Business owners who are contemplating a sale of their company should not overlook the opportunity for a management buyout (“MBO”). An MBO refers to a transaction whereby a company’s existing management team acquires a significant interest in, or all of, the shares of the company. An MBO can be an attractive exit alternative because it tends to be a quicker process than selling to an outside buyer. Furthermore, an MBO avoids the risk of exposing confidential information to competitors.

An MBO can also offer lucrative upside potential for company management. In fact, management often stands to be the biggest winner in a successful MBO, if they are able to successfully grow the company in the years following the MBO transaction.

In most cases involving companies of a meaningful size, MBO’s involve one or more commercial lenders and/ or private equity firms who provide financing to facilitate the transaction. The amount of financing required, and whether debt or equity financing is raised, depends on the size of the transaction, the financial resources available to management and the debt capacity of the company.

The MBO Process

MBO’s can be thought of as comprising eight stages, which are set out in Exhibit 1. However, it should be noted that these stages are not always distinct, and they may overlap or even change order, depending on the deal.

Exhibit 1: The MBO Process

An MBO starts where the business owner approaches management, or vice-versa, to determine their level of interest in acquiring the company. The parties should then look to establish a reasonable estimate for the value of the company. In many cases, an independent valuator is retained to help establish a fair price. Whether the initial valuation represents the ultimate purchase price will be subject to management’s ability to raise capital and the dynamics of negotiations with financial investors that are involved.

Where financial investors (debt or equity) will be required in order to facilitate an MBO, management will need to prepare a confidential information memorandum (“CIM”) to entice those groups. The CIM should highlight management’s capabilities, strategic plans and growth opportunities, which are key considerations for financial investors.

Where external financing is needed to consummate the transaction, the business owner, management and their advisors will identify providers of debt and/or equity financing that may be interested in the deal. Financial investors can generally be categorized as senior debt lenders, mezzanine (or subordinated) debt lenders and private equity firms. Senior debt is attractive due to the lower cost of interest payments (which generally are tax-deductible). However, it is important to remember that it is not just the cost of financing that needs to be considered, but also the restrictions and covenants that may be placed on the company as a condition of financing.

Where the financing gap can be satisfied by debt, that route usually is chosen as it does not result in any equity erosion for management or the business owner, who may choose to retain a residual interest in the company. However, equity financing may be required where adequate debt financing cannot be secured on reasonable terms.

Financial investors that express an interest in the MBO opportunity will conduct their initial due diligence on the company and meet with management and the business owner. Financial investors that continue to be interested in the opportunity following their initial due diligence will submit a term sheet, which sets out the terms of financing the transaction. As with any transactions, the terms of the deal can be just as important as the stated purchase price.

The financial investor(s) offering the term sheet that best meets the needs of the business owner and management are provided a period of time to complete their due diligence, negotiate the definitive agreements and close the transaction.

Private Equity Financing

Private equity firms refer to organizations that look to earn significant returns through equity participation in their portfolio companies. Many private equity firms have a strong interest in backing MBO’s because those transactions are viewed as being less risky than venture capital type investments.

Private equity firms typically seek investment opportunities in companies that exhibit the following characteristics:

- strong business fundamentals, such as companies having a sustainable differential advantage or those that are leaders within a market niche;

- excellent potential for growth, either organically or through acquisition;

- a strong management team with a proven track record, and sufficient breadth and depth in the company’s management ranks;

- management commitment, which is usually demonstrated by management investing their own capital in the company. In most cases, the absolute amount of management’s investment is not the primary issue, so long as it represents a meaningful commitment by the individual(s). Managers can often realize lucrative upside potential where things turn out as planned;

- alignment of interests, in terms of working with management to grow the business over the next several years and then selling it within the expected investment horizon. This extends to an agreement as to how management will participate in that growth (e.g. through stock options or other incentives for achieving performance targets);

- the ability to utilize debt financing in order to reduce the size of the equity investment and magnify returns. This requires that the company has good assets and strong cash flows, which can support debt financing at reasonable rates; and

- exit strategy opportunities. Since private equity firms generally have a 3 to 7 year time horizon to liquidate their investment, they seek companies that can either be sold to a strategic buyer or are believed to be good candidates for an initial public offering.

Exhibit 2: What Private Equity Firms Look For

Private equity financing should not be viewed as a one-way street. The business owner and management team should expect to receive more from the private equity firm than just a lump sum of cash on closing. Other important considerations include the ability of the private equity firm to accommodate follow-on financing (commonly referred to as “dry powder”) that may be needed to support growth through acquisition or an unexpected shortfall in cash flow, and value-added service offerings. Financial investors should be expected to provide things such as sound business advice, business contacts, and other services that help the company to grow and prosper. In this regard, many private equity firms have begun to specialize in certain industry sectors in order to accomplish these things.

Common Obstacles to an MBO Transaction

Despite the potential attractiveness of an MBO, business owners should also weigh the challenges in consummating the transaction and realizing value in any residual equity interest that they retain.

An MBO creates a conflict of interest between the business owner, who wants to maximize value, and the management team, who want a lower valuation in order to get a bigger equity stake in the company for their investment. Management’s conflict of interest can also thwart opportunities with strategic buyers. Unlike a strategic buyer, management does not have the ability to realize synergies. This can reduce the price that management can afford to pay.

Getting key managers to commit capital is another common challenge. Managers may not have the same entrepreneurial spirit as the business owner, and they may be reluctant to commit capital, or have limited ability to do so. Financial investors may be wary of making a significant investment where key employees have not made a meaningful monetary commitment.

Where a private equity firm becomes involved, they will tend to focus on short term results, given their limited investment horizon. This can place considerable pressure on management. Furthermore, the use of debt financing by private equity firms can result in additional covenants and operating restrictions being imposed on the company post-closing.

Private equity firms exercise control of their investee companies through their participation on the board of directors. Consequently, there may be a need for a more formalized governance structure and additional reporting requirements, which may prove onerous. Finally, the upfront fees from private equity firms and lending institutions, including ‘stamping fees’, ‘loan arrangement fees’ and other one-time expenses can be significant.

Both lenders and private equity firms generally prefer MBO’s where the business owner retains a residual interest and remains active in the company following the transaction. This may not be consistent with the objectives of the business owner. Further, where the business owner does retain a residual equity interest in the company, there is no assurance as to when, or whether, value from that residual interest will be realized.

The MBO Value Matrix TM

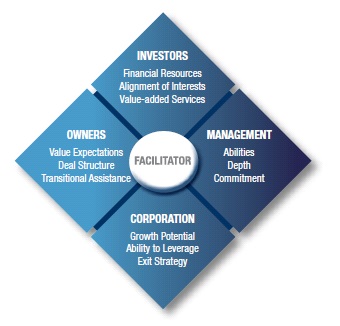

The interests of the various parties involved in an MBO are naturally conflicting to some degree. The business owner wants the highest price for their company, management wants the ability to acquire the largest equity stake possible and the financial investors are seeking to maximize their own return on invested capital. For an MBO to be successful, all participants must make compromises and structure a deal that creates a collectively beneficial scenario. In order to do so, it is critical to engage a facilitator to assist in bringing the parties together.

The facilitator normally is a financial advisor (supported by other consultants, such as legal and tax advisors) who not only understands the workings of an MBO, but who also can offer the parties objective advice on the pros and cons of various alternatives. The principal role of the facilitator is to assist both the owner and the management team in identifying and attracting the right financial investor ‘partners’ and in helping to develop the terms of a deal that satisfies the collective interests of all parties. In doing so, the facilitator helps the various parties to identify ways in which they can reconcile their respective positions and preserve a sense of ‘value fairness’ to each. The role of the facilitator within the MBO process is captured in the MBO Value MatrixTM, illustrated in Exhibit 3.

Exhibit 3: The MBO Value MatrixTM

Conclusions

MBO’s can provide a viable exit strategy alternative for business owners, particularly where the company has strong growth potential, financing is available and attractive exit alternatives exist. The financial payoffs in an MBO can be substantial where forecasted operating results and exit strategy expectations are realized.

MBO transactions are more likely to occur where the business owner has realistic expectations as to the value of their company and they are prepared to work with the management team and the financial investors in terms of deal structuring and transitional assistance. A critical component to a successful MBO is the financial investor’s perception of the management team in terms of their abilities, depth and commitment. The business owner and the management team should seek the right financial investor ‘partners’ in terms of their financial resources, alignment of interests and the value-added services that they offer.

The MBO Value MatrixTM serves as a framework for illustrating how the facilitator plays a pivotal role in bringing the various parties together and in helping to develop a deal structure that allows all participants the opportunity for value realization.