delay final payment of redemption proceeds until after the completion of the fund's audit.

Side-pockets

Side-pockets are permitted for Cayman funds where assets which are illiquid or hard to value can be allocated to a separate class (or classes) of equity interest until they can be realised. This is achieved by allocating the relevant assets into a separate portfolio represented by the side-pocket interests and by effecting a mandatory pro-rata reduction in the number or amount of equity interests held by investors and by creating for the benefit of such investors a corresponding pro-rata interest in the side-pocket interests.

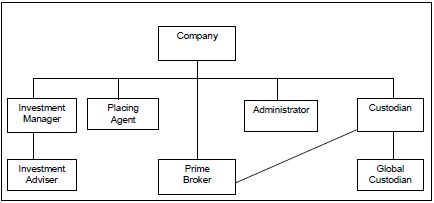

SERVICE PROVIDERS

Investment Managers and Investment Advisers

There is no requirement for a Cayman fund to appoint a Cayman domiciled investment manager or investment adviser. However, where a Cayman entity is considered appropriate for these roles in terms of tax structuring for their shareholders or in terms of regulatory efficiency the investment manager or investment adviser will either be licenced under the Securities Investment Business Law (Revised) or fall within an exemption under that law. Where the fund will be a regulated or licensed fund and the investment manager and/or investment adviser is incorporated in Cayman the manager/advisor is likely to fall within an exemption under the Securities Investment Business Law (Revised) and need only make an annual filing of prescribed particulars, pay an annual fee and adopt Cayman anti-money laundering compliance procedures. A full licencing for the investment manager or investment adviser will involve the approval of its operators and beneficial owners by CIMA and the maintenance of adequate financial resources and insurance, implementation of compliance and operational procedures and the appointment of approved Cayman based auditors.

Operators

There is no requirement for a Cayman domiciled corporate fund to appoint Cayman resident directors although tax advice provided to the fund or its promoters may be that the appointment of Cayman resident directors may be beneficial to the fund. Dillon Eustace can introduce directors to our clients on request.

There is no requirement for a Cayman domiciled limited partnership fund to appoint a Cayman domiciled general partner although tax advice provided to the fund or its promoters may be that the appointment of a Cayman resident general partner may be beneficial to the fund. The general partner may be a corporate entity or an individual. Where a corporate general partner is used this can be a Cayman domiciled company or a non-Cayman company which has be registered under the Companies Law (Revised) as a foreign registered company in either case Cayman resident directors are not required but may be beneficial depending on tax advice.

A Cayman fund structured under a Cayman law governed unit trust instrument will generally have a Cayman domiciled trustee which will need to be licensed under the Banks and Trust Companies Law (Revised). Dillon Eustace are able to introduce a number of Cayman domiciled professional trustees or to assist in the licensing of a new Cayman domiciled trustee.

Administrator

There is no requirement for a Cayman domiciled fund to appoint a Cayman domiciled administrator. For a registered fund the administrator will generally perform the anti-money laundering services for the fund to the Cayman law standard. CIMA maintains a list of jurisdictions which it considers to have equivalent anti money laundering laws and regulations.2 Provided that an administrator is located in and subject to the anti money laundering laws and regulations of one of these jurisdictions CIMA will be satisfied with that administrator providing the anti money laundering services to the fund. Alternatively, an administrator located outside these jurisdictions might agree to apply anti money laundering services to the Cayman law standard. For a licensed fund CIMA will need to be satisfied that the reputation and experience of the appointed administrator before a license is issued to the fund.

Auditor

A registered fund and a licensed fund will each be required to appoint an auditor approved by CIMA and based in Cayman. Dillon Eustace are able to introduce a number of Cayman based auditors who are approved by CIMA to assist in the provision of audit services to registered or licensed funds.

Custodian and Prime Broker

There is no requirement to appoint a custodian or prime broker to a Cayman fund and if they are appointed there is no requirement for them to be domiciled in Cayman.

Registered Office

A Cayman domiciled company and a Cayman law governed limited partnership are required to maintain a registered office in Cayman. A general partner to a Cayman law governed limited partnership which is registered as a foreign company under the Companies Law (Revised) is required to appoint an agent for the service of process in Cayman. Dillon Eustace are able to source the provision of registered office services and process agent services on request.

Offering Document Disclosure

Relationships with counterparties will generally be fully disclosed in the offering document which will include a description of potential exposures arising from the relationship.

TAXATION

There is no income or capital gains tax imposed by the Cayman Islands government which will apply to distributions or redemptions of interests held by investors in a Cayman fund. Each of the legal structures which may be used for a Cayman fund may register as an exempted entity and apply to the Cayman Islands Governor in Cabinet for an undertaking that no law enacted in Cayman imposing any tax on profits, gains or appreciation or which is in the nature of estate duty or inheritance tax shall apply to the structure for a period of 20 years in the case of a company and 50 years in the case of a limited partnership or trust.

USE OF TRADING SUBSIDIARIES / SPVS

As noted above, Cayman funds are tax neutral but at the same time Cayman funds do not have access to a double tax treaty network to eliminate or minimise any foreign taxes which might arise on a fund's underlying investments. However, the resultant tax leakage at the level of the fund's investments may be reduced through the establishment of an intermediate trading vehicle which is tax resident in a tax efficient jurisdiction and which has access to that jurisdiction's double tax treaty network to eliminate or reduce foreign withholding taxes which might arise on the fund's underlying investments. One such tax efficient jurisdiction which has an extensive double tax treaty network is Ireland.

There may be many other reasons why a fund may choose to invest through a trading conduit, normally structured as limited or unlimited liability companies. For example, restrictions on foreign ownership may result in the fund being unable to invest in a particular market other than through a local company, in which case the fund may choose to establish a wholly owned subsidiary in the relevant country.

Ireland is a leading jurisdiction in which to establish special purpose vehicles for structured financing transactions. The main reason for this is the attractive taxation regime, commonly known as 'Section 110', in reference to the Irish tax legislative provision that provides a special tax regime for structured finance transactions involving Irish "qualifying" companies.

A qualifying company means a company:

- which is resident in Ireland;

- which (i) acquires "qualifying assets" from a person, (ii) as a result of an arrangement with another person holds or manages qualifying assets or (iii) has entered into a legally enforceable arrangement with another person which arrangement itself constitutes a qualifying asset;

- where the company carries on in Ireland a business of holding, managing or both the holding and management of qualifying assets;

- which, apart from activities ancillary to that business, carries on no other activities;

- in relation to which company (i) the market value of all qualifying assets held or managed, or (ii) the market value of all qualifying assets in respect of which the company has entered into legally enforceable arrangements, is not less than €10 million on the day on which the qualifying assets are first acquired, first held, or an arrangement referred to in paragraph (b)(iii) above is first entered into by the company;

- which has notified in writing the ITA in a form prescribed by them that it is or intends to be a company to which paragraphs (a) to (e) above apply and has supplied such other particulars related to the company as may be specified on the prescribed form and

- which has not entered into any transaction or arrangement other than by way of a bargain at arm's length. There is one exception to this requirement that all transactions be conducted by way of a bargain made at arm's length and that is profit participating loans or loans of a similar nature, and this exception is subject to certain conditions.

Section 110 companies are normally established as private limited or unlimited companies with nominal share capital. The Cayman fund finances (directly or indirectly) the Section 110 company in exchange for profit participating debt (i.e. a note or bond linked to the performance of the Section 110's portfolio). The Irish withholding tax issues in respect of any return arising on the profit participating debt and in ensuring the Section 110 company obtains a tax deduction for any such return needs to be carefully managed.

The Section 110 company is a taxable entity which, at current rates, pays tax at 25% on its profits, however, provided it satisfies various conditions, it can utilise various techniques to minimise the Irish tax arising on its underlying investments. The Section 110 company can invest in a wide range of qualifying assets though it must be invested to a minimum value of Euro 10,000,000 (or its foreign currency equivalent) on the first day on which it purchases such a qualifying asset (i.e. first day only test).

IRISH STOCK EXCHANGE LISTING

The ISE is a leading international exchange for the listing of investment funds, having developed a specific investment funds listing regime tailored to provide a streamlined and progressive listing regime for a wide variety of international fund structures including companies, unit trusts and segregated portfolio companies from a variety of domiciles.

Combining a comprehensive set of listing rules, a commitment to aggressive timings on processing listing applications, a low cost structure and a flexible and proactive listing process, the listing regime is highly transparent and user friendly, contributing to and supporting the funds industry both domestically and internationally.

The ISE commits to turnaround times of a maximum of 5 working days on the initial draft followed by a 2 day turnaround on subsequent drafts and has a dedicated team which is trained to handle the particular requirements of the funds market.

A listing on the ISE offers a number of advantages including:

- access to a wider investor base by allowing promoters to market the fund to institutional investors who may require a listing on a recognised stock exchange in order to invest; and in countries where the relevant authorities require or provide exemptions for investment in listed securities, e.g. French funds of funds;

- a quoted market price, enabling securities to be marked to market;

- tax advantages in specific jurisdictions, e.g. Japan and Canada;

- cost efficiencies by publication of NAVs via the ISE website; and

- allowing investment by professional employees of the Cayman fund's manager in the fund at levels which are less than the US$100,000 minimum required of a registered fund whose equity interest are not listed on a specified stock exchange.

Footnotes

1. As at 30.3.11 - Amman Stock Exchange, Athens Exchange, Australian Securities Exchange, BATS Exchange, Bayerische Borse AG, Berlin Stock Exchange, Bermuda Stock Exchange, BM&F Bovespa, BME Spanish Exchanges, BOAG Borsen AG, Bolsa de Comercio de Buenos Aires, Bolsa de Comercio de Santiago, Bolsa de Valores de Caracas*, Bolsa de Valores de Colombia, Bolsa de Valores de Lima, Bombay Stock Exchange, Borsa Italiana SPA, Bratislava Stock Exchange, Bucharest Stock Exchange, Budapest Stock Exchange, Bulgarian Stock Exchange, Cayman Islands Stock Exchange, Channel Islands Stock Exchange*, Chicago Board Options Exchange, Chicago Stock Exchange, CME Group, Colombo Stock Exchange, Copenhagen Stock Exchange, Cyprus Stock Exchange, Czech Stock Exchange, Deutsche Borse, Dusseldorf Stock Exchange, EDX London, Eurex, Euronext, Fukuoka Stock Exchange*, Hong Kong Exchange and Clearing, Indonesia Stock Exchange, Intercontinental Exchange, International Securities Exchange, Irish Stock Exchange, Istanbul Stock Exchange, JASDAQ, Johannesburg Stock Exchange, Korea Stock Exchange, London Stock Exchange, Ljubljana Stock Exchange, Luxembourg Stock Exchange, Madrid Stock Exchange, Malaysia Stock Exchange, Malta Stock Exchange, Mexican Stock Exchange, Montreal Exchange, Moscow Interbank Currency Exchange, Nagoya Stock Exchange*, NASDAQ OMX, NASDAQ OMX BX, NASDAQ OMX PHLX, NASDAQ Stock Market, National Stock Exchange (U.S.), National Stock Exchange of India, New York Stock Exchange, New Zealand Exchange, NYSE Amex, NYSE Arca, NYSE Euronext, OMX Nordic Exchanges, Osaka Securities Exchange, Oslo Axess, Oslo Stock Exchange, Philippine Stock Exchange, PLUS Markets, Prague Stock Exchange, RMX Hannover, Saudi Stock Exchange (Tadawul), Shanghai Stock Exchange, Shenzhen Stock Exchange, Singapore Exchange, Stuttgart Stock Exchange, SIX Swiss Exchange, Stock Exchange of Mauritius, Taiwan Stock Exchange, Tel Aviv Stock Exchange, The Egyptian Exchange, The Stock Exchange of Thailand, TLX s.p.a., Tokyo Stock Exchange, Toronto Stock Exchange, Valencia Stock Exchange, Vienna Stock Exchange, Vilnius Stock Exchange and Warsaw Stock Exchange. [* indicates discretionary approval]

2. Argentina, Australia, Austria, Bahamas, Bahrain, Barbados, Belgium, Bermuda, Brazil, British Virgin Islands, Canada, Denmark, Finland, France, Germany, Gibraltar, Greece, Guernsey, Hong Kong, Iceland, Ireland, Isle of Man, Israel, Italy, Japan, Jersey, Liechtenstein, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Norway, Panama, Portugal, Singapore, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, United Kingdom and United States of America

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.