Originally published on August 18, 2011

Keywords: India, Competition, competition commission, CCI, National Stock Exchange, NSE

Introduction

In July 2011 the Competition Commission of India ("CCI") published its first decision giving its clearance to a notified transaction. The merger control provisions in the Competition Act, 2002 (as amended) ("Competition Act") had come into force on 1 June 2011 (See Legal update).

The CCI has also in June 2011, found the National Stock Exchange ("NSE"), India's leading stock exchange guilty of abusing its dominant position. This is the first finding of abuse of a dominant position under the Competition Act since the CCI announced in May 2009 that the provisions relating to anti-competitive agreements and prohibition of abuse of dominance have come into force (See Legal update).

Despite its relative inexperience the CCI seems not to be shy of entering turbid waters and the decision on abusive conduct contains several novel aspects. The CCI has found that the NSE holds a dominant position although it holds only the third largest market share in the relevant market. The CCI has also found that the zero pricing policy followed by NSE in one segment of business by cross subsidising from another segment of business where it is also dominant is an abuse. The level of fine imposed indicates that although the CCI is a relatively new enforcement authority, it will be aggressive in setting fines.

2. Report on cases

A. Mergers

Prior to the coming into force of the merger control provisions several concerns had been raised including those relating to the low notification thresholds, absence of proper local nexus requirements and lack of clarity regarding triggering events (See Legal update). The CCI published the CCI (Procedure in regard to the transaction of business relating to combination) Regulations, 2011 to deal with some of these concerns.

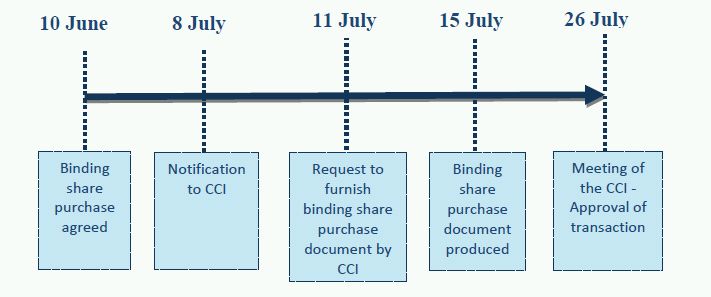

The first transaction notified and approved by the CCI was a proposal of Reliance Industries Limited and Reliance Industrial Infrastructure Limited to acquire a 74 per cent stake in Bharti AXA Life Insurance Company Limited and Bharti AXA General Insurance Company Limited. The companies to be acquired were joint venture companies operating in the insurance sector in which AXA SA, headquartered in Paris had a stake.

The CCI was able to complete its review of the notified transaction within 18 days of its notification even though the clock was apparently stopped for 4 days. It is encouraging that the CCI has demonstrated its ability to clear non-problematic transactions within 30 days

The CCI also accepted a single notification form on the basis that the acquisitions are inter-connected and inter-dependent. The decision confirms that, the CCI considers a binding share purchase agreement a 'triggering event' for the purposes of notification to the CCI.

B. Abuse of a dominant position

On 23 June 2011, the CCI published its order in MCX Stock Exchange Ltd. & Ors. vs. National Stock Exchange of India Ltd. & Ors. finding the NSE guilty of abusing its position in the market of stock exchange services for exchange traded currency derivatives in India ("CD segment").

Two out of six members of the CCI issued a dissenting order. The CCI order refers to the existing case law in Europe and in the U.S, but apparently differs from the accepted principles and case law in some instances. Some observations which would be of interest to operators in the market are drawn out below.

Definition of the relevant market – The CCI found that stock exchange services in respect of the CD segment in India is an independent and distinct relevant market. The CCI also found that the SSNIP test ('the Hypothetical Monopoly test') is irrelevant in the case as (i) the CD segment did not exist prior to August 2008 (ii) transaction fees, data fees etc., which may be said to constitute price have not been charged by any market player since the inception of the CD segment; and (iii) the proportion of transaction value that a broker/trader pays as transaction fees and other fees is so small and insignificant that it would have practically no bearing on substitutability.

Dominant position – The CCI finds that according to the Competition Act a dominant position is a 'position of strength' which enables an undertaking to operate independently of competitive forces; or to affect its competitors or consumers or the relevant market in its favour. The CCI concludes that NSE has a position of strength which enables it to affect its competitors in its favour and therefore enjoys a dominant position in the relevant market.

The CCI refers in its decision to the report of the Director General which states that NSE had a market share of 47-48% in the CD segment as against 52-53% of MCX-SX at the stage of investigation. The CCI also notes that more recent figures published in the public domain reveal that the market shares are divided almost equally between the three players in the market with MCX-SX, NSE and USE (latest entrant) having 34%, 30% and 36% respectively.

It is interesting to note that the CCI found that NSE holds a dominant position despite the fact that it did not enjoy the highest market share and that the latest entrant to the market was able to gain the largest share of the market in a relatively short period of time.

The CCI refers to European case law in AKZO and United Brands where 40% market share is used as an indicator of dominance, but concludes that evaluation of the strength is to be done not just on the basis of the market share and that the indicator does not have to be pegged at any point. The CCI observes that it is to be seen whether a particular player in the market has clear comparative advantages in terms of factors such as financial resources, technical abilities, brand value and historical legacy to be able to do things which would affect its competitors who, in turn, would be unable to do the same or would find it extremely difficult to do so on a sustained basis.

Pricing – In terms of abusive conduct the CCI investigated the zero price policy of NSE i.e. waiver of fees relating to transaction and admission. NSE also did not collect annual subscription charges or levy advance minimum transaction charges and provided data feed with respect to the CD segment for free.

In this relation the CCI finds that 'predatory price' is a subset of 'unfair price'. The CCI also considered that the unfairness of pricing (as distinct from the concept of predatory pricing) cannot be determined by selecting Average Total Cost, Average Variable Cost, Long Run Average Incremental Cost, Average Avoidable Cost or any other costing calculation used in accounting. The CCI concluded that MCX-SX operates only in the CD segment and has no other sources of income unlike the NSE and as NSE and MCX-SX are not on an equal footing in terms of resources available, nationwide presence etc., the zero price policy of NSE in the relevant market is 'unfair' and can be termed as annihilating or destructive pricing.

Leveraging – The CCI concludes that the NSE has abused its position of strength in the non CD segment to protect its position in the CD segment. It is not apparent from the order that the CCI conducted a proper analysis when identifying a "market of stock exchange services for the non CD segment". The CCI finds that the intention of the NSE was to acquire a dominant position in the CD segment by cross subsidising this segment of business from the other segments where it enjoyed a monopoly. There is again however no analysis in the order to substantiate the conclusion that NSE enjoys a "monopoly" in the "other segments".

Penalty and directions: The CCI, while imposing a penalty on NSE, refused to confine the turnover to be taken into account as that from the relevant product or geographic market. A penalty of 5% of the average turnover of NSE in the last three years (2007-2010) which was Rupees 55.5 crores (€8.4 million (approx.)) was imposed. In addition the NSE has also been directed to modify its zero price policy and ensure that appropriate transaction costs are levied.

It is understood that following the decision of the CCI, NSE has decided to do away with its zero price policy and will start charging for its trades. It is to be noted that the remedy may lead to higher costs for the consumer.

3. News and related developments

In a development which raises concern it is understood that a petition has been filed before the Delhi High Court alleging that the CCI has failed to maintain confidentiality of trade and business secrets in an ongoing investigation. The petition alleges that CCI has circulated the investigation report containing confidential information to other companies accused in the alleged cartel. It has been a widespread concern among corporations that the CCI will be unable to be protect confidential information/business secrets supplied to it.

It is good to note that the Government of India seems to be pro-active in its effort to build a competition culture. A committee has been constituted by the Ministry of Corporate Affairs for the framing of a National Competition Policy. The terms of reference of the Committee include preparation of a report on any changes required in the Competition Act. Pursuant to its mandate, the Committee has submitted a draft National Competition Policy which has been published by the Ministry of Corporate Affairs for comments.

In other related developments, the term of the CCI Chairperson, Mr. Dhanendra Kumar ended on 5 June 2011. A replacement is yet to be announced.

Visit us at mayerbrown.com

Learn more about our Antitrust/Competition and Corporate & Securities practices.

Mayer Brown is a global legal services organization comprising legal practices that are separate entities (the Mayer Brown Practices). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; Mayer Brown JSM, a Hong Kong partnership, and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2011. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.