There tend to be two types of business owners and executives: (1) those who love debt, and who use the maximum amount of leverage possible; and (2) those who avoid debt like the plague. While an appropriate amount of leverage is highly dependent on the fact-specific circumstances of any given business, in many cases, a modest amount of debt is the best solution.

Debt, or financial leverage, allows business owners and executives to increase shareholder value, so long as the risk is manageable. This is because debt can be used as a low-cost substitute for equity financing, and because interest payments are (usually) tax deductible.

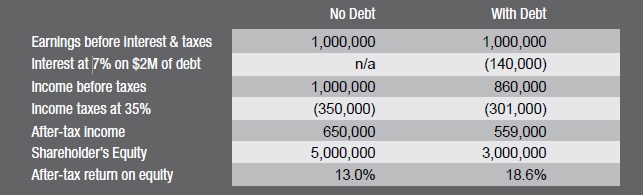

Consider the following example. Company A currently generates $1 million in earnings before interest and taxes (EBIT) and has no debt. It pays taxes at a rate of 35%, leaving $650,000 of earnings after-tax. If Company A’s equity is $5 million (consisting of share capital and retained earnings), then the after-tax return on equity under a debt-free capital structure is 13% (calculated as $650,000 / $5 million).

Now assume that Company A borrows $2 million at a 7% interest rate, and pays a $2 million dividend to its shareholders (note that this can be a tax-deferred dividend if the recipient is a holding company). The interest on the debt reduces Company A’s income by $140,000, but income taxes are also reduced, resulting in revised after-tax earnings of $559,000. However, Company A’s shareholder’s equity has declined to $3 million, given that $2 million in retained earnings have been paid out in the form of a dividend. Consequently, the after-tax return on equity increases to 18.6% (see Exhibit 1).

Exhibit 1

Comparison of Shareholder Returns For Company A

Another benefit of replacing equity with debt is added diversification for shareholders. This is because many business owners have most of their personal wealth invested in their business. By replacing equity with a modest amount of debt, the owners can invest the proceeds in a more diversified portfolio.

While a recapitalization of the business may offer attractive returns, business owners and executives should carefully consider the risks involved. The introduction of debt into a business creates ‘financial risk’, because the lender has a priority claim on the assets of a business. It will also result in banking covenants, which may constrain the activities of the business. Common banking covenants include minimum working capital levels and banking approval prior to making any major capital expenditures or shareholder distributions.

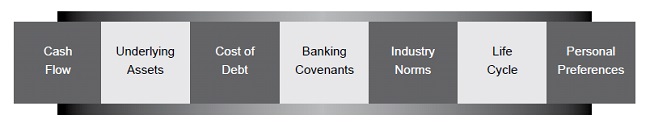

This begs the question “how much debt should my company use?” The answer is “it depends”. While not an exhaustive list, some of the factors that should be considered when determining the appropriate amount of debt for a company include the following:

- cash flow levels and the volatility thereof. Cash is required in order to fund both the interest expense and principal repayments. To the extent that cash is required to service debt, it is not available to the company for other uses, such as capital expenditures. Businesses that are cyclical, or that have volatile cash flows, normally employ less debt than those with stable cash flows;

- the quantity and quality of underlying assets. Most lenders look for security against their debt. Traditional lending formulas include:

-

Up to 75% of accounts receivable under 90 days;

Up to 50% of inventories, depending on their nature and salability;

Up to 60% of the appraised value of capital assets, depending on their nature; and

Up to 75% of the appraised value of real property; - the after-tax cost of debt. This is a function of the stated interest rate that will be charged and the effective tax rate at which interest will be deductible. In addition, consideration should be given to any fees and charges that will be incurred to place or sustain the debt;

- banking covenants, including financial performance measures (such as minimum levels of working capital, equity and cash flow) and restrictions on business activity. Both covenants on existing lending arrangements as well as covenants on new debt arrangements should be considered;

- industry norms. While no two companies within a given industry are exactly alike, the use of debt among companies within an industry in general provides some indication as to the degree that lenders are interested in extending debt financing within that industry;

- the stage of the company’s life cycle. Early stage companies tend to use less debt as compared to mature companies, as early stage companies require cash in order to finance growth and expansion; and

- the personal preferences of the business owner(s) and executives. Ultimately, those who own and operate the business must be satisfied with the risk-reward tradeoff of their company’s capital structure.

Exhibit 2

Factors that Influence the Amount of Debt

In most cases, it is prudent not to employ the maximum amount of debt that can be raised within a business. Rather, business owners and executives should leave themselves some degree of flexibility in the event that unexpected issues and opportunities arise. Leaving some “wiggle room” is also advisable from the standpoint that a bank’s appetite for lending and the terms and conditions thereof tend to evolve over time. Witness the high levels of debt usage during the 2005-2007 time period, inspired by relaxed banking covenants and low interest rates. Circumstances have changed in 2008, as bankers have returned to more conservative lending approaches. Business owners and executives should avoid being in a position of having to manage the bank rather than managing their business.

Finally, there is the issue of whether short term debt or long term debt should be raised. As a general rule, businesses normally follow the “matching principle” in this regard. That is, matching the term of the debt with the term of the underlying assets used to secure that debt. Therefore, short term debt (such as bank operating loans) should be used against short term assets (such as accounts receivable and inventories) while long term debt (such as capital leases and mortgages) should be used against capital equipment and real property.

To summarize, the use of some debt in a business can serve to increase shareholder returns and allow business owners to diversify their investments. However, caution must be employed to ensure that the financial risks are fully understood and manageable. Business owners and executives should consider factors such as cash flow levels, underlying assets, the after-tax cost of debt, banking covenants, industry norms, company life cycle and personal preferences when determining the level of debt that is appropriate for their business.